- XRP is down sharply from its 2024 peak, with rising concern it may revisit $1.

- Whale promoting and weak demand close to $2 are including stress.

- ETF inflows stay sturdy, however macro uncertainty continues to cap upside.

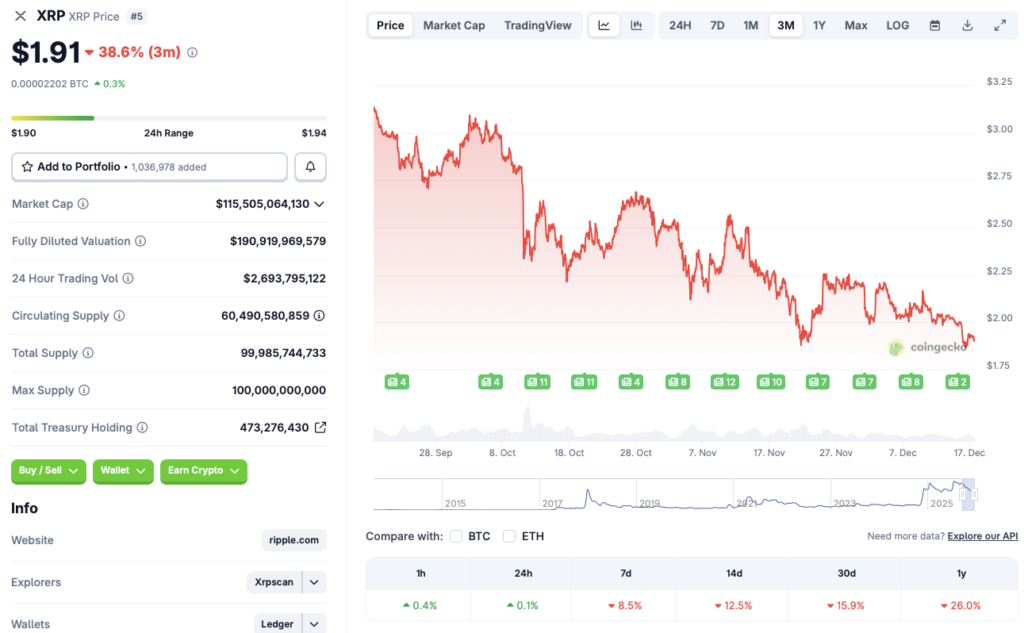

Ripple’s XRP entered the yr with sturdy momentum, however that early optimism has light quick. The token broke above $3 in January for the primary time in seven years and later pushed to an all-time excessive of $3.65 in July. Since then, the development has steadily reversed. CoinGecko information reveals XRP is down 8.5% over the past week, 12.5% over the previous 14 days, practically 16% on the month, and about 26% since December 2024. With promoting stress constructing, the danger of XRP revisiting the $1 stage is changing into tougher to disregard.

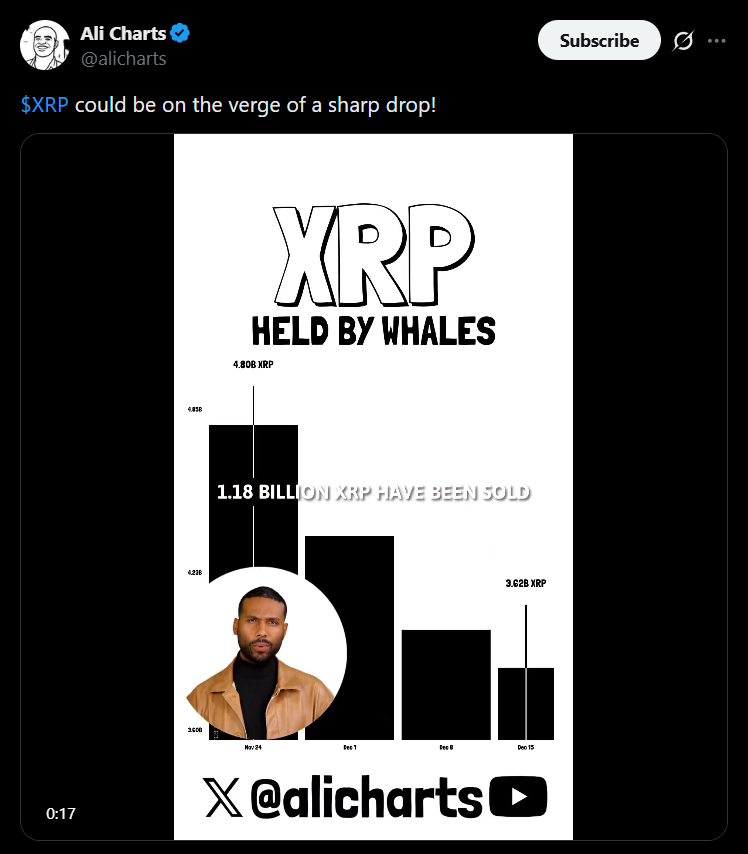

Whale Promoting Provides Downward Strain

One of many greatest considerations proper now’s exercise from massive holders. In response to crypto analyst Ali Martinez, whale wallets have unloaded roughly 1.18 billion XRP over the past 4 weeks. That scale of distribution has considerably elevated draw back threat, particularly in a market already leaning bearish. When massive holders promote into weak spot, it usually accelerates declines fairly than stabilizing value motion.

Weak Demand Round Key Ranges

One other difficulty weighing on XRP is the obvious lack of sturdy demand close to the $2 vary. With out a clear help zone, promoting stress can construct shortly as merchants search for decrease ranges to step in. This absence of significant buy-side curiosity makes it simpler for value to slip, even with no main damaging catalyst.

ETF Inflows Haven’t Moved the Needle

Apparently, XRP ETFs have continued to draw capital regardless of the falling value. Whole inflows lately surpassed the $1 billion mark, signaling ongoing institutional curiosity. Nonetheless, these inflows haven’t translated into upward value momentum. As with different crypto ETFs, share creation doesn’t at all times lead to quick spot shopping for, which helps clarify the disconnect between flows and value.

Macro Circumstances May Determine What Comes Subsequent

XRP’s near-term outlook doubtless hinges on broader market circumstances. Persistent macro uncertainty and a risk-off mindset have pushed heavy liquidations throughout crypto. There are some early indicators of potential aid — UK inflation dropped to three.2% in November, its lowest stage in eight months, elevating expectations of charge cuts. If world circumstances ease and threat urge for food returns, XRP and different digital belongings may see some respiratory room. Till then, draw back stress stays the dominant power.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.