Welcome to the US Crypto Information Morning Briefing—your important rundown of crucial developments in crypto for the day forward.

Seize a espresso and skim in regards to the implications of getting older demographics within the US amid rising debt, its inadvertent impression on the nation’s debt, and the way all these bode for Bitcoin (BTC).

Crypto Information of The Day: US Debt Will Sink Fiat

Bitcoin pioneer Max Keiser just lately highlighted rising US debt threat, as indicated in one of many US Crypto Information publications.

Raoul Pal, founding father of Actual Imaginative and prescient, has echoed the sentiment, solely otherwise. He sounded the alarm on the macroeconomic implications of getting older demographics and ballooning debt.

The previous Goldman Sachs govt factors Bitcoin as a “life raft” from the approaching storm.

“Over time, because of getting older demographics, governments have to borrow more cash to help GDP development to pay curiosity on the debt… That debases the forex and lowers the denominator, optically making scarce belongings extra precious,” Pal wrote in a put up.

He argues this dynamic is essentially misunderstood however vital to understanding world markets. “It’s all demographics. It all the time has been,” Raoul Pal added.

The US exemplifies this demographic debt entice. A shrinking working-age inhabitants should help a rising variety of retirees, pushing authorities expenditures increased.

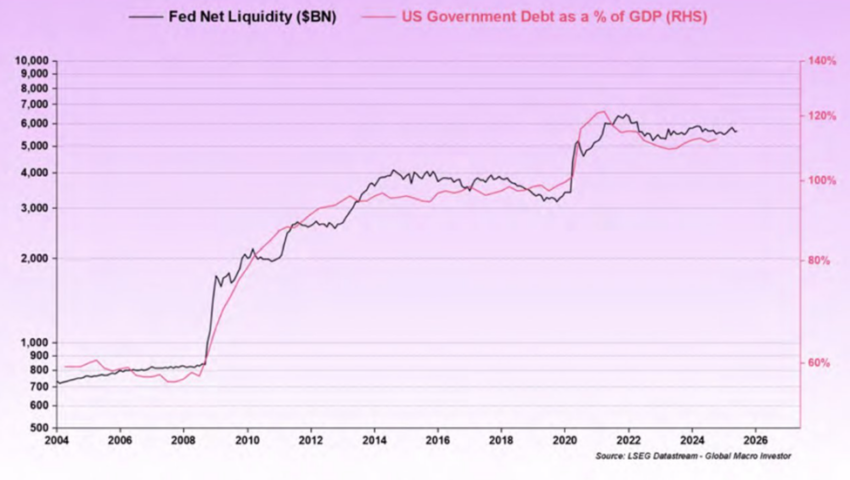

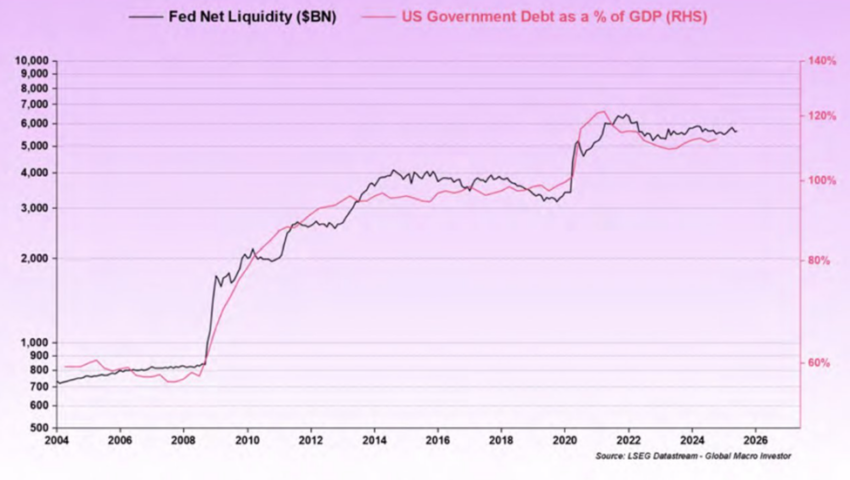

The Congressional Finances Workplace (CBO) projected in February 2024 that US debt would attain 116% of GDP by 2034. If present insurance policies stay unchanged, that is up from simply over 100% at the moment.

To maintain such debt ranges, governments are more and more reliant on central banks to inject liquidity by way of instruments like quantitative easing (QE).

Pal highlights how this artificially props up debt markets, with the Fed successfully “printing” cash through elevated web liquidity.

Alternatively, by nudging banks to soak up extra authorities debt by way of regulation. The result’s a gentle debasement of fiat currencies, which Pal estimates as an 8% annual erosion in greenback worth.

“At over 100% of GDP in debt there isn’t sufficient financial money circulate to fund the debt development so it will get ‘printed’ through Fed Internet Liquidity and likewise pressured, through regulation, onto the steadiness sheet of the banks,” Pal defined.

Apart from Pal, Twenty One Capital’s Jack Mallers additionally termed Bitcoin a life raft, describing Bitcoin because the exit door in opposition to forex debasement.

Pal Says Bitcoin Offsets an 8% Annual Fiat Debasement

In keeping with Raoul Pal, crypto and primarily Bitcoin, is the life raft, offsetting the annual 8% debasement whereas on the similar time gaining worth because of adoption results.

In 2020, he shared the same sentiment on Actual Imaginative and prescient’s weblog, at a time when demographic pressures turned much more acute post-COVID.

“Bitcoin is the life raft. It’s not simply an escape mechanism from the financial system, however it’s a superior model of it. It’s the supermassive black gap that absorbs all vitality and capital from the normal system,” learn an excerpt within the weblog.

Primarily based on his newest put up on X (Twitter), his conviction has solely strengthened.

Macro analysts Olivier Garret and Pal share Pal’s views. In 2017, he argued that demographics can be the largest driver of economic markets sooner or later.

He pointed to Japan as a cautionary story, that includes an getting older inhabitants, stagnant productiveness, and hovering debt ranges forcing countless financial easing.

“That is How the World Works…When each inhabitants and productiveness development fall in conjunction, the long-term pattern price of GDP falls. So, how do you resolve the issue of falling GDP stemming from inhabitants development and productiveness? Develop the debt,” Pal acknowledged in a Substack put up years in the past.

With its mounted 21 million provide, Bitcoin gives a pointy distinction to fiat forex. Its enchantment lies not simply in shortage however in its rising world adoption. El Salvador’s 2021 adoption of Bitcoin as authorized tender displays this shift.

Charts of the Day

Byte-Sized Alpha

Right here’s a abstract of extra US crypto information to comply with at the moment:

- Regardless of the SEC’s delays, the chance of an XRP ETF approval by 2025 jumps to 98%, signaling sturdy investor confidence.

- California Meeting passes AB 1180, authorizing digital asset funds for state charges by way of a pilot program. AB 1180 positions California as a possible chief in cryptocurrency adoption inside state monetary techniques.

- Trump household’s World Liberty Monetary executed a high-profile airdrop, distributing 47 USD1 to every WLFI holder.

- Ripple CEO Brad Garlinghouse denied rumors of a $5 billion provide to accumulate Circle and dismissed hypothesis a few stablecoin merger.

- Bitcoin’s unrealized earnings have surged above the +2-standard deviation, signaling potential market exuberance, adopted by doable short-term corrections.

- A consumer misplaced 100 ETH, price over $263,500, because of a pockets bug whereas bridging funds to the Base blockchain. Nonetheless, the Protected Pockets staff and Protofire builders found the difficulty and recovered the ETH hours later.

- Regardless of a subdued BTC worth, Bitcoin ETFs noticed $378 million in inflows, strengthening investor confidence.

- NYSE Arca filed a 19b-4 with the SEC for the Reality Social Bitcoin ETF, which goals to supply regulated publicity to Bitcoin. The SEC has 45 days to resolve on approval, with a ultimate determination deadline in January 2026, and the chances are favorable because of previous approvals.

- SolarBank integrates Bitcoin into its reserve belongings to hedge in opposition to inflation and improve monetary resilience amid fiat devaluation.

- South Korea’s new president, Lee Jae-myung, guarantees to permit pension fund funding in Bitcoin and introduce spot Bitcoin ETFs.

Crypto Equities Pre-Market Overview

| Firm | On the Shut of June 3 | Pre-Market Overview |

| Technique (MSTR) | $387.43 | $387.59 (+0.041%) |

| Coinbase World (COIN) | $258.91 | $263.15 (+1.64%) |

| Galaxy Digital Holdings (GLXY.TO) | $19.13 | $19.21 (+0.42%) |

| MARA Holdings (MARA) | $15.33 | $15.29 (-0.26%) |

| Riot Platforms (RIOT) | $9.03 | $9.09 (+0.66%) |

| Core Scientific (CORZ) | $11.80 | $11.98 (+1.53%) |

The put up Why Bitcoin is a Life Raft Amid Rising US Debt | US Crypto Information appeared first on BeInCrypto.

Supply hyperlink