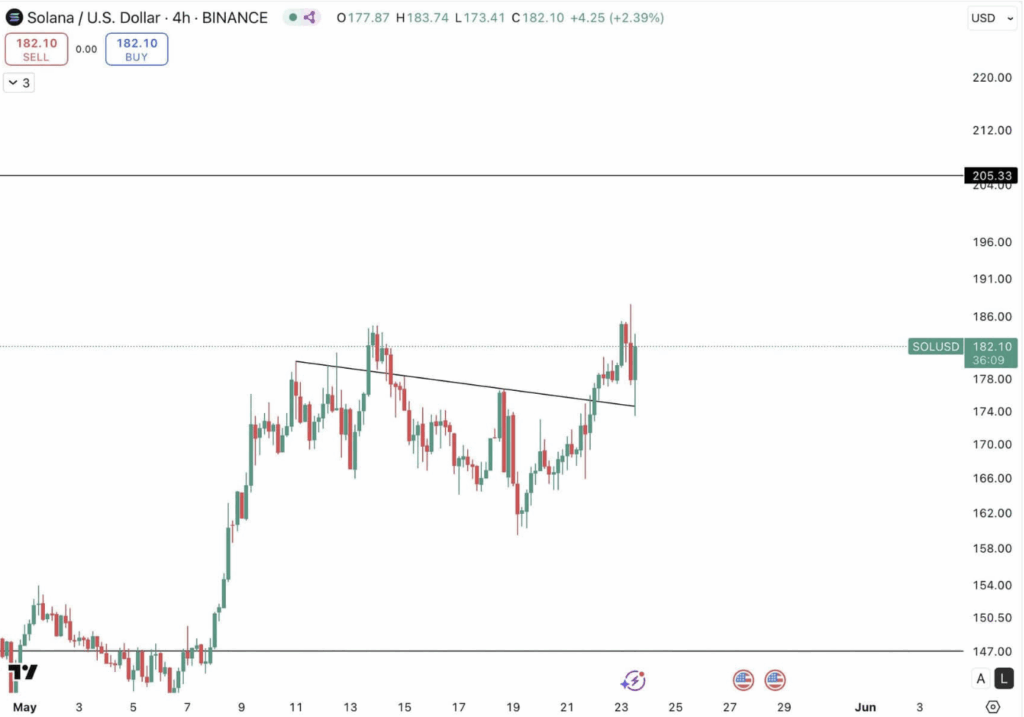

- Bullish breakout confirmed: SOL broke out of a symmetrical triangle on May 27, retested $175 as support, and is now holding above $180 with strong volume backing the move.

- Technical strength visible: Indicators like MACD, RSI, and the 50-period moving average all point to rising momentum and institutional interest.

- Next target in sight: Traders are eyeing $205 as the next key level, with $190 and $200 offering only light resistance if the bullish trend holds.

Solana (SOL) is picking up steam again, climbing to $180.34 with a solid 6.48% gain over the past week. With a 24-hour trading volume at $7.17 billion and a market cap close to $94.74 billion, the coin’s holding up well — short-term action looks stable, and bulls are showing up.

Breakout? Yep, We Got One

Looking at the 12-hour chart, SOL recently popped out of a symmetrical triangle — that’s a pattern that usually screams indecision. Price bounced around in that triangle through late May, until it finally broke out above $180 on May 27. That move was loud and clear.

Not long after, price dropped for a quick retest at $175 — now flipped into support — and that little confirmation has given traders a reason to lean into the move.

Indicators Are Lining Up

Volume spiked with the breakout, which is exactly what you want to see. MACD and RSI weren’t spelled out number-wise, but they’re flashing green on the chart, showing growing pressure from buyers. Momentum looks solid.

Also, SOL retraced to the 50-period moving average before bouncing back up — that’s usually where serious traders perk up. When trendlines, volume, and moving averages all line up like this, it tends to attract even more buying.

So What’s Next? Eyes on $205

With price floating around $183.71 now and up 4.45% in the last 12 hours, traders have set sights on $205. That’s just over 11% higher — not a stretch, especially with the current tailwind.

Sure, there might be a little static at $190 and $200 — psychological levels often throw a quick curveball — but they’re not expected to hold back the move for long.

If broader market vibes stay friendly and macro stuff doesn’t throw a wrench in things, Solana’s got a decent shot at pushing through. The setup’s looking sharp, and bulls seem ready to run with it.

Source link