Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

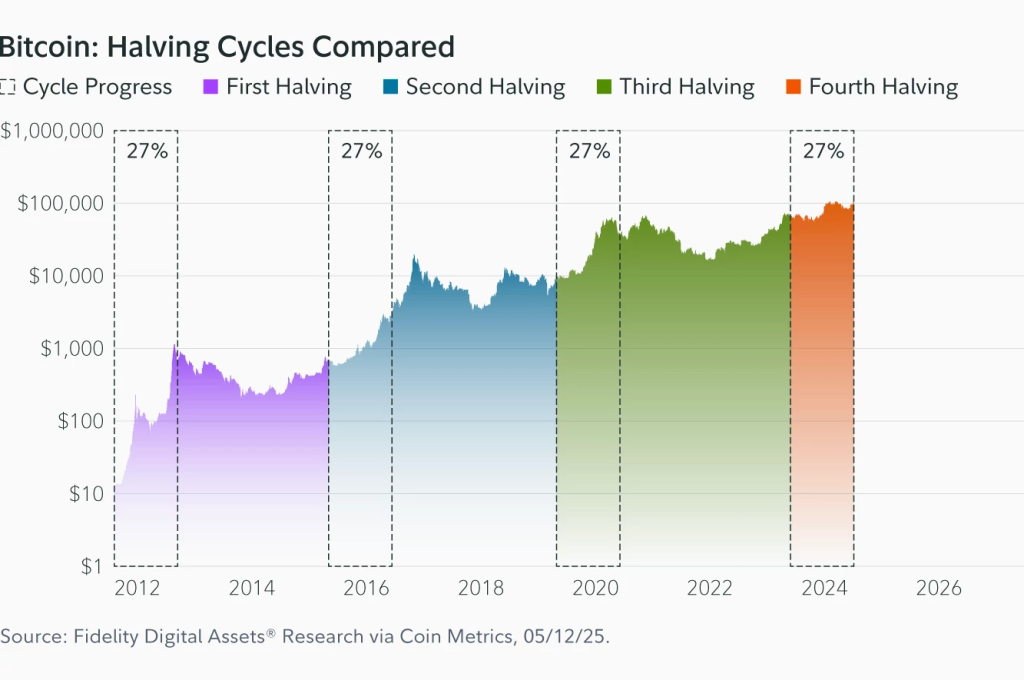

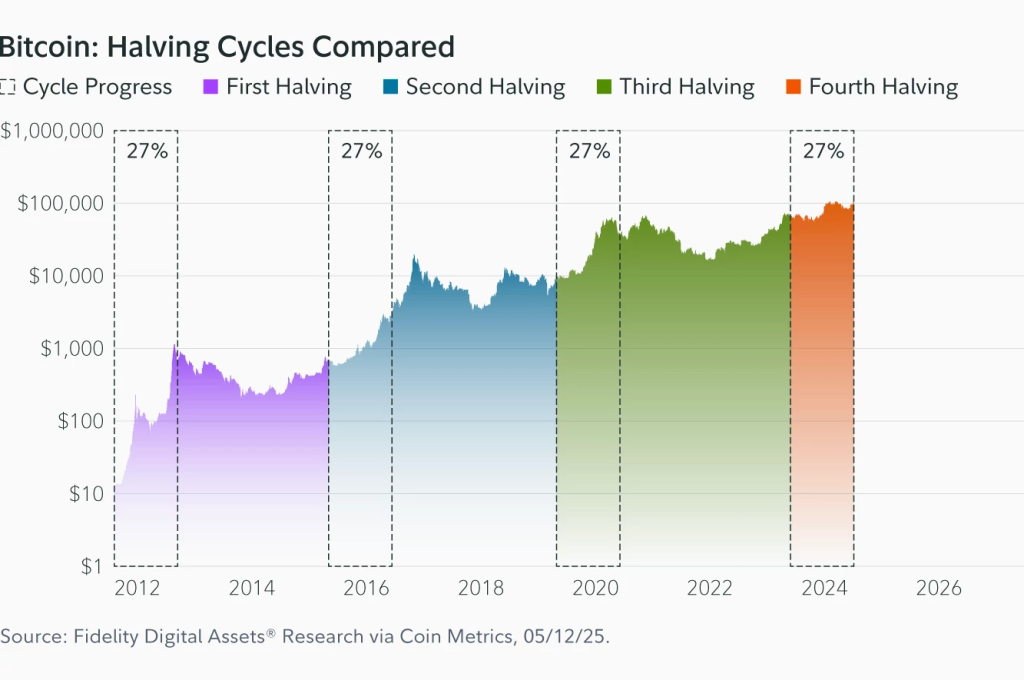

Constancy Digital Property selected a single submit on X to border its newest analysis word: “Bitcoin is up ~63 % from its 2024 halving worth with 27 % of this halving epoch accomplished. Whereas previous epochs noticed triple-digit rallies, a brand new story could also be unfolding: certainly one of rising maturity, deeper adoption, and community resilience.” The tweet landed minutes after the agency launched “2024 Bitcoin Halving: One 12 months Later,” authored by senior analyst Daniel Grey, who contends that the obvious lull in worth motion masks “a strengthening basis.”

Constancy Flags Bitcoin’s Silent Surge

“Bitcoin presents a nuanced narrative a 12 months after its fourth halving, with indicators pointing towards consolidation, community resilience, and rising institutional adoption,” Grey writes, including that structural indicators “recommend a strengthening basis.”

Whereas earlier cycles delivered triple- and even quadruple-digit share positive factors by this stage, Grey argues the softer trajectory indicators maturation: “Historical past means that we might be effectively into the bull run at this level within the fifth epoch — however this cycle could also be unfolding extra cautiously.”

From a market-share perspective the info are unequivocal. “Bitcoin’s market dominance excluding stablecoins has risen to only over 72.4% as of 11 Could, a brand new eight-year excessive,” Grey notes, declaring that Ether and Solana have surrendered floor at the same time as “fragmentation on the lengthy tail of property has failed to provide a transparent various chief.”

Associated Studying

On-chain safety metrics inform the same story: “Bitcoin’s day by day hash-rate rose above one zetta hash per second twice in April, reflecting continued funding in mining infrastructure regardless of a 60 p.c collapse in hash worth for the reason that halving,” he observes.

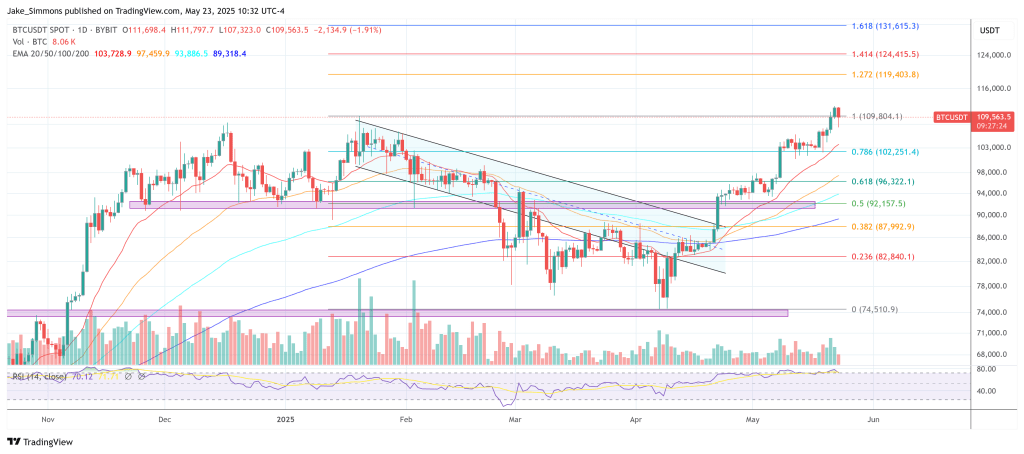

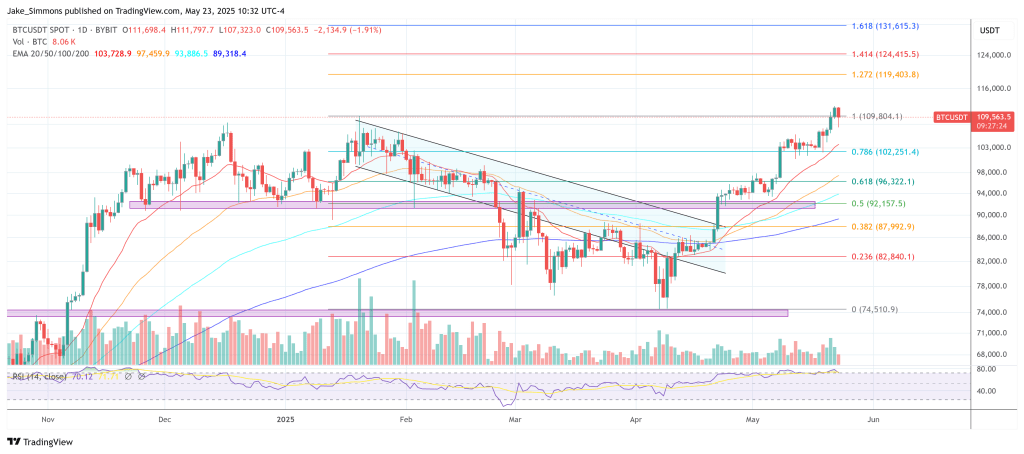

Spot-market behaviour has begun to echo these fundamentals. Bitcoin printed a file intraday excessive of $109,486 on 21 Could earlier than extending above $111,000 on so-called Pizza Day, holding close to $110,600 at press time.

The transfer has been underwritten by renewed demand from US spot ETFs, which drew $934.8 million of internet subscriptions yesterday, Could 22— the heaviest single-day haul in virtually 4 weeks. Derivatives exercise mirrors the pattern: mixture futures open curiosity reached a file $80 billion on Could 23, up roughly 30% for the reason that begin of the month, in line with CoinGlass knowledge.

Associated Studying

In the meantime, funding charges in most crypto exchanges are on the baseline or under it. “That is the least euphoric new all-time highs within the historical past of Bitcoin,” crypto analyst Alex Krüger (@krugermacro) wrote by way of X.

Grey cautions that buyers ought to focus much less on headline returns and extra on the structure taking form beneath them. “Though returns have been extra measured in comparison with earlier cycles, structural metrics recommend a strengthening basis. Total, it seems Bitcoin is probably maturing—one thing buyers might discover extra notable than short-term worth motion,” he writes.

His closing evaluation is blunt: “One 12 months post-halving, Bitcoin’s worth efficiency could appear muted, however its fundamentals seem stronger than ever … this can be a cycle that redefines Bitcoin’s function in a contemporary portfolio.”

In different phrases, Constancy’s message for would-be spectators is as clear as its headline: don’t blink.

At press time, BTC traded at $109,563.

Featured picture created with DALL.E, chart from TradingView.com