Regardless of latest volatility, distinguished analysts argue XRP’s technical setup isn’t bearish but. They spotlight particular value ranges essential for confirming the pattern.

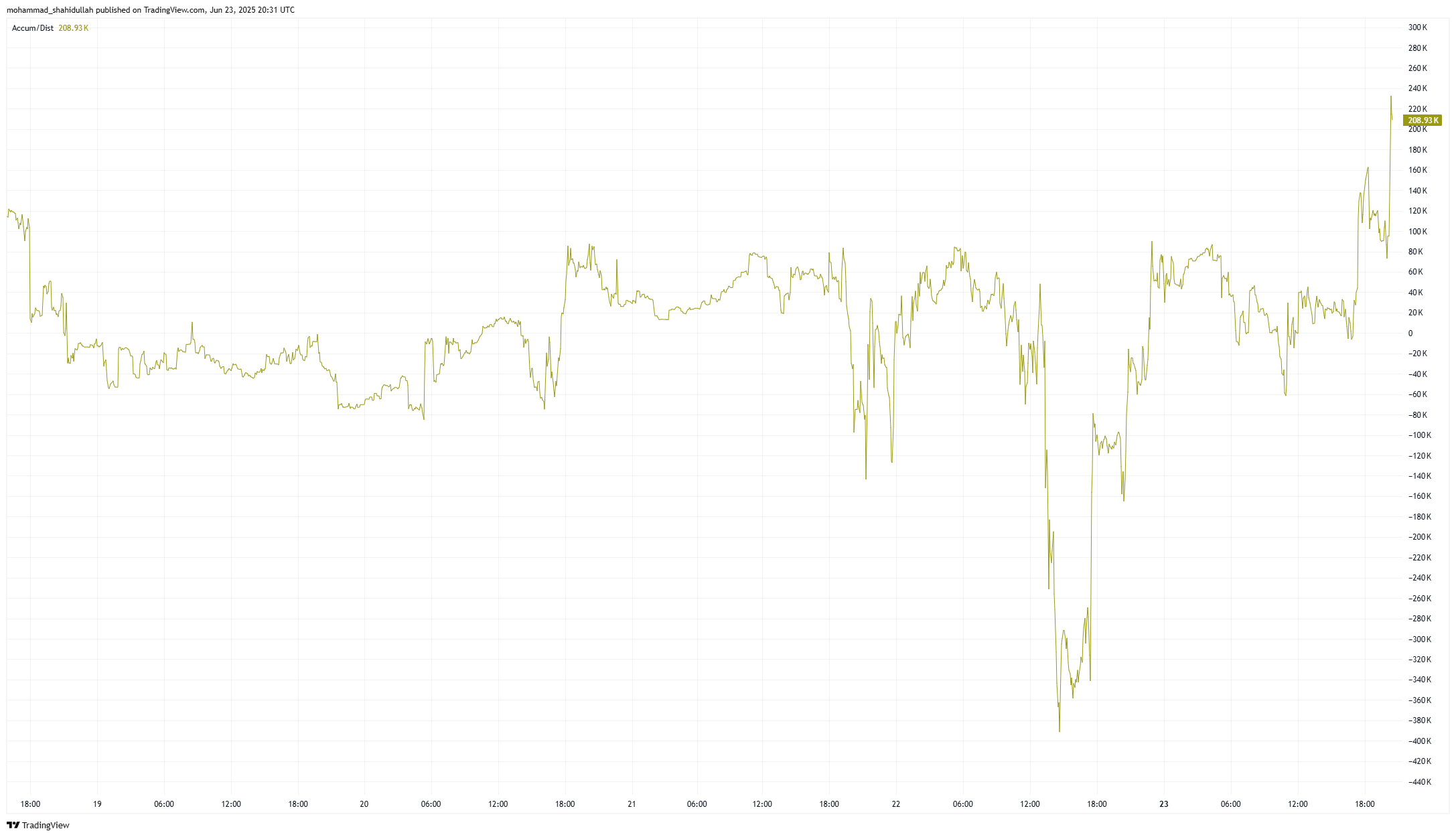

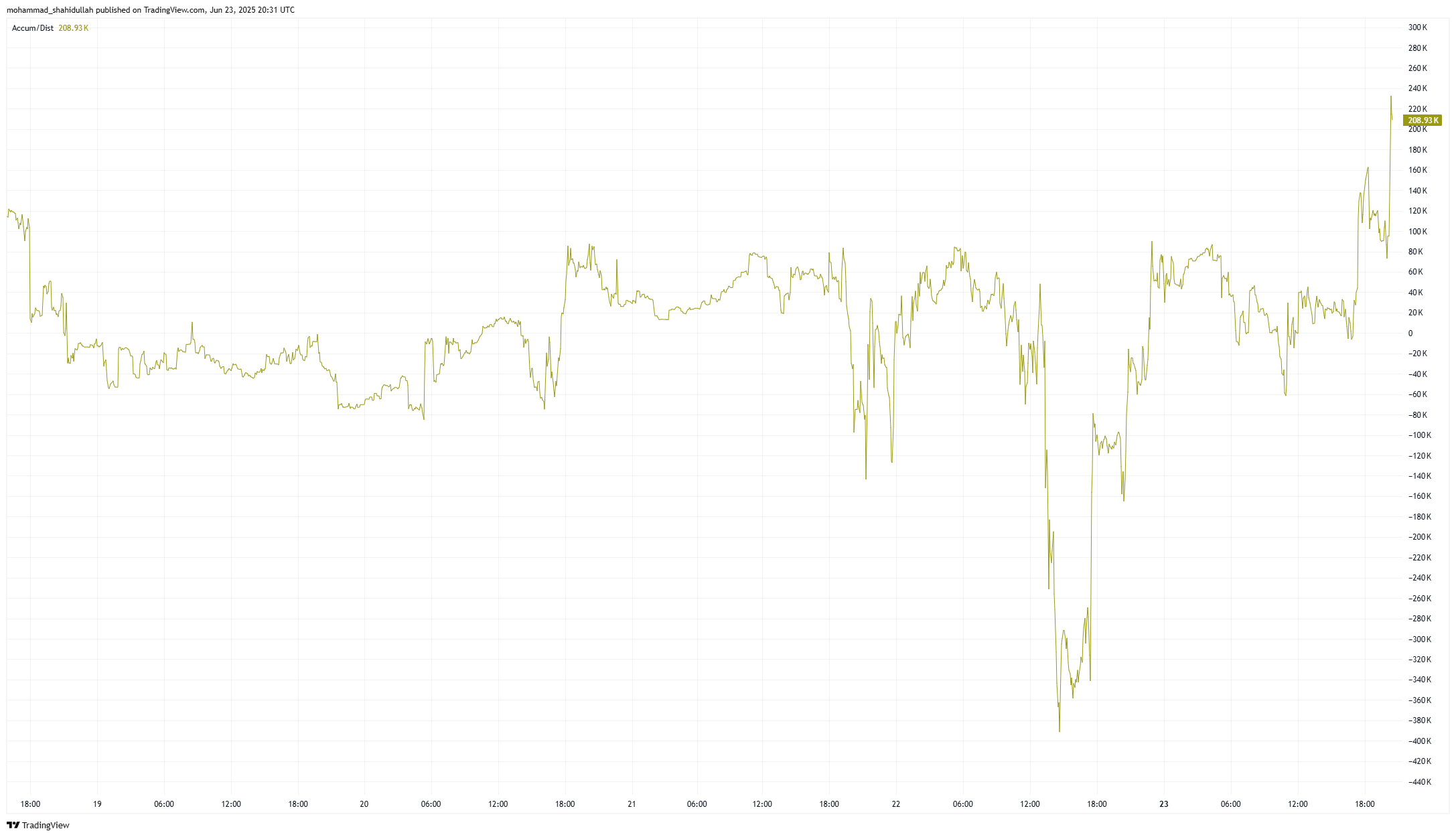

A technical analysis of XRP’s latest 5-day chart provides context to those analyst views.

Analysts Stay Cautiously Optimistic About XRP Worth

XRP costs dipped practically 7% over the previous week amid heightened geopolitical tensions, notably pushed by US airstrikes on Iranian services. The altcoin fell from roughly $2.20 to a low close to $1.90 earlier than stabilizing round $2.06.

Veteran dealer Peter Brandt highlighted a possible Head-and-Shoulders (H&S) sample on XRP’s chart. That is historically a bearish indicator that alerts a reversal from bullish to bearish if key assist ranges break.

Nonetheless, Brandt emphasizes warning towards untimely bearish conclusions. He explicitly notes the significance of XRP sustaining assist above $1.80.

A decisive weekly shut under that essential stage can be wanted to verify a bearish state of affairs.

In the meantime, analyst EGRAG CRYPTO supplied an in depth bullish perspective utilizing a number of technical indicators.

The Gaussian Channel is a volatility indicator used to establish pattern energy and potential reversals. Closing inside this channel boundary, round $1.75 at present, might sign weakening momentum and attainable downward strain.

EGRAG emphasizes the significance of XRP staying above this boundary to take care of bullish energy.

Moreover, the 21-week EMA acts as a essential shifting common that merchants use to establish macro developments.

A detailed above the EMA stage of $2.33 would signify sturdy bullish momentum.

Furthermore, breaking above the resistance at $2.65 would affirm a strong long-term bullish pattern.

EGRAG additionally applies Elliott Wave evaluation, a technical strategy that identifies repeating patterns (waves) in market costs to forecast potential targets.

Utilizing Elliott Wave ratios, the analyst tasks XRP might attain between $9 and $10 if the altcoin efficiently completes its anticipated fifth wave, supplied present assist ranges maintain agency.

Quick-Time period Technical Evaluation Helps Warning

XRP confronted vital promoting strain as costs declined sharply in direction of $1.90, confirmed by the Accumulation/Distribution (A/D) line dropping notably.

The A/D line measures cumulative shopping for and promoting strain, and its decline signifies greater buying and selling quantity on value decreases, reflecting sturdy vendor exercise.

As XRP value reached assist close to $1.90, the A/D line stabilized and started a modest climb through the rebound, indicating renewed purchaser exercise.

Nonetheless, the buildup throughout this rebound has not but absolutely neutralized the sooner distribution, suggesting warning stays warranted.

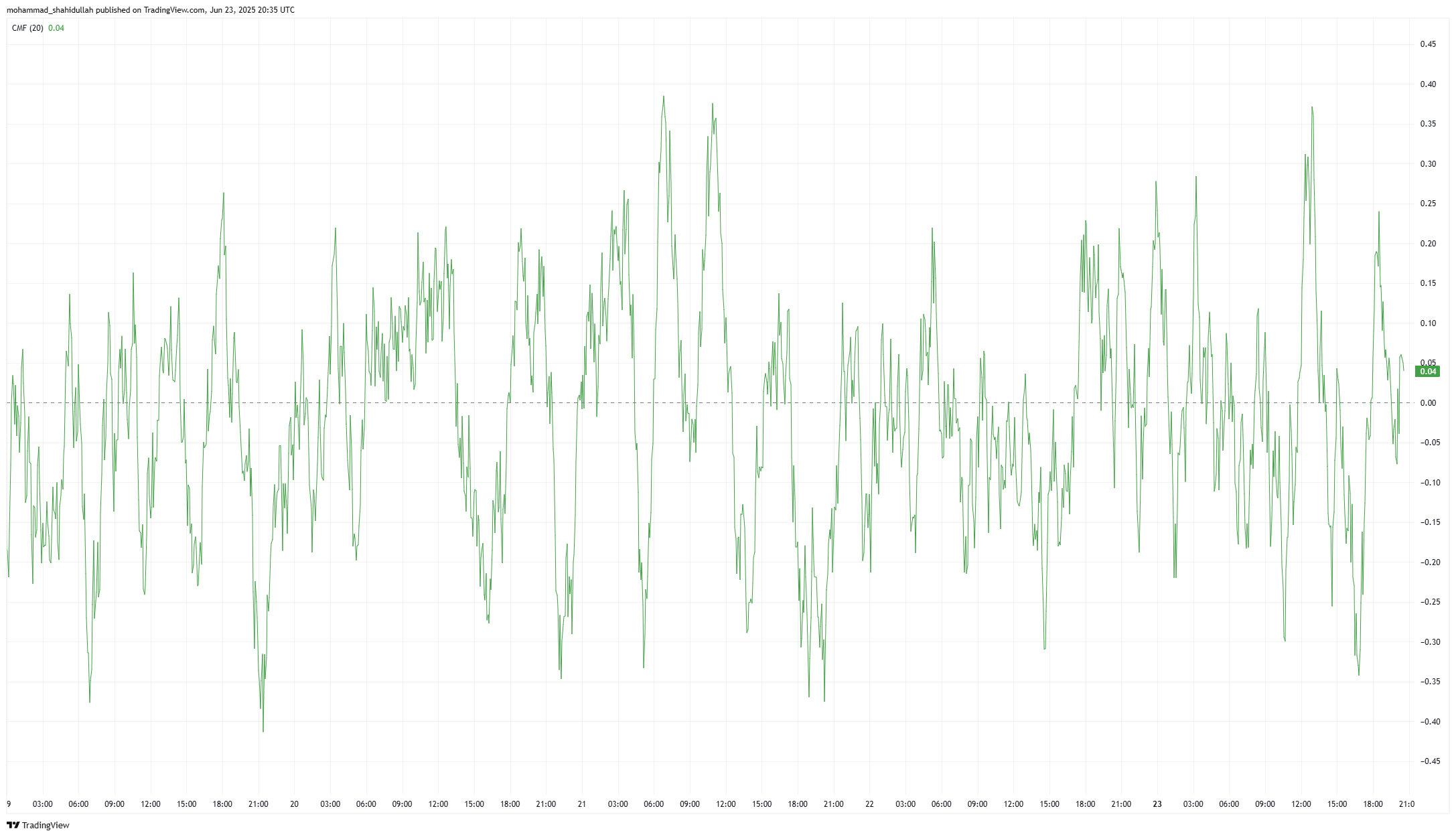

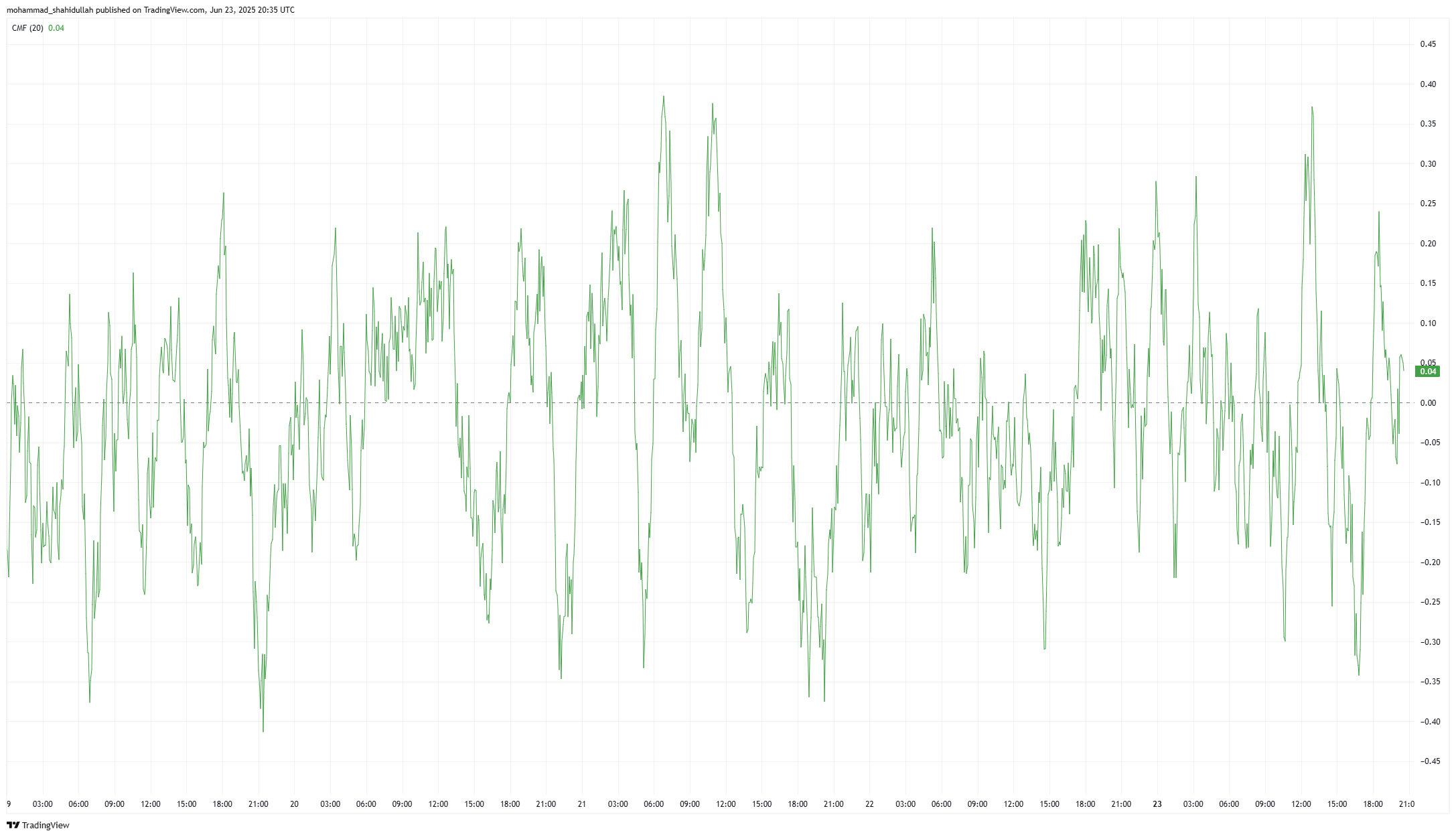

In the meantime, the Chaikin Cash Circulation (CMF), an indicator displaying the energy of cash flowing into or out of an asset, turned unfavourable through the sell-off, confirming sturdy outflows.

Though CMF improved considerably throughout XRP’s rebound, it remained weak and didn’t enter constructive territory, signaling that patrons stay tentative.

Consolidation and Vital Ranges to Look ahead to XRP

These technical indicators recommend XRP is at present in cautious consolidation. Whereas assist close to $1.90 proved sturdy, the restricted enchancment in CMF signifies ongoing market uncertainty.

General, this evaluation aligns with analyst views that key assist round $1.75 to $1.80 stays intact. Solely a decisive weekly shut under these helps would validate a bearish outlook.

Merchants ought to carefully monitor XRP’s interplay with essential assist and resistance ranges.

Particularly, a confirmed breakout above $2.33 after which $2.65 would sign bullish continuation, whereas a decisive breach of $1.75-$1.80 assist would point out elevated bearish danger.

Disclaimer

In keeping with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.