Hedera Hashgraph’s native token HBAR has dropped to a nine-day low, dragged down by waning market exercise amid rising geopolitical tensions between Israel and Iran.

The declining sentiment has sparked a surge briefly positions in opposition to the token, suggesting merchants are bracing for deeper losses.

Merchants Flip Bearish on HBAR

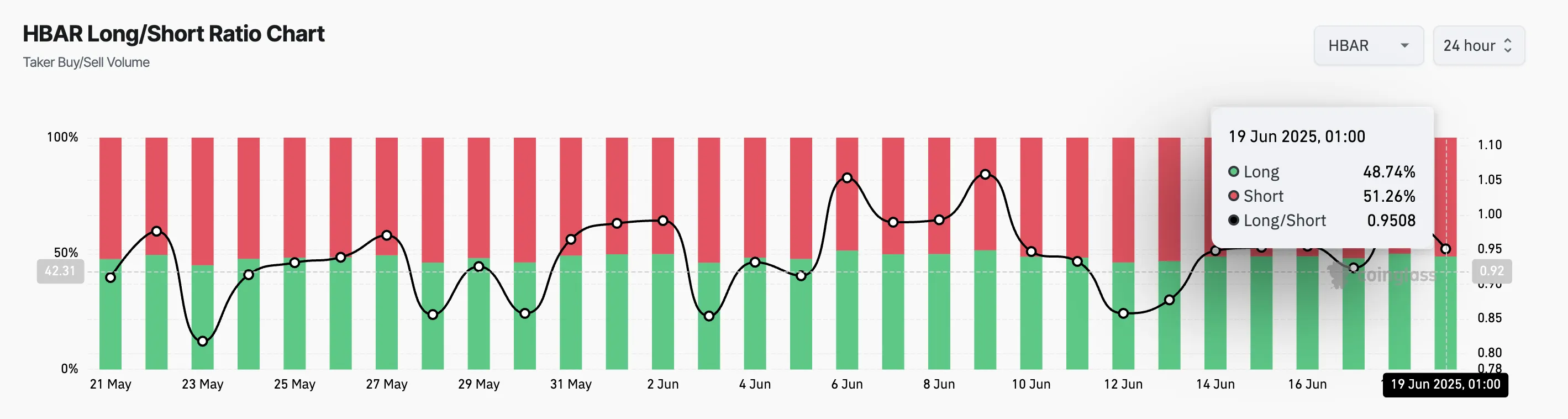

Based on Coinglass, HBAR’s lengthy/quick ratio is 0.95 at press time, indicating the bearish bias dominating its future market.

This ratio compares the variety of lengthy and quick positions in a market. When its worth is above 1, there are extra lengthy than quick positions, indicating that merchants are predominantly betting on a value enhance.

Conversely, as with HBAR, a protracted/quick ratio under one signifies that almost all merchants anticipate a value drop. This exhibits heightened bearish sentiment in opposition to the altcoin and declining confidence in any short-term value rebound.

Moreover, the setup of HBAR’s Tremendous Pattern line on the every day chart confirms this bearish outlook. At press time, this indicator varieties a dynamic resistance above the token’s value at $0.14.

The Tremendous Pattern line helps merchants establish the market’s route by putting a line above or under the worth chart based mostly on the asset’s volatility. When an asset’s value trades under the Tremendous Pattern line, it alerts a bearish pattern, indicating that the market is in a downtrend and promoting stress is dominant.

As HBAR struggles to interrupt above this stage, the pattern line reinforces the bearish sentiment and will increase the downward stress on the worth.

Will HBAR Revisit April Ranges?

Presently exchanging fingers at a ten-day low of $0.14, HBAR has remained under a descending pattern line all through the previous week.

This sample emerges when an asset’s value varieties decrease highs over time, connecting these peaks with a downward-sloping line. It alerts persistent promoting stress and confirms HBAR’s ongoing bearish setup.

If demand weakens additional, HBAR may fall to $0.12, a stage final seen in April.

Nonetheless, a rebound in shopping for curiosity may see the Hedera token break above the resistance shaped by its descending pattern line and Tremendous Pattern indicator, probably rallying towards $0.19.

Disclaimer

In step with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.