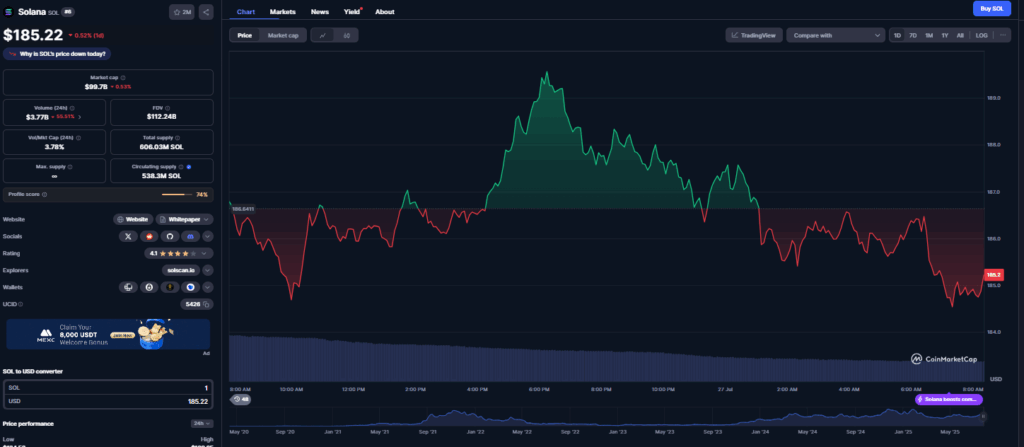

- Solana dropped 3.2% to round $180, holding key help close to $177.

- Analysts predict a push towards $205, with larger targets if bullish momentum holds.

- The July 29 FOMC assembly may affect SOL’s subsequent main transfer, particularly if price cuts are hinted.

Solana (SOL) lately cooled off after its rally, slipping about 3.2% over the previous week. The sixth-largest crypto is now hovering round $180, a stage the place it’s discovering some first rate help. There’s speak that SOL may dangle across the $177 zone for a bit, possibly even choose up momentum if patrons step in. It’s been a uneven market although, so the following transfer would possibly rely on how a lot persistence merchants have.

Analysts Predict a Push Towards $205

A number of analysts are leaning bullish regardless of the dip, saying this would possibly simply be a pause earlier than one other climb. The concept? SOL may scoop up liquidity right here after which goal again at $200, and even push larger. Nonetheless, some suppose buyers might hold promoting with all of the uncertainty floating round. The SEC hasn’t helped a lot both—5 Solana ETF purposes, together with ones from Constancy and Grayscale, have been delayed till Fall 2025. Even so, Polymarket odds are betting 80% that approval will come finally.

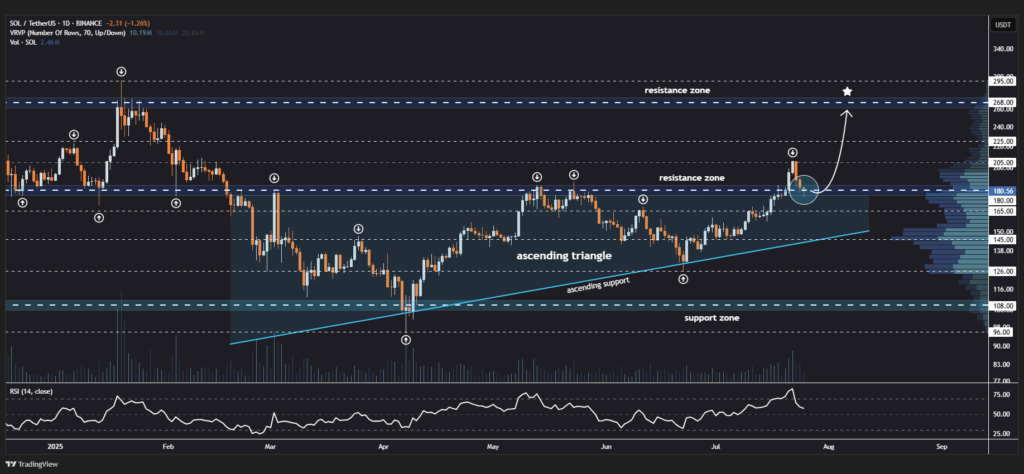

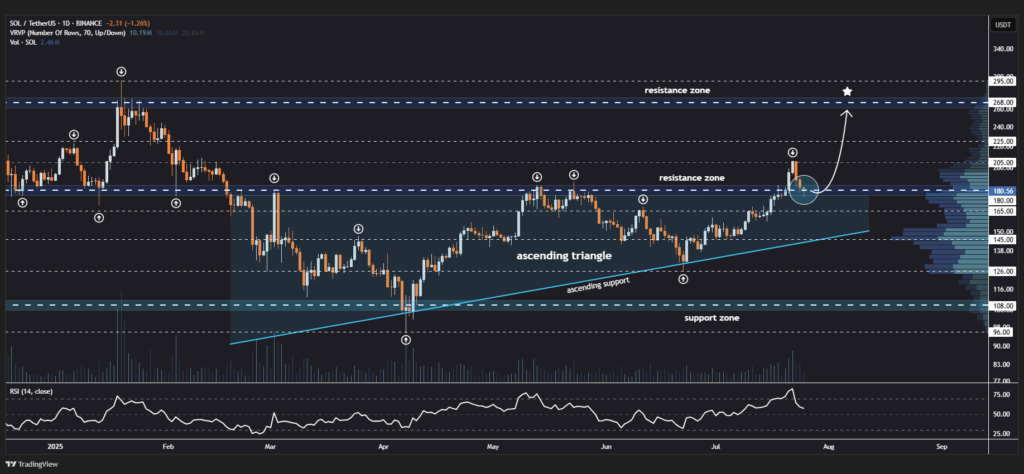

Technical Setup Factors to Breakout Potential

On the charts, SOL simply broke above the highest of an ascending triangle—a bullish sample that’s been in play since March. It’s now testing that breakout zone, and if it holds, we may see fireworks. Analyst Jonathan Carter says a stable bounce right here would possibly push SOL towards $205 first, and doubtlessly to $225 and even $268 if momentum builds. That $205 stage is being watched intently, particularly because it was a reversal level again in April.

Market Sentiment and the Fed Issue

After all, the broader crypto temper is shaping what occurs subsequent. The Federal Open Market Committee (FOMC) assembly on July 29 is more likely to be a giant driver. If the Fed alerts price cuts, markets may get that shot of adrenaline they’ve been ready for. Till then, shopping for the dip is perhaps tempting however dangerous—SOL may simply dip additional earlier than the development flips. Some merchants are holding off for clearer alerts from the Fed earlier than leaping in.

Supply hyperlink