XRP has been down 2.6% within the final 24 hours, reflecting rising technical weak point throughout a number of indicators. Its worth is beneath $2.40. Its RSI has sharply dropped into impartial territory, signaling fading momentum after almost reaching overbought ranges simply someday prior.

The Ichimoku Cloud setup has turned bearish, with the worth now buying and selling beneath key help strains and beneath a crimson cloud, indicating growing downward strain. Including to the priority, XRP’s EMAs are on the verge of forming a dying cross, a bearish sign that might result in deeper declines except a powerful restoration emerges.

XRP Loses Power After RSI Falls Sharply From Close to-Overbought Ranges

XRP’s Relative Power Index (RSI) has dropped to 46.72, falling from 64.86 only a day earlier, indicating a swift lack of upward momentum.

The RSI is a broadly used momentum oscillator that ranges from 0 to 100. It helps merchants establish overbought and oversold circumstances.

Readings above 70 sometimes recommend an asset could also be overbought and due for a correction, whereas values beneath 30 point out oversold circumstances that might result in a bounce. Ranges between 30 and 70 are thought-about impartial and replicate a scarcity of sturdy directional development.

With XRP now sitting at 46.72, the token has returned to a impartial zone, signaling indecision and a possible pause in its earlier upward transfer.

The sharp decline suggests weakening purchaser curiosity, which might result in additional worth consolidation or gentle draw back if market sentiment doesn’t enhance.

For bullish momentum to renew, XRP would doubtless want a bounce in RSI towards the 60–70 vary, supported by a broader restoration in crypto markets. Till then, worth motion might stay range-bound or barely bearish.

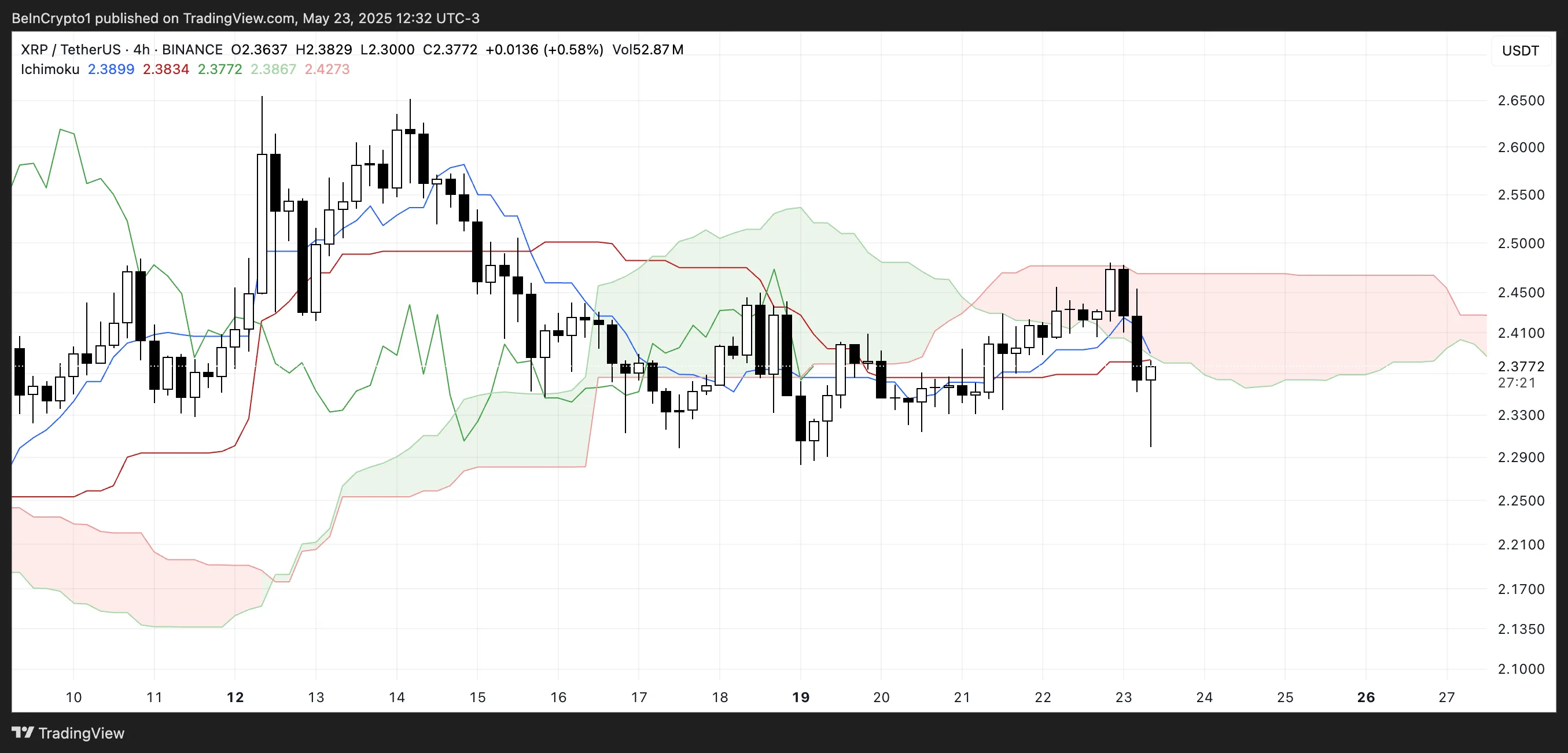

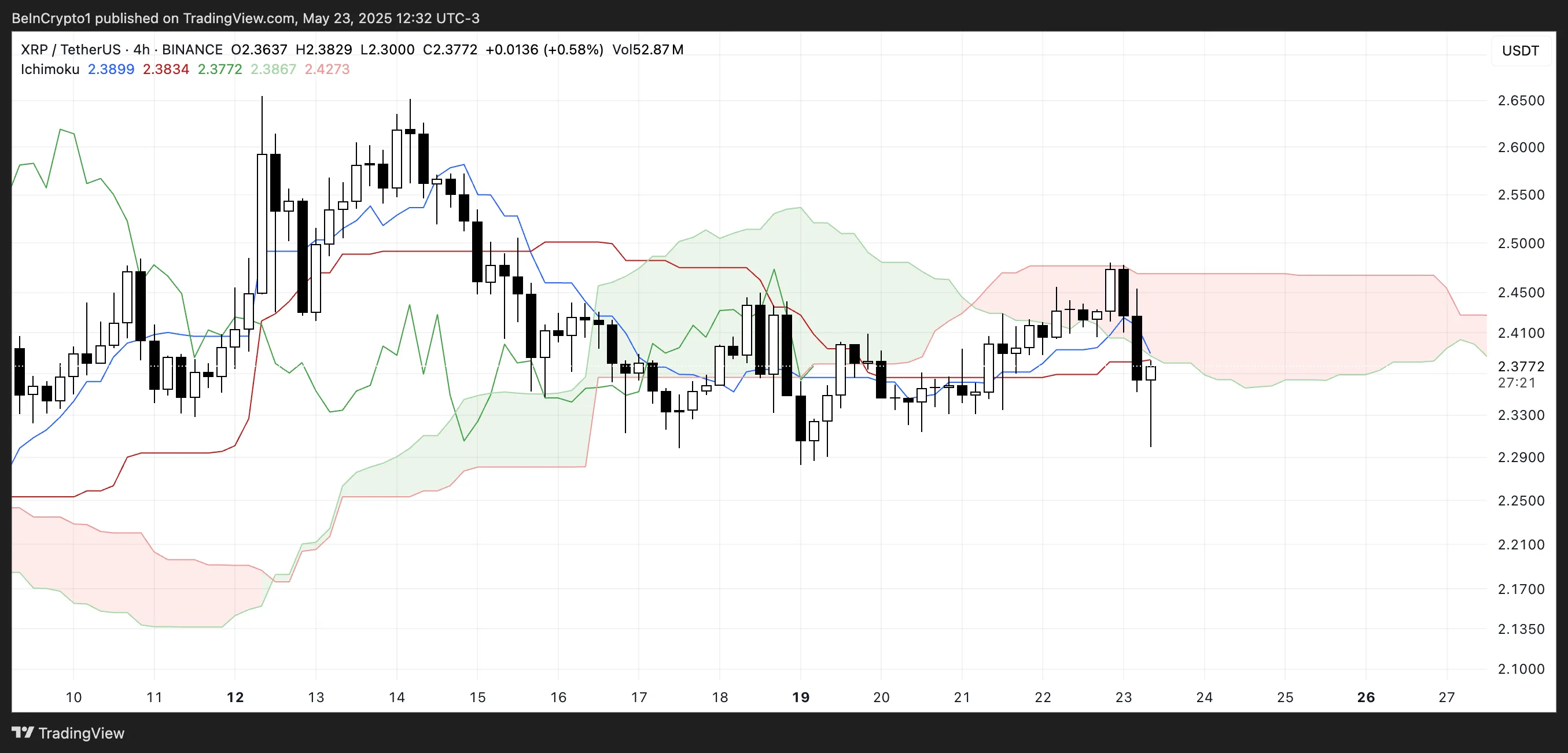

Ichimoku Cloud Turns Bearish for XRP as Worth Drops Beneath Key Strains

The Ichimoku Cloud chart for XRP exhibits a bearish shift in momentum. The worth has damaged beneath each the Tenkan-sen (blue line) and the Kijun-sen (crimson line), signaling a short-term development reversal.

The worth motion is now positioned beneath the Kumo (cloud), which has transitioned from inexperienced to crimson—a sign that market sentiment is weakening and downward strain is constructing.

The crimson cloud forward means that bearish momentum might proceed except there’s a powerful restoration to push the worth again above the cloud.

Moreover, the Senkou Span A (main inexperienced line) is trending downward, and the Senkou Span B (main crimson line) is flat, displaying a lack of bullish momentum and potential for range-bound or declining motion.

Though not clearly proven, the Chikou Span (lagging inexperienced line) seems to be beneath the worth motion, additional confirming a bearish outlook.

Total, the Ichimoku setup displays growing resistance and declining help, suggesting XRP is in a susceptible technical place except consumers step again in forcefully.

XRP Faces Bearish Threat as EMA Demise Cross Looms

XRP just lately approached the $2.50 zone however confronted sharp rejection as Bitcoin’s sudden drop triggered a broader market pullback.

The promoting strain has weighed closely on XRP’s construction, and its exponential shifting averages (EMAs) are actually converging in a approach that means a possible dying cross. This bearish crossover sometimes indicators prolonged draw back threat.

If confirmed, this sample might open the door to a deeper correction, with key help ranges at $2.32 and $2.28 in focus. A break beneath these zones might speed up losses towards $2.12 and $2.07 if bearish momentum intensifies.

Nonetheless, the outlook might shift shortly if XRP manages to stabilize and regain upward momentum.

A push again towards the $2.449 resistance could be the primary key check for bulls, and reclaiming $2.479 might open the best way for a retest of the $2.65 stage.

Such a transfer would doubtless require a broader restoration in crypto sentiment, notably from Bitcoin, in addition to a transparent rejection of the looming dying cross. Till then, the technical bias stays tilted to the draw back.

Disclaimer

In keeping with the Belief Challenge tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.