- Stellar is up over 7% across the $0.30 space, with futures open curiosity leaping ~11% and a long-to-short ratio above 1, hinting that merchants are quietly leaning bullish once more.

- Worth is rebounding inside a descending channel however nonetheless trapped below the 50, 100, and 200-day EMAs; a break above these and towards the $0.37 channel prime can be the primary actual signal of a stronger development shift.

- Momentum is enhancing with a bullish MACD cross and RSI close to 49, however the latest Loss of life Cross retains a bearish cloud overhead, and a drop under $0.2520 would affirm a recent breakdown from the present construction.

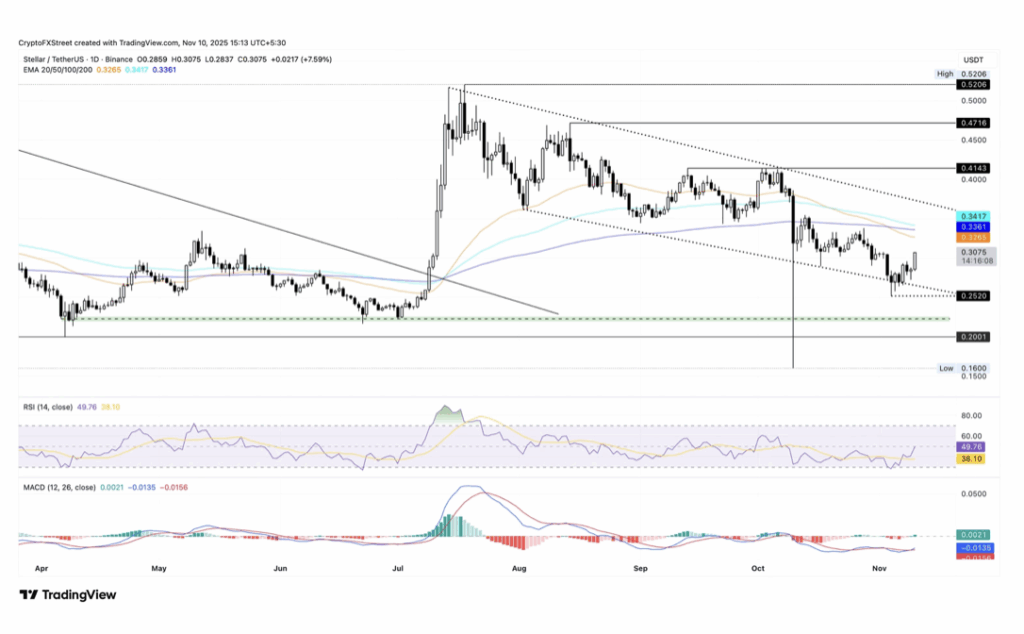

Stellar (XLM) lastly awakened a bit on Monday. The token edged larger by just a little over 7% at press time, stretching its rebound inside a still-intact descending channel on the every day chart. Costs are curling up from the decrease finish of that sample, which seems good on the floor, however zoom out and also you’ll see it’s nonetheless swimming in opposition to a broader downtrend.

Beneath the hood, derivatives knowledge present that merchants are slowly shifting again into risk-on mode. Open curiosity is climbing, lengthy positions are edging forward of shorts, and sentiment feels much less “doom” and extra “hmm, possibly there’s a bounce right here.” Even so, XLM nonetheless has a number of layers of resistance hanging above it like a low ceiling, and any bullish development shift should struggle by means of these one after the other.

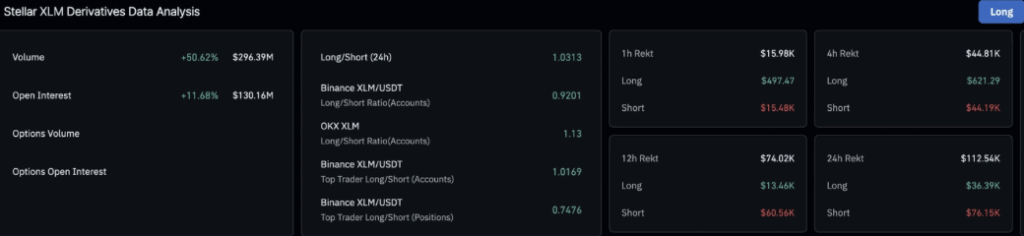

Derivatives merchants are quietly loading up on XLM

As the broader crypto market begins the week on a stronger footing — helped partly by optimism round a possible US authorities shutdown decision — Stellar is pulling extra curiosity from derivatives merchants. CoinGlass knowledge exhibits that XLM futures open curiosity has climbed to about $130.16 million, up roughly 11.68% within the final 24 hours. That’s a reasonably strong bounce and often alerts that merchants anticipate extra motion forward, not much less.

The long-to-short ratio is backing up this shift in tone. Over the previous day, the ratio for XLM has moved to round 1.0597. Something above 1 means there are extra excellent lengthy positions than shorts, which mainly interprets to: merchants are barely extra satisfied about upside than draw back proper now. It’s not some loopy euphoric studying, but it surely does present a light bullish lean fairly than a fearful one.

So whereas the spot chart nonetheless seems prefer it’s recovering inside an even bigger downtrend, the derivatives crowd appears to be quietly betting that this rebound has not less than a bit extra room to run.

Worth recovers, however nonetheless trapped under key transferring averages

On the spot aspect, Stellar is buying and selling near the $0.3000 mark as of Monday, bouncing from inside that descending channel construction on the every day timeframe. The transfer larger is occurring inside a bigger bearish sample, which is necessary — it’s a restoration leg, not but a confirmed development reversal.

Proper now, XLM remains to be buying and selling under three necessary Exponential Shifting Averages:

- the 50-day EMA close to $0.3265

- the 100-day EMA round $0.3417

- and the 200-day EMA near $0.3361

These ranges are stacked above value like a staircase of resistance. If this restoration run can push by means of these common traces and maintain above them, Stellar might begin eyeing the higher boundary of the descending channel, which sits close to the $0.3700 area. That overhead trendline can be the subsequent huge check for any severe bullish continuation.

Momentum is enhancing, however the “Loss of life Cross” nonetheless hangs over the chart

Technical indicators on the every day chart are beginning to present a little bit of life once more. The MACD has crossed above its sign line, a basic signal that draw back momentum is cooling and patrons are getting extra lively. On the similar time, the RSI has climbed to about 49, creeping nearer to the impartial 50 zone. Which may sound boring, but it surely truly issues: it means promoting stress has eased off sharply, and the market is shifting again towards steadiness as an alternative of being tilted closely to the bears.

Nevertheless — and this can be a huge “nonetheless” — the chart remains to be carrying the shadow of a latest Loss of life Cross. On November 3, the 50-day EMA crossed under the 200-day EMA, which is mostly seen as a medium-term bearish sign. It mainly says, “sure, there’s a bounce, however the bigger development remains to be below bear management for now.” Till value can climb again above these larger EMAs and keep there, that Loss of life Cross acts like a warning label caught to the chart.

If this short-term restoration fizzles out, XLM might flip decrease once more and revisit final week’s low round $0.2520. A every day shut under that stage would affirm a bearish breakout from the falling channel and certain open the door to deeper draw back. Then again, a robust rebound that clears these key transferring averages and drives towards $0.3700 would go a great distance towards proving that that is extra than simply one other dead-cat bounce.

For now, Stellar sits in that awkward center zone: stronger than it seemed a couple of days in the past, however nonetheless preventing in opposition to greater, slower bearish forces hanging above it.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.