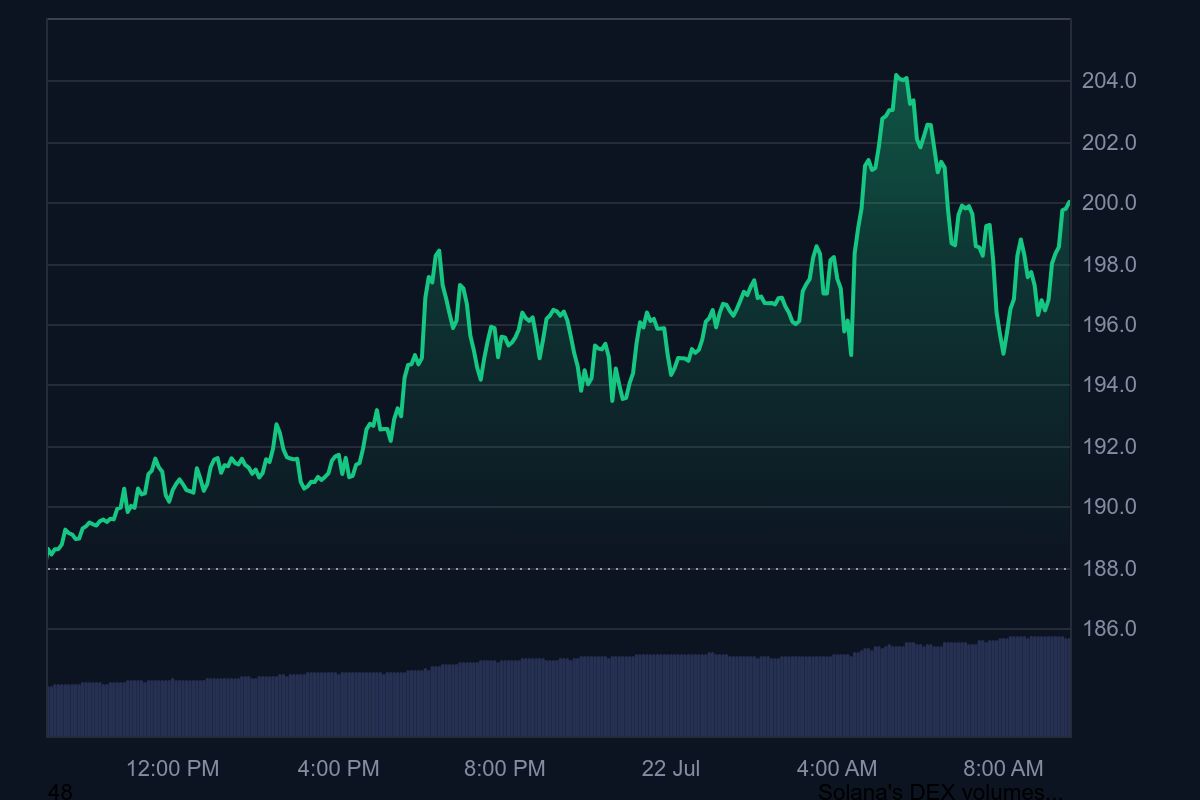

Solana surged 5.6% to reclaim the $200 degree for the primary time since February, fueled by a confluence of bullish technical, basic, and institutional catalysts.

The breakout triggered over $34 million briefly liquidations and reignited momentum throughout the Solana ecosystem amid a broader altcoin rotation.

$200 breakout ignites liquidation spike and upside momentum

The July 22 transfer confirmed an ascending triangle breakout on Solana’s each day chart, with the $200 degree appearing as a important psychological and technical barrier. The breakout unleashed a cascade of algorithmic shopping for and liquidated $34.59 million briefly positions inside 24 hours. The RSI (14) spiked to 79.69, signaling robust—however not but exhausted—momentum, whereas the MACD histogram remained constructive at +3.25.

Merchants are actually watching the subsequent Fibonacci extension targets at $218.52 (127.2%) and $243.47 (161.8%) for potential upside ranges within the coming classes.

Establishments tighten provide as ETF optimism builds

Past technicals, supply-demand dynamics proceed to tilt bullish. Mercurity Fintech introduced a $200 million dedication towards Solana-based digital asset methods, additional tightening token provide. This follows a big 141,383 SOL accumulation by DeFi Growth Corp, signaling rising institutional conviction within the ecosystem.

In the meantime, ETF hypothesis has resurfaced as a serious catalyst. VanEck and Galaxy have superior their Solana ETF filings, with approval odds reportedly above 80%, based on analysts. This narrative mirrors Ethereum’s current ETF-driven momentum and has positioned Solana as a frontrunner within the subsequent wave of institutional-accessible Layer 1s.

Jito Labs additionally added gasoline to the hearth with the launch of its Block Meeting Market, geared toward enhancing MEV effectivity throughout the Solana community—one other sign of evolving infrastructure energy.

With over $10 billion in open curiosity (+35% in two weeks), Solana’s derivatives market displays rising leveraged optimism, suggesting that momentum may prolong additional if BTC dominance continues to retreat.

Supply hyperlink