New knowledge from senior Bloomberg analyst Eric Balchunas reveals that US crypto ETFs (exchange-traded funds) beat out Vanguard’s famend S&P 500 ETF (VOO) in July.

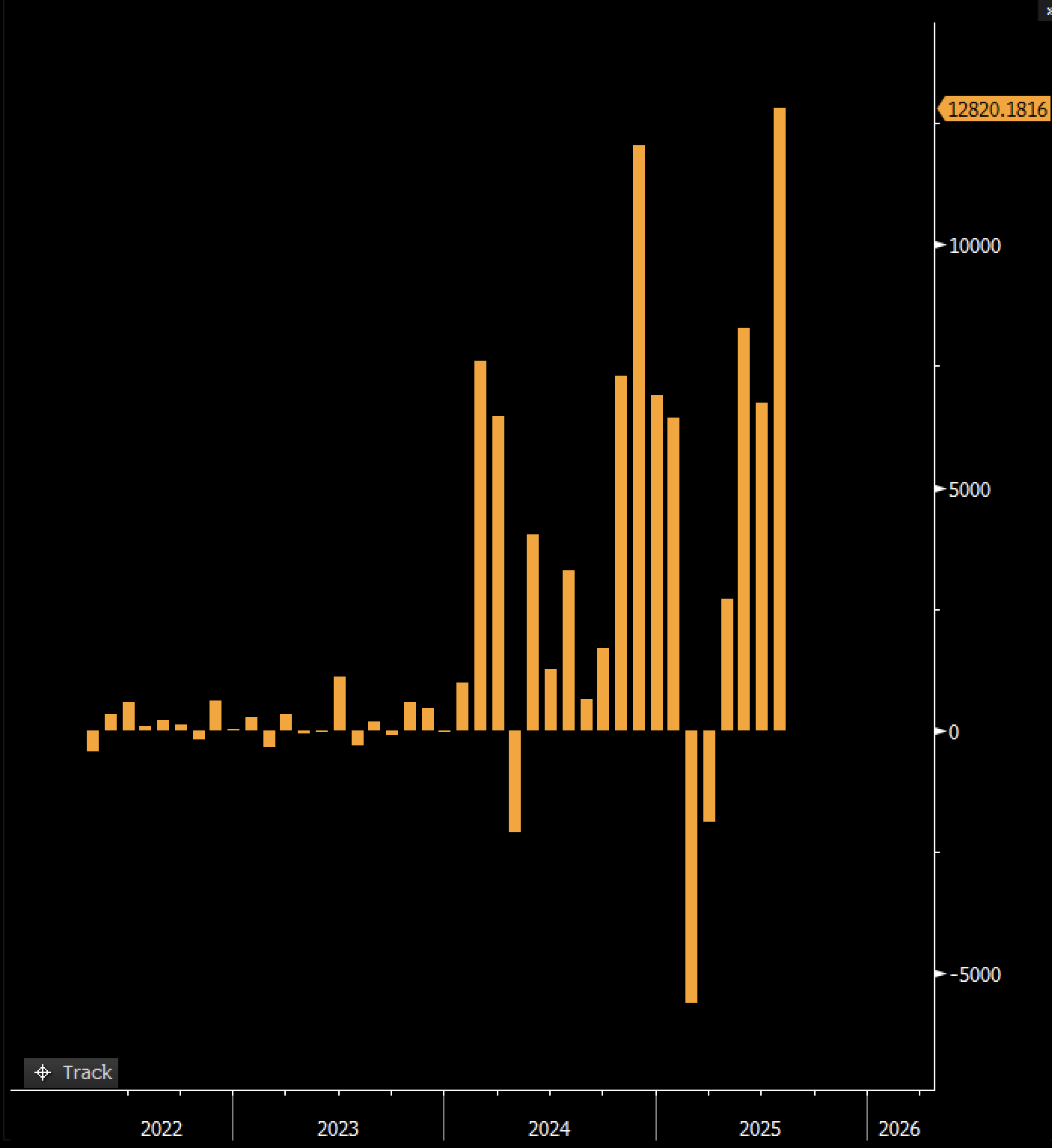

In a brand new thread on the social media platform X, Balchunas notes that US crypto ETFs had a staggering $12.8 billion value of inflows in July, outpacing all different ETFs, together with VOO, which at the moment has $713.13 billion in belongings beneath its administration.

“US Crypto ETFs took in $12.8 billion in July, the perfect month ever, [at] a $600m/day tempo, about double [the] common. As a bunch, that’s greater than any single ETF did, together with the Mighty VOO.

Additional, each ETF in [the] class took in money (ex the transformed trusts) w/ Bitcoin and Ether making equal contributions. Most all-around dominant efficiency because the Eagles ended the Chiefs within the Tremendous Bowl. Will likely be exhausting to high.”

The analyst goes on to say that asset administration titan BlackRock’s iShares Bitcoin Belief ETF (IBIT) is doing nicely and drawing in new prospects.

“Wonderful stat: 75% of the traders who purchased IBIT ($87 billion by way of a million folks) have been first-time prospects of BlackRock. And 27% of them went on to purchase one other iShares ETF. Only a complete coup for BLK throughout.”

In response to Balchunas, IBIT – which launched in January 2024 – had a major hand in Bitcoin’s (BTC) large value development over the past two years.

“1) ETFs maintain BTC at a 1:1 ratio. There is no such thing as a lending, there isn’t any paper IOUs. ETFs are clear and above board and each dime of AUM is linked to the proportional Bitcoin.

2) Zoom out: Bitcoin is up almost 300%(!) because the notorious BlackRock submitting two years in the past. ETF flows huge a part of that.

3) From what I’m listening to on right here, the promoting is irritated OGs who don’t like that Wall St. and the federal government has adopted BTC. I assume they like BTC to have intermediaries like Sam Bankman-Fraud as a substitute.”

Bitcoin is buying and selling for $113,763 at time of writing, a 3.2% lower on the day whereas IBIT and VOO are valued at $64.27 and $572, respectively.

Comply with us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Verify Worth Motion

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any losses you might incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney