Trusted Editorial content material, reviewed by main trade specialists and seasoned editors. Advert Disclosure

On-chain information reveals Realized Loss has spiked on the XRP community, with traders taking the very best every day loss since April 2025.

XRP Blockchain Is Going Via A Capitulation Occasion

In a brand new put up on X, on-chain analytics agency Glassnode has mentioned concerning the newest pattern within the Realized Loss for XRP. This indicator measures, as its identify suggests, the whole quantity of loss that merchants on the XRP community as an entire are “realizing” via their transactions.

The metric works by going via the transaction historical past of every token being offered to see what value it was moved at previous to this. If the final transaction value for any coin was greater than the worth that it’s now being moved at, then the token’s sale is realizing some web loss.

The precise quantity of loss harvested within the switch is of course equal to the distinction between the 2 costs. The Realized Loss sums up this worth for transactions throughout the community to search out the whole state of affairs.

Just like the Realized Loss, there may be additionally an indicator known as the Realized Revenue, conserving monitor of the transactions of the alternative sort. That’s, it accounts for the gross sales involving a price foundation decrease than the most recent value.

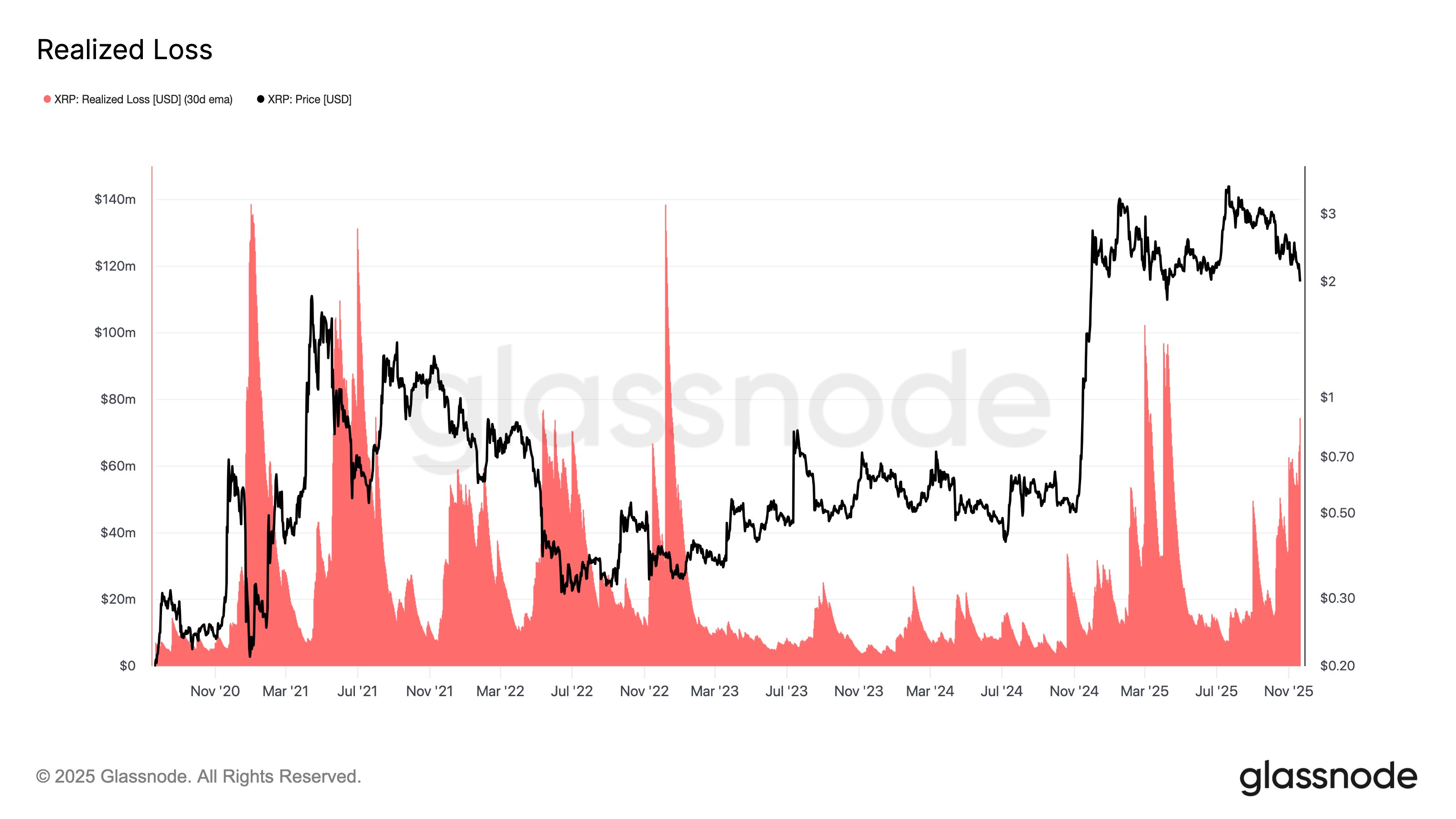

Now, right here is the chart shared by Glassnode that reveals the pattern within the 30-day exponential shifting common (EMA) XRP Realized Loss over the previous couple of years:

The 30-day EMA worth of the metric appears to have shot up in latest weeks | Supply: Glassnode on X

As displayed within the above graph, the XRP Realized Loss has witnessed a robust surge lately, indicating traders have ramped up loss taking. This pattern has emerged because the cryptocurrency’s value has gone via its crash.

The indicator’s 30-day EMA worth is now sitting at round $75 million, which is the very best that it has been since April 2025. Again then, the spike in loss realization led to a backside for the asset.

Traditionally, this identical sample has typically appeared, with spikes within the Realized Loss coinciding with or forming close to value lows. The reason behind the sample might be that such capitulation occasions lead to cash shifting from weak arms to extra resolute entities, who maintain off on promoting, permitting the bearish pattern to succeed in a state of exhaustion.

For now, the metric remains to be notably beneath the highs from earlier within the 12 months, so it solely stays to be seen whether or not XRP investor capitulation has been of a enough diploma to pressure not less than an area backside or not.

XRP Worth

Bearish momentum has continued within the cryptocurrency sector throughout the previous day, and XRP has been no exception as its value has plummeted to the $1.89 mark. In reality, the coin has been among the many worst weekly performers, sitting 17.5% down, higher than solely Cardano’s return among the many high 20 cash by market cap.

The pattern within the value of the coin during the last 5 days | Supply: XRPUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.