Be a part of Our Telegram channel to remain updated on breaking information protection

The XRP worth jumped greater than 9% after the Depository Belief and Clearing Company (DTCC) listed 5 spot XRP ETFs (exchange-traded funds), as optimism grows {that a} deal to finish the US authorities shutdown is close to.

The listings on the DTCC web site had been from Bitwise, Franklin Templeton, 21Shares, Canary Capital, and CoinShares, which appeared underneath DTCC’s “lively and pre-launch” class, usually seen as signaling readiness for market debut.

XRP was buying and selling at $2.46 as of 12:58 a.m. EST after erasing final week’s losses, in response to CoinMarketCap.

XRP worth (Supply: CoinMarketCap)

Crypto ETF Floodgates To Open As US Authorities Shutdown Nears Finish

This comes because the US authorities shutdown seems near an finish, with senators reaching a bipartisan deal to fund key departments by means of subsequent yr. The settlement handed an preliminary 60–40 Senate vote and now heads to the Home earlier than going to President Donald Trump for approval.

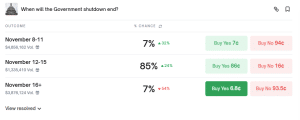

Merchants on the decentralized predictions market Polymarket are assured that the shutdown will finish someday this week.

Contract asking when the shutdown will finish (Supply: Polymarket)

In a Polymarket contract asking when the US authorities shutdown will finish, odds of a conclusion earlier than tomorrow have risen prior to now 24 hours. Merchants see an 85% likelihood that the shutdown ends between Nov. 12 and Nov. 15.

As the federal government shutdown nears its potential conclusion, NovaDius Wealth President Nate Geraci says that it’ll result in the “spot crypto ETF floodgates opening.”

Authorities shutdown ending = spot crypto ETF floodgates opening…

In meantime, may see first ‘33 Act spot xrp ETF launch this week.

— Nate Geraci (@NateGeraci) November 10, 2025

He added {that a} first spot XRP ETF may launch this week.

Generic Itemizing Requirements Pave The Method For Sooner Crypto ETF Approvals

The SEC’s newly authorized generic itemizing requirements for crypto ETFs additionally counsel a surge in launches within the coming weeks.

Underneath the foundations, crypto ETF functions might be fast-tracked by way of amended S-1 filings with out procedural delays. This opens up the likelihood that the pending spot XRP ETF functions will turn out to be efficient by mid-to-late November.

Earlier this month, Grayscale and Bitwise revealed charges for his or her respective spot XRP funds. Canary Capital CEO Steven McClurg additionally reportedly informed attendees on the Ripple Swell occasion final week that his agency is ready to launch its spot XRP ETF this week.

A number of crypto ETFs confronted resolution deadlines final month which have come and gone because of the ongoing US authorities shutdown. With authorities companies working on lowered workers, the SEC mentioned that it’ll not ship selections on new functions till the shutdown ends.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection