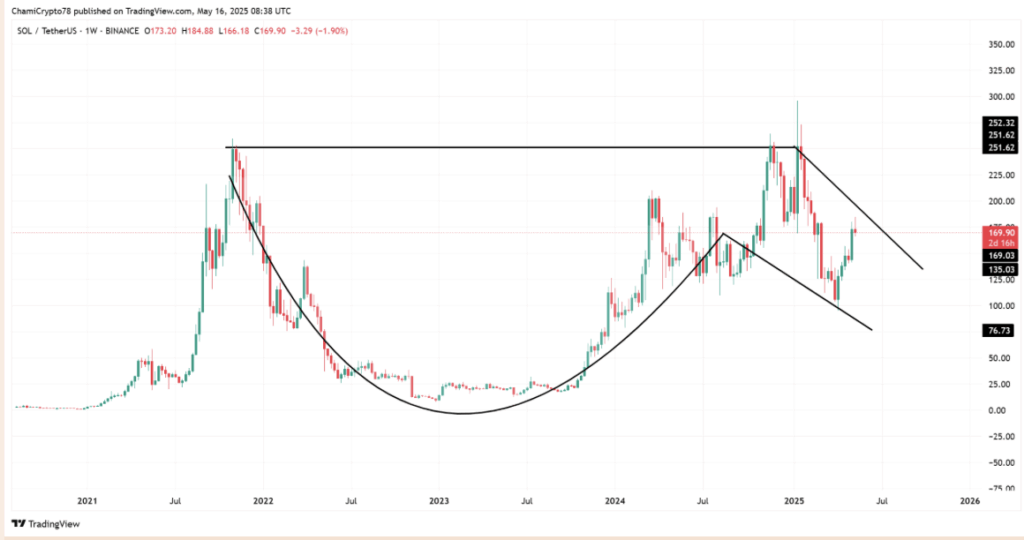

- Solana Eyes Key Breakout: SOL is forming a traditional cup-and-handle sample on the weekly chart, with resistance between $200 and $210. A breakout above this zone may set off a powerful bullish transfer, however the value is at present sitting at $170.20 after a slight pullback.

- Blended Sentiment and Lengthy Bias: Whereas Binance information exhibits a heavy lengthy bias with 70.53% of merchants positioned for upside, sentiment stays barely adverse at -0.46, suggesting warning regardless of the bullish technical setup.

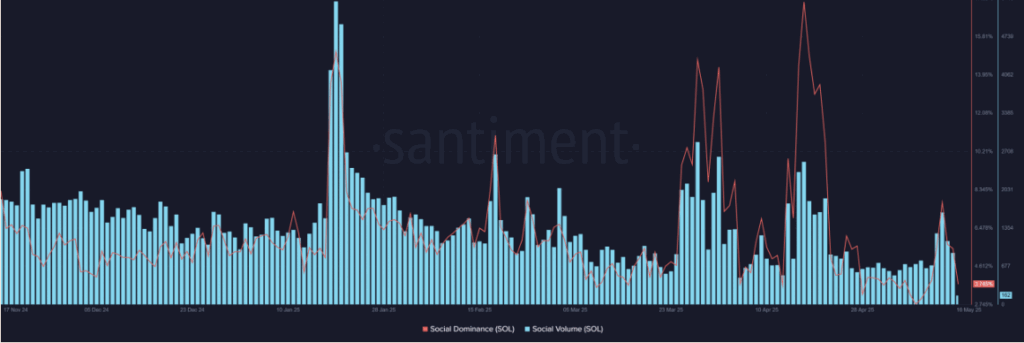

- Retail Curiosity Fades Amid Uncertainty: Social metrics present declining engagement, with quantity all the way down to 162 and dominance slipping to three.74%. A push above $200 may reignite curiosity, however with out stronger accumulation or sentiment reversal, the market stays hesitant.

Solana’s chart is cooking up one thing attention-grabbing – a traditional cup-and-handle sample on the weekly timeframe. After bouncing off $135, SOL’s now pushing towards the neckline resistance between $200 and $210. However with the value at present sitting at $170.20, down 1.57% within the final 24 hours, the large query is whether or not bulls can muster sufficient momentum to interrupt by means of.

Eyeing the $200 Mark – Will SOL Break Out?

Regardless of the slight dip, the deal with construction remains to be holding up, and the descending trendline stays below stress. A breakout above $200 may kick off a stronger bullish leg, doubtlessly validating the reversal setup. However for now, it’s all about testing that resistance zone.

Change Flows – Holding, Not Exiting

On Might sixteenth, alternate move information confirmed $148.49 million in inflows in opposition to $149.55 million in outflows – nearly a impasse. The slim hole suggests promoting stress isn’t overwhelming, however there’s additionally not a ton of conviction behind the shopping for both.

This balanced move often helps bullish setups, particularly close to main resistance ranges. However with no main outflow spike, it’s clear that stronger accumulation indicators could be wanted to push SOL above $200 convincingly.

Lengthy Bias Dominates – However At a Danger

Binance information reveals that 70.53% of merchants are holding lengthy positions, with a Lengthy/Quick Ratio of two.39. That’s a heavy tilt towards the bulls, signaling sturdy upside expectations. Nevertheless, it additionally creates a threat of liquidation if the value reverses – too many longs may result in a cascade of stop-loss hits.

Nonetheless, so long as the value motion holds regular, the excessive lengthy curiosity may gas a speedy breakout if $200 will get taken out. If shorts begin to cowl, the transfer may get amplified rapidly.

Sentiment Stays Cautious – However Is {That a} Good Factor?

Curiously, Solana’s weighted sentiment remains to be adverse at -0.46, indicating that regardless of the bullish chart setup, market individuals stay cautious. Traditionally, rallies that begin below bearish sentiment are likely to run longer – much less hype means fewer late patrons to entice.

But when SOL can’t clear $200 quickly, that pessimism may deepen, including extra weight to the draw back threat.

Retail Curiosity Fades – Is {That a} Pink Flag?

Social metrics are additionally cooling off. Quantity dropped to 162, whereas dominance slipped to three.74%. Solana’s not the new subject in retail circles proper now, however that would work in its favor. Much less noise typically units the stage for greater strikes – although a spike in social quantity would assist verify that the group is beginning to concentrate once more.

Backside Line – Promising Setup, However Affirmation Wanted

Solana’s chart construction is as textbook because it will get – a transparent cup-and-handle with sturdy long-side positioning. However the broader market isn’t solely on board but, with sentiment nonetheless leaning bearish and social curiosity fading.

If SOL can break above $200 and maintain, it may spark a run towards earlier highs. However with out stronger accumulation or a sentiment shift, the market might keep in wait-and-see mode for now.