- Sui rebounds after chaos: Regardless of an enormous DEX exploit and sharp liquidations, SUI held above $3.30, displaying sturdy help backed by dev exercise and rising DEX quantity.

- On-chain power stays stable: TVL bounced again to $1.68B, stablecoins stayed above $1B, and the group swiftly recovered $162M in frozen funds after a 90% approval vote.

- Merchants eye subsequent leg up: With good cash indicators flashing and bullish sentiment returning, SUI might push towards $4.10—if it breaks previous the $3.60–$3.75 resistance zone.

After getting rocked by liquidations and a DEX exploit, Sui (SUI) is discovering its footing once more. Value has been hovering simply above $3.30, holding a key technical stage whereas the community quietly regains power. Developer exercise’s nonetheless going sturdy, and with some large macro stuff in play—like a possible Fed pivot later this 12 months—merchants are anticipating that $4.10 mark. A couple of are even tossing round $4.50 as a stretch goal, assuming momentum sticks.

Ecosystem Rebuilds After the Cetus Shake-Up

Even after the $223M Cetus DEX exploit, the Sui group didn’t waste time responding. Over 90% voted to get well $162M in frozen belongings, now sitting in a multisig pockets ready for distribution. Regardless of the chaos, TVL dropped however then bounced from $1.54B to $1.68B. That’s not a small transfer. Stablecoin provide stayed agency above $1B—so liquidity didn’t dry up, which is an efficient signal. Every day DEX quantity can also be again on the upswing, from $178M to just about $272M. Devs are nonetheless constructing, customers are nonetheless round, and the community’s not skipping a beat.

SUI Value Holds Fib Assist, Merchants Eye Breakout Zones

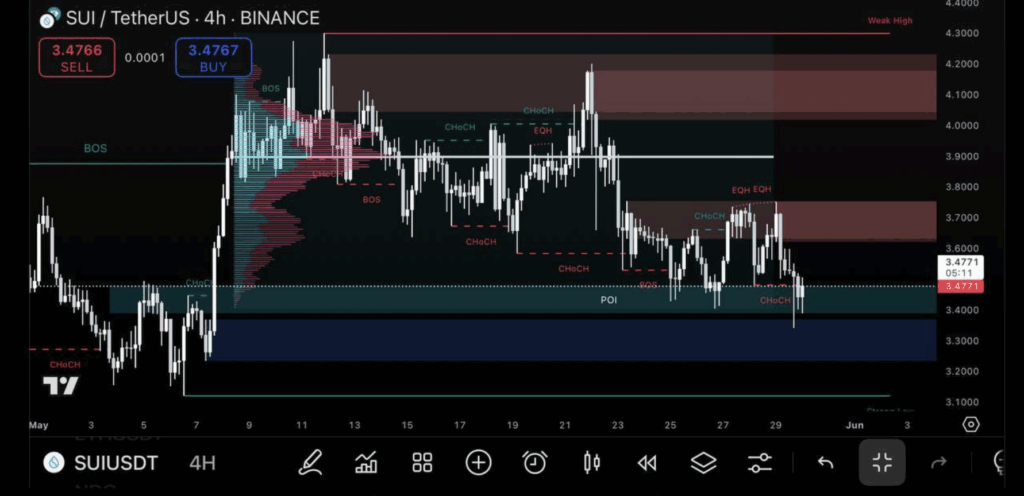

Proper now, SUI’s chillin’ at $3.44—proper on the basic 0.382 Fib stage. Consumers have been holding down the $3.30 to $3.45 vary fairly tightly, and if it holds, that might imply one other leg up. First checkpoints? Round $3.75, perhaps $4.10 if momentum clicks. Analyst Kamil thinks we’re in an accumulation zone—good cash strikes like BOS (Break of Construction) and CHoCH (Change of Character) recommend bullish intent. Nonetheless, short-term resistance may pop up round $3.80–$3.90 the place liquidity traps are likely to occur.

Market Shakeouts Clear the Board—Now What?

That $16M liquidation wave worn out a bunch of longs quick. Open curiosity dropped practically 15%, so the leverage bought flushed. However larger image? Merchants on Binance and OKX are nonetheless leaning lengthy, exhausting. The lengthy/brief ratio is 2.11 by quantity for high Binance merchants—individuals are nonetheless betting on upside. Funding charges have turned constructive once more, and a few shorts bought wrecked just lately. If SUI breaks previous $3.60 with good quantity, that $4.10 goal may come into sight sooner than anticipated. If not, patrons will most likely have a look at reloading round $2.91 or $2.33—main Fib ranges.

Fed Watch and Déjà Vu from 2017

Macro-wise, issues really feel a bit like 2017 once more—large spikes, large drops, everybody attempting to guess the following transfer. International markets are nonetheless jittery, and merchants are watching the Fed’s subsequent steps. Some say we’d see a shift by late This autumn, which might open the doorways for a crypto rally. Till then, SUI has to carry its base—wherever between $3.10 and $3.30 could be a springboard. If that ground holds and quantity picks up, SUI may very well be prepping for a recent leg up, with $4.10 nonetheless in sight. Possibly even increased, if stars align.