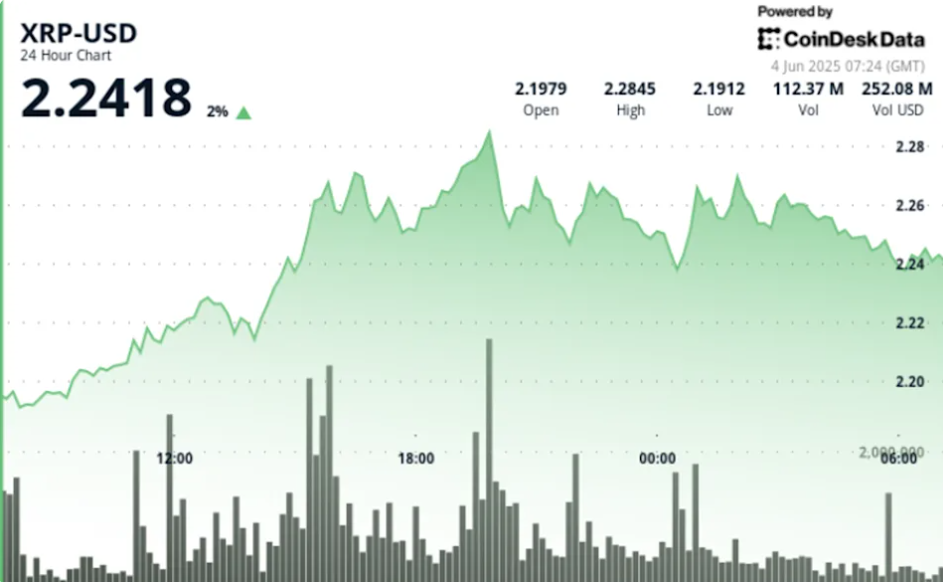

- XRP’s chart patterns look bullish, with a falling wedge focusing on $3.20 and an ascending triangle aiming for $3.50 if resistance ranges are cleared.

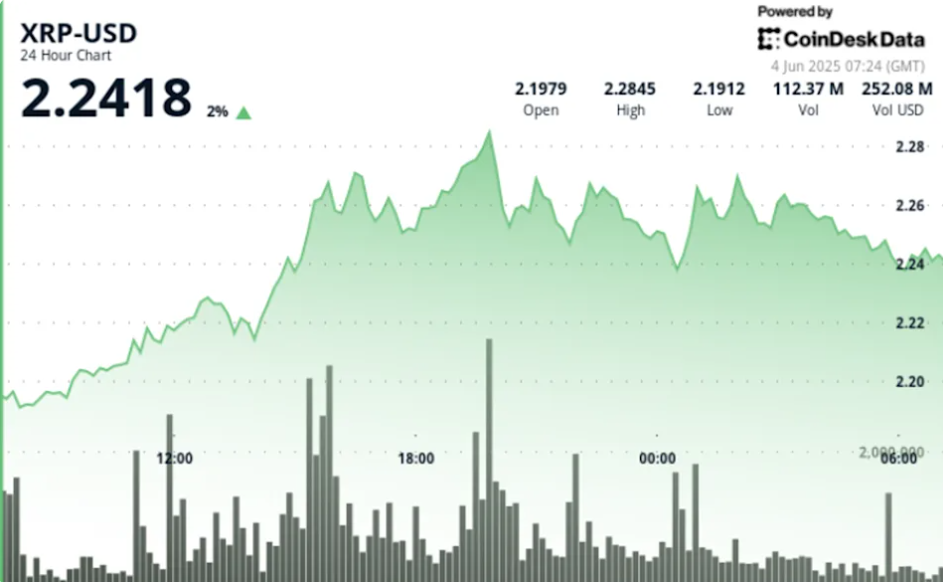

- XRP/BTC reveals a powerful bullish divergence, suggesting vendor exhaustion and potential for a 70% rally that aligns with XRP hitting $3.

- Patrons are dominating the market once more, as seen within the constructive spot taker CVD, signaling regular accumulation regardless of current worth dips.

XRP’s flashing indicators in all places, and a few of them are beginning to line up. The charts are displaying promise — not wild hype, however strong setups that recommend we may be heading towards $3 someday this month. From falling wedges to triangles and bullish divergences, the technical case is stacking up. It’s not a certain guess, however the groundwork’s undoubtedly there.

First up — the falling wedge. On the weekly chart, XRP is pushing in opposition to resistance round $2.43. If it manages to shut above that, the goal jumps to $3.20 — which might be a forty five% transfer from present costs. That wedge isn’t some random sample both. It’s a type of basic bullish setups, and XRP is bouncing alongside all its main shifting averages, which is normally a inexperienced gentle for trend-followers. Not dangerous in any respect.

Triangle Patterns and BTC Pair Gasoline Extra Optimism

Then there’s the ascending triangle. On the day by day chart, XRP’s been working its means up since a significant bounce from $1.61 in April — that was a 70% restoration, by the way in which. Proper now, it’s urgent in opposition to $2.60, and a break above that stage units a goal of $3.50. That’s a 60% upside, and triangles like this usually finish with an enormous transfer — up or down, however on this case, all indicators level upward.

And it’s not simply greenback charts. The XRP/BTC pair is giving off some bullish divergence vibes. Worth has been falling for years — not nice — however RSI has been climbing within the background. That cut up normally means sellers are getting drained, and consumers are quietly gaining floor. If XRP breaks the 0.00003375 BTC wall, it might explode to 0.00003609 BTC, which, if it follows the sample, strains up with XRP touching $3 once more. Coincidence? Possibly not.

Patrons Are Nonetheless Right here, Even After the Dip

Now for one thing just a little completely different — CVD. That’s cumulative quantity delta, in case you’re questioning. It tracks the distinction between purchase and promote orders. Proper now? It’s inexperienced. Which means consumers are nonetheless energetic — inserting extra orders than sellers — even after the value fell 17% from its Could highs. That type of habits normally reveals quiet confidence, like they’re loading up whereas issues are nonetheless low cost.

Again in March, issues have been bleak — sellers ran the present. XRP even dropped to $1.61. However since mid-Could, that tide’s turned. CVD flipped constructive round Could 19, and hasn’t actually regarded again. That type of persistent shopping for? It usually results in rebounds. If this holds, and consumers keep cussed, there’s a strong likelihood we’ll see a recent rally kick off — possibly all the way in which to $3, possibly extra. Simply don’t blink.