- Trump Media’s belongings surged to $3.1B after shopping for $2B price of Bitcoin, making it one of many high company crypto holders regardless of a $20M Q2 web loss.

- Fact Social and Fact+ are increasing globally, with constructive working money stream and new options like digital wallets, subscriptions, and upcoming AI instruments.

- Excessive authorized and non-cash bills—primarily from the 2024 SPAC merger—proceed to weigh on financials, however the firm stays centered on crypto ETFs and fintech progress.

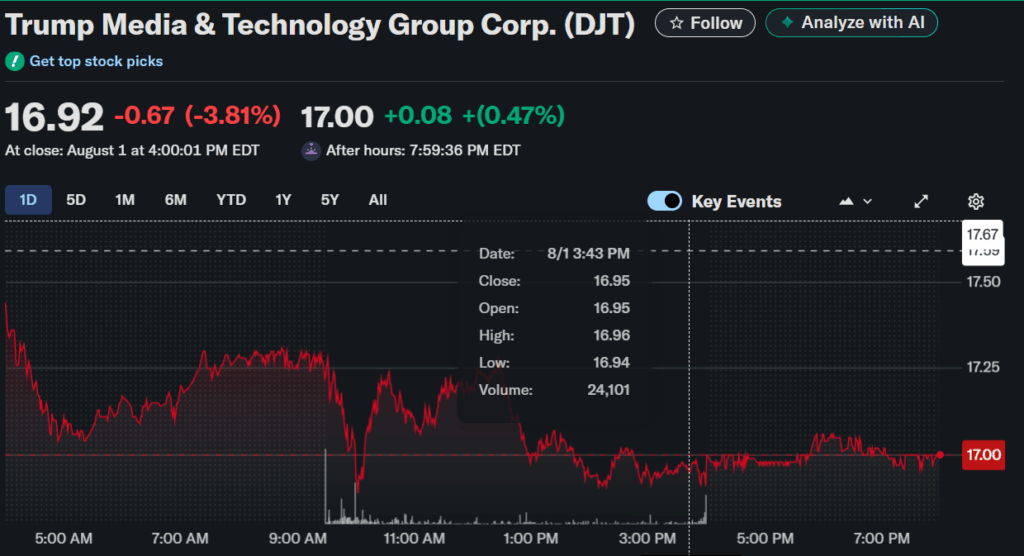

Trump Media & Know-how Group (DJT) has formally gone all in on Bitcoin. Regardless of logging a $20 million loss in Q2, the corporate’s asset pool swelled to $3.1 billion—fueled principally by a jaw-dropping $2 billion BTC purchase. Shares slipped almost 4% in the course of the day on August 1, closing at $16.92, however clawed again just a little after hours to settle at $17 flat.

Yeah, the loss stings, however that Bitcoin stash? That’s what actually turned heads.

A Treasury Crammed with Bitcoin

So, right here’s what occurred: Trump Media pulled in almost $2.4 billion by way of a personal funding spherical involving roughly 50 big-money backers. That money was used to snap up round $2 billion price of Bitcoin and associated crypto belongings. This principally catapults DJT into the most important leagues of company Bitcoin holders.

The corporate’s pitch? Bitcoin isn’t only a flex—it’s a strategic asset. They’re calling it a safeguard in opposition to debanking and a possible revenue generator. Plus, it provides them monetary ammo for future merchandise and acquisitions. The crypto seize occurred principally in July, proper after the fundraising wrapped.

Money Circulate, Platforms, and New Instruments

Surprisingly, Trump Media recorded constructive working money stream for the primary time—about $2.3 million within the inexperienced. That’s a giant second because it pushes enlargement of its Fact Social app and the brand new Fact+ streaming platform. Fact+ is now stay in most areas, with its Patriot Package deal subscription in beta. Suppose: auto-verification, new posting instruments, and finally, a digital pockets baked proper in.

Oh, and so they’re additionally cooking up an AI-powered software for Fact Social to spice up consumer expertise. Extra options = extra customers = higher engagement. No less than, that’s the concept.

Authorized Charges Drag, However Future Seems…Fascinating

On the draw back, income solely got here in at $0.9 million—up simply 6% from final 12 months. In the meantime, authorized payments are by way of the roof—$15 million in Q2 alone, principally tied to the 2024 SPAC merger drama. Toss in one other $20.5 million in non-cash bills (inventory comp, depreciation, and so forth.) and yeah, it’s messy.

Nonetheless, administration thinks wrapping up the litigation may clear issues up quick. They’re additionally eyeing a collection of ETFs, some with a crypto twist, to spice up their footprint in fintech.