- Solana is extra established, has deeper liquidity, and is backed by institutional strikes. Safer, however decrease upside.

- Sui is newer, leaner, and transferring quicker. Extra threat, but additionally extra room to develop.

- Each are sturdy L1s—however Sui’s innovation and up to date features give it actual long-term potential.

Alright, right here’s a face-off value your consideration—Sui vs. Solana. Two blazing quick blockchains, each with low charges, tight safety, and bold targets. However just one can actually take the crown this cycle. Solana’s the outdated favourite from the 2021 insanity, whereas Sui’s the scrappy new contender. So, which one’s acquired that next-level upside? Let’s dig in and break it down.

Solana ($SOL): The Veteran With Muscle

Solana kinda dominated the final bull run, proper? From $1.50 to $260 in a flash. That’s like… absurd. A 173x in only over a 12 months. Wild. However even crazier—Solana solely launched in 2020. Since then, it’s matured right into a critical participant. Now sitting fairly within the high 10 by market cap, it’s acquired actual cred.

It additionally fastened a few of its outdated points—like uptime. The chain barely hiccupped since late 2022. Large enchancment. And establishments? They’re watching intently now. A $SOL staking ETF launched in July and racked up $33 million in day-one quantity. Extra ETFs (spot ones too) are within the pipeline. Some huge companies are even stashing $SOL of their treasuries.

Let’s not overlook the RWA angle—Solana’s cooking up tokenized shares, treasuries, and even bodily belongings. Assume stuff from BlackRock, Franklin Templeton, and even collectible platforms. That’s a giant deal. Oh—and yeah, the memecoin scene’s wild right here too, whether or not you find it irresistible or hate it.

Sui ($SUI): The Underdog With Momentum

Sui didn’t even exist earlier than mid-2023, but right here it’s already cracking the highest 10 in DeFi TVL. That’s nuts. It even leapfrogged Hyperliquid. One of many stars right here? Bluefin, a number one perps alternate that’s completely crushing it. And BTCFi is booming too—Bluefin rolled out $tBTC to make your Bitcoin work more durable.

There’s additionally Suilend, which is gaining traction within the lending house. Whereas Bitcoin dipped just lately, $LEND (its native token) jumped 16% in a day. Not unhealthy. One other identify to observe is Momentum—particularly for those who’re farming airdrops.

Then there’s Walrus Protocol. Sounds goofy however it’s doing critical stuff. Assume decentralized storage however manner cheaper—like 80% cheaper. Even Grayscale is watching this intently. Their latest report gave Walrus a giant thumbs-up, and yeah, a second airdrop’s coming too.

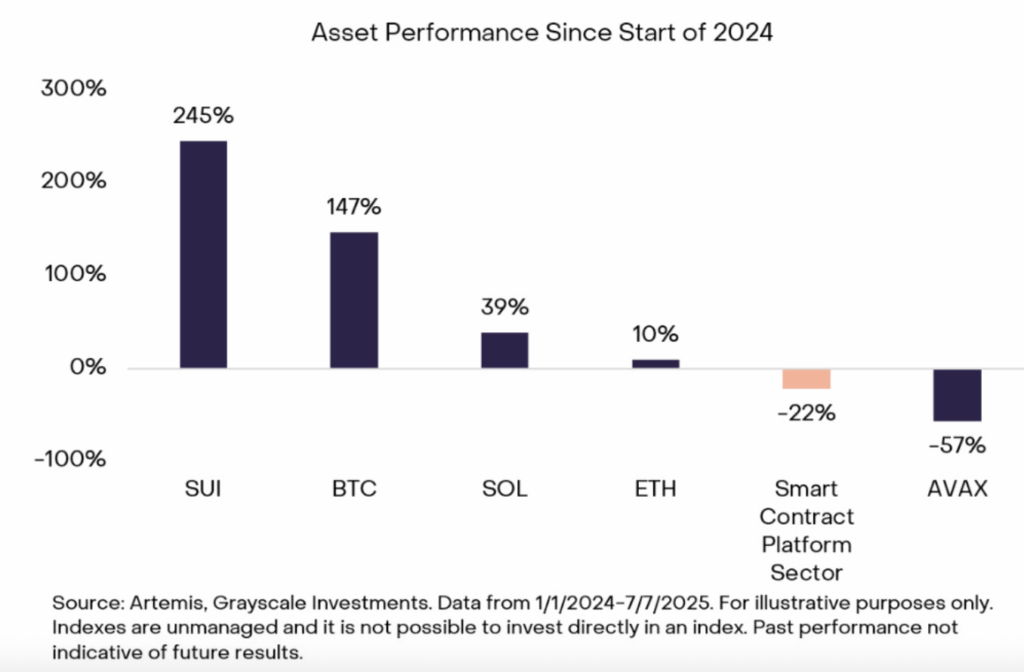

Sui’s momentum is difficult to disregard. It’s crushed Bitcoin, gold, the S&P 500, and Coinbase inventory prior to now 12 months. Dev exercise’s up. Token metrics are up. Person depend? By means of the roof—over 230 million accounts and nonetheless rising.

Verdict: So Who Wins This Factor?

Let’s be actual—each are stable picks. Solana is the established beast. It’s deep, dependable, and loaded with liquidity. DeFi, NFTs, RWAs—it’s acquired all of it. However it’s not gonna do one other 100x. You may see $600, possibly $800 if the celebrities align. Nonetheless, that’s a pleasant 4–5x from the place it’s at.

Sui, however, is the hungry newcomer. Extra threat, certain. However far more upside. Its structure is completely different (object-centric!), and its ecosystem is ramping up quick. At $3.90, a push to $15 feels affordable. That’s 4x too—however actually, it may overshoot.

So, short-term? Solana’s the safer trip. Lengthy-term? Sui may simply be the darkish horse that blows previous expectations… if it retains delivering.