Key Insights:

- XLM should shut above $1 to validate a long-term bullish breakout, in keeping with Peter Brandt.

- Stellar is gaining momentum from July’s Protocol 23 improve and PayPal’s PYUSD integration.

- Institutional tokenization on Stellar now stands at greater than $445 million, in a present of sturdy fundamentals.

Veteran dealer Peter Brandt has set his sights on Stellar Lumen (XLM). The analyst now calls it probably the most promising crypto within the charts, and a few bullishness may very well be inbound. Nevertheless, there’s a catch. For XLM to register any form of encouraging bullish transfer, it must decisively shut above $1 first.

XLM’s Bullish Setup

Peter Brandt, who is thought for many years of correct market predictions, not too long ago highlighted XLM as having “probably the most bullish chart of all.”

His optimism is centered round two long-term technical formations, together with a multi-year ascending triangle and a cup-and-handle sample. Traditionally talking, each of those have a tendency to come back earlier than giant worth actions.

Nevertheless, for that bullishness to grow to be actuality, XLM should meet some very particular circumstances. Brandt insists that the altcoin should keep above its April low of $0.20 and extra importantly, shut above $1 on the month-to-month chart.

Doubtlessly probably the most bullish chart of all belongs to $XLM

XLM MUST MUST stay above Apr low and MUST MUST shut decisively above $1. Till then this chart will stay vary sure pic.twitter.com/NZvKLp5SVW— Peter Brandt (@PeterLBrandt) July 17, 2025

Till this occurs, he warns that the value is more likely to stay caught in a spread.

His evaluation isn’t simply technical. It reveals a extra basic market sentiment that sees Stellar as in an awesome place to experience the following wave of crypto adoption. If it will possibly overcome resistance and make sure the breakout, that’s.

“XLM MUST MUST stay above Apr low and MUST MUST shut decisively above $1. Till then, this chart will stay range-bound,” Brandt posted on social media.

XLM’s Historic Value Struggles

Stellar’s worth historical past presents context for this outlook. Since hitting its all-time excessive in early 2018, XLM has been caught in a symmetrical triangle formation. Regardless of makes an attempt to interrupt out in 2021 and late 2024, the value has repeatedly retreated.

As of July 19, XLM is buying and selling round $0.50, which is its highest degree in over a yr. This additionally stands as a 120% acquire for the reason that begin of July. But it’s nonetheless removed from the $1 degree that Brandt describes because the gatekeeper to additional positive aspects.

This barrier isn’t simply psychological; it’s structural. A break above it will validate the multi-year bullish formations and will even set off a rally to Brandt’s long-term goal of $7.20.

For some extra perspective, this could usher in a 14x return from present ranges.

Why July Modified the Recreation for XLM

July has been a turning level for Stellar, with the cryptocurrency having fun with consideration from three main developments. The primary of those is Stellar’s upcoming Protocol 23, which introduces enhancements that enhance sensible contract efficiency and decrease prices throughout the community.

The second of those is how PayPal’s USD-backed stablecoin, PYUSD, is about to combine with Stellar. This transfer might massively develop XLM’s utility by enabling near-instant, low-cost cross-border transfers all over the world.

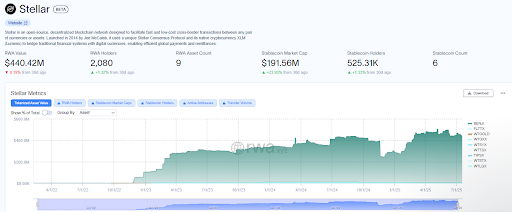

Lastly, knowledge from RWA.xyz reveals that over $445 million in real-world belongings (RWAs) have been tokenized on Stellar.

Massive asset managers like Franklin Templeton and Circle are main this development, and the long run seems brilliant for this cryptocurrency.

Contemplating the similarity between XRP and XLM when it comes to cross-border funds, XLM may very well be on the verge of following XRP’s footsteps after the latter not too long ago hit a excessive of $3.65.