Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Whereas Bitcoin and different main cryptocurrencies have surged to new all-time highs, Tron (TRX) has remained in a good consolidation vary. Regardless of the broader market’s bullish momentum, TRX remains to be buying and selling practically 66% beneath its early December peak. Nonetheless, this lagging value motion has not gone unnoticed—traders and analysts are more and more watching Tron as a possible breakout candidate.

Associated Studying

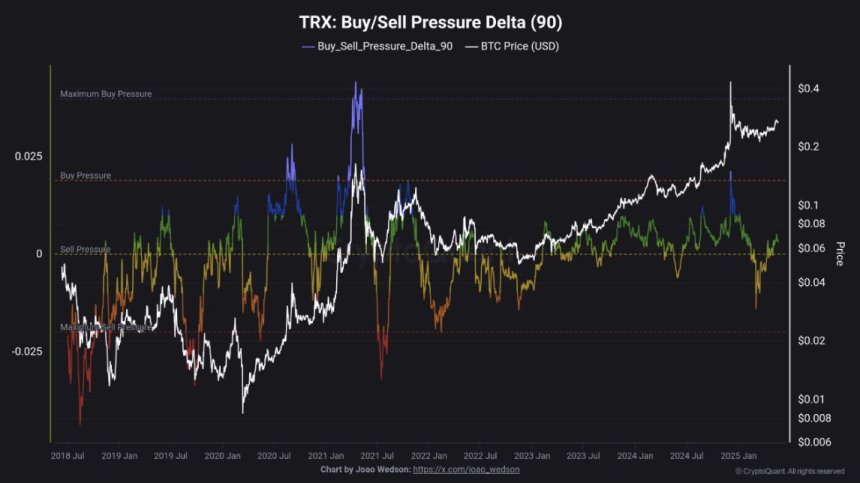

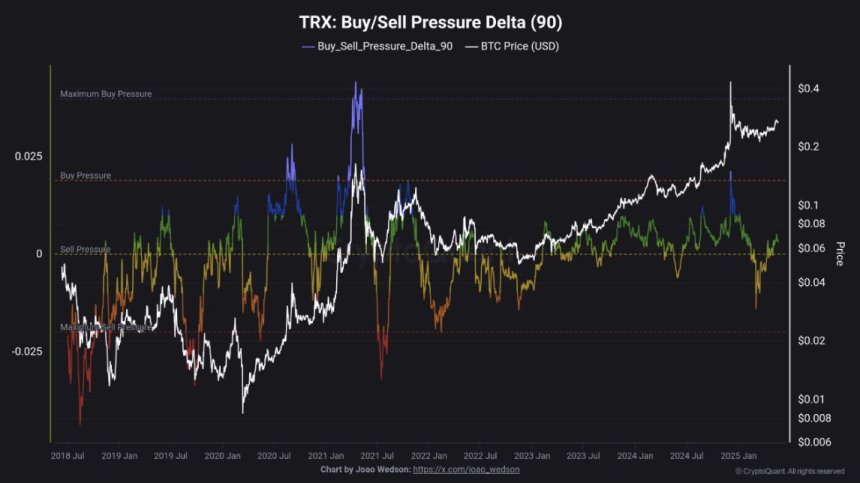

As one of many top-performing Layer-1 blockchains over the previous 12 months, Tron’s fundamentals stay sturdy. The community continues to guide in stablecoin settlement quantity and person exercise, positioning it nicely for renewed upside if altcoins observe Bitcoin’s lead. Latest on-chain knowledge from CryptoQuant provides to the optimism: the Purchase/Promote Stress Delta, which measures web shopping for or promoting exercise over the previous 90 days, reveals that TRX has re-entered a shopping for strain zone.

Traditionally, this sign has preceded bullish value actions, particularly when mixed with sturdy fundamentals and bettering market sentiment. If shopping for strain persists and value breaks above present resistance ranges, Tron might stage a big rally to meet up with the broader market. For now, all eyes are on whether or not this contemporary demand can spark TRX’s subsequent leg greater.

Tron Holds Robust As Bullish Momentum Rebuilds

Tron (TRX), probably the most resilient altcoins lately, continues to point out energy regardless of a difficult setting for many non-Bitcoin belongings. Since late 2022, TRX has adopted a gentle uptrend, defying broader market corrections and sustaining sturdy on-chain fundamentals. Now, the asset consolidates close to crucial technical ranges, making ready for what could possibly be its subsequent leg upward.

Though Bitcoin has clearly led the present cycle—hitting new all-time highs and attracting the vast majority of capital—many altcoins like Tron are nonetheless lagging. This divergence has led a number of analysts to query whether or not an altseason remains to be on the desk. Most imagine this can be a Bitcoin-dominant cycle, particularly given the influx to BTC ETFs and macroeconomic uncertainty. Nonetheless, hope stays for a rotation into altcoins.

Supporting that optimism, CryptoQuant insights reveal that TRX has returned to a shopping for strain zone. The Purchase/Promote Stress Delta reveals a transparent transition out of the promoting strain space. Demand is as soon as once more exceeding provide, favoring bulls.

Importantly, TRX has not but reached the historic thresholds that sometimes precede value tops. This means that there’s nonetheless room for progress earlier than warning units in. If the broader market helps a rotation, Tron might emerge as a standout Layer-1 performer as soon as once more, particularly as merchants seek for sturdy setups past Bitcoin.

Associated Studying

Technical Evaluation: Bulls Defend Larger Lows Above Help

The each day chart for Tron reveals that the asset is consolidating after a robust push towards the $0.28 resistance zone. Worth motion has maintained a transparent bullish construction since early April, with greater lows forming constantly alongside the 34-day EMA ($0.26), which now acts as dynamic help. The 50, 100, and 200 SMAs are all trending upward and tightly aligned beneath the present value, signaling long-term bullish alignment.

TRX stays in a short-term consolidation vary between roughly $0.26 and $0.28. The value just lately examined this higher boundary twice however failed to interrupt by way of with sturdy momentum. Nonetheless, help at $0.26 has held firmly, suggesting patrons are nonetheless in management.

Associated Studying

To substantiate a breakout, bulls should decisively push the value above $0.28 with greater quantity, which might open the door to a transfer towards $0.30 and probably retest December’s highs close to $0.36. On the draw back, shedding $0.26 would weaken this setup and certain set off a drop towards the $0.2430 area, the place the 100 SMA presently sits.

Featured picture from Dall-E, chart from TradingView