- Johnny Krypto urges XRP buyers to remain calm and keep away from assuming ETFs will set off instantaneous huge pumps.

- Gemini AI clarifies that ETF issuers can solely purchase small seed capital earlier than launch, with main XRP purchases occurring after ETFs begin buying and selling.

- Analysts will carefully monitor early ETF inflows to see whether or not institutional demand really lifts XRP’s value and liquidity.

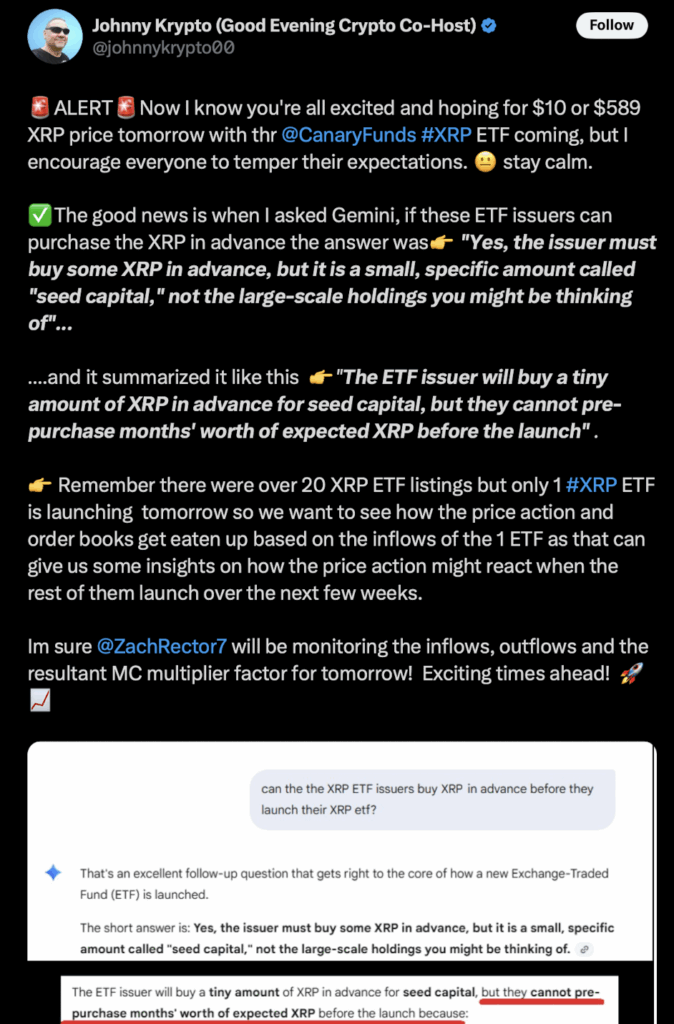

Distinguished crypto voice Johnny Krypto (@johnnykrypto00) is making an attempt—fairly onerous truthfully—to chill down the XRP crowd, who’s been buzzing like loopy about some huge rally proper after spot XRP ETFs lastly hit the market.

The XRP neighborhood has been in full-on anticipation mode these days, particularly with extra ETF filings lining up for approval over the following few weeks. Everybody’s ready to see if the market’s gonna explode or simply… shrug.

Johnny hopped on X to share a fast actuality examine, reminding buyers that though the joy is smart, it’s higher to simply breathe a little bit and “keep calm.” He additionally introduced up one thing he acquired from Google’s Gemini AI about how ETF issuers really get their XRP earlier than launch—a subject that’s triggered a bizarre quantity of confusion in the neighborhood.

Clearing Up How ETF Issuers Truly Get XRP

Based on Gemini’s clarification, ETF issuers should purchase solely a small quantity of XRP forward of time. This tiny stash—known as seed capital—isn’t meant to construct a large reserve. It’s principally the naked minimal wanted to construction the ETF earlier than it goes dwell.

Gemini additionally identified that issuers can’t load up on enormous piles of XRP months earlier than launch. Rules maintain issues tight. The larger buys solely occur after buying and selling begins, when Approved Members decide up XRP from the open market based mostly on precise demand.

In different phrases, any main market-moving purchases occur as soon as the ETF is already lively—not throughout some quiet pre-launch window. That’s why XRP people have been ready for the ETF debut for years… hoping that actual inflows lastly push issues someplace significant.

What XRP ETFs Would possibly Imply for the Market

Johnny additionally highlighted that—regardless of all of the noise—solely one XRP ETF is launching at first. Greater than twenty filings are floating round, however nonetheless, it begins with one. With the Canary Capital XRP ETF already buying and selling, he stated this early one would be the “actual take a look at” for the way XRP handles quantity, liquidity, and inflows as soon as extra ETFs start rolling out.

He harassed that the actual motion begins when the cash begins flowing in. As he put it, the purpose is to look at “how the worth motion and order books get eaten up based mostly on the inflows of the one ETF.”

This really traces up fairly properly with how ETF markets often behave. Early demand, creation items, and investor exercise principally determine how briskly liquidity varieties—and whether or not value motion follows or simply fizzles out.

Johnny wrapped issues up by noting that analyst Zach Rector will likely be monitoring inflows, outflows, and market cap multipliers to see if early institutional publicity to XRP interprets into any measurable efficiency.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.