Tron (TRX) has entered a interval of consolidation following its spectacular surge to multi-year highs final week. After robust momentum carried costs upward, the market is now transferring in a tighter vary, reflecting a section of recalibration. Regardless of this pause in value motion, the general construction stays bullish, with increased lows and robust resilience from consumers supporting the pattern.

Associated Studying

Fundamentals proceed to play a big position in driving Tron’s progress. The community’s increasing footprint throughout decentralized functions, funds, and stablecoin transactions has strengthened confidence amongst each retail and institutional contributors. This resilience has allowed TRX to keep up upward momentum even amid broader market volatility.

Knowledge from CryptoQuant means that the present section could symbolize extra than simply consolidation. The metrics level to circumstances aligning with the formation of a neighborhood backside area, typically a precursor to renewed upward motion. As consumers regularly regain dominance and promoting strain begins to fade, analysts spotlight the potential for TRX to increase its bullish trajectory.

Tron Spot Market Alerts Native Backside

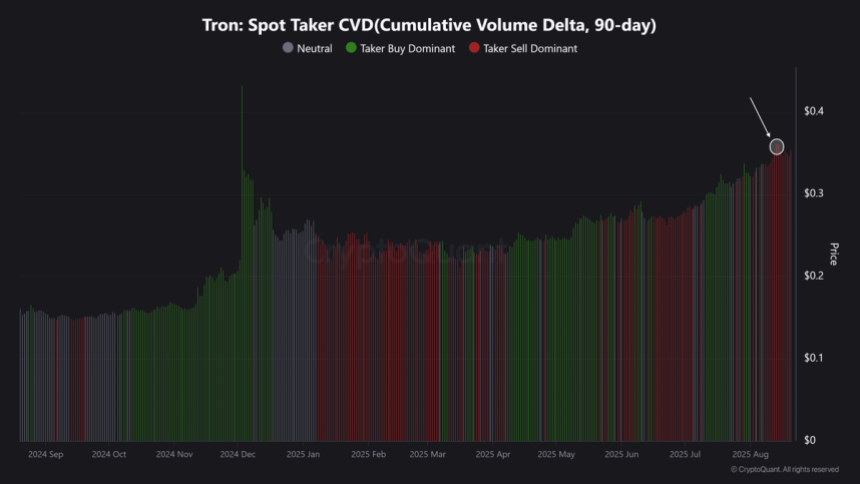

In accordance with CryptoQuant analyst Burak Kesmeci, the Spot Taker CVD (Cumulative Quantity Delta) has been a extremely dependable device for gauging buyer-seller dominance within the Tron (TRX) spot market over the previous 12 months. This indicator tracks whether or not aggressive consumers or sellers are dominating trades, and its historic efficiency has produced correct alerts for main value shifts.

One notable instance was throughout November–December 2024, when purchaser strain clearly strengthened. The Spot Taker CVD confirmed this shift, and TRX surged by greater than 180% in just some weeks. This case highlights the indicator’s capacity to seize market dynamics at important turning factors.

Quick-forward to August 2025, and the CVD is as soon as once more sending necessary alerts. On August 13, 2025, vendor dominance reached its highest level up to now 12 months, marking excessive strain available in the market. Nonetheless, since then, that dominance has begun to weaken, suggesting that promoting momentum is fading. Traditionally, such circumstances typically precede a neighborhood backside formation as promoting exhaustion provides approach to renewed shopping for exercise.

Kesmeci factors out that the present setup signifies bulls could also be regaining power. If this pattern continues, TRX could possibly be on the verge of one other robust leg upward. The approaching days might be important, as affirmation of weakening promote strain could open the door for a renewed rally, additional extending Tron’s bullish market construction.

Associated Studying

TRX Consolidates Under Key Ranges

The day by day chart of TRON (TRX) reveals the asset consolidating close to $0.3567 after reaching new multi-month highs earlier in August. Regardless of latest pullbacks, TRX continues to commerce nicely above its key transferring averages, with the 50-day SMA at $0.3238, the 100-day SMA at $0.2990, and the 200-day SMA at $0.2693. This alignment displays a powerful bullish construction, because the short-term averages stay stacked above the longer-term ones, confirming that momentum continues to be in favor of the bulls.

The latest consolidation slightly below $0.38 means that TRX is pausing after a powerful rally quite than reversing. Worth motion is holding above the 50-day SMA, which is now performing as dynamic assist. If consumers handle to push the worth above the latest highs, the subsequent goal could possibly be the psychological $0.40 degree, with potential continuation towards $0.45.

Associated Studying

On the draw back, a failure to carry above $0.32 would expose TRX to deeper corrections, with the 200-day SMA close to $0.27 serving as a key long-term assist. TRX stays in a bullish pattern, with consolidation signaling a possible base for the subsequent leg upward. Bulls want to keep up assist above $0.32 to maintain momentum intact.

Featured picture from Dall-E, chart from TradingView