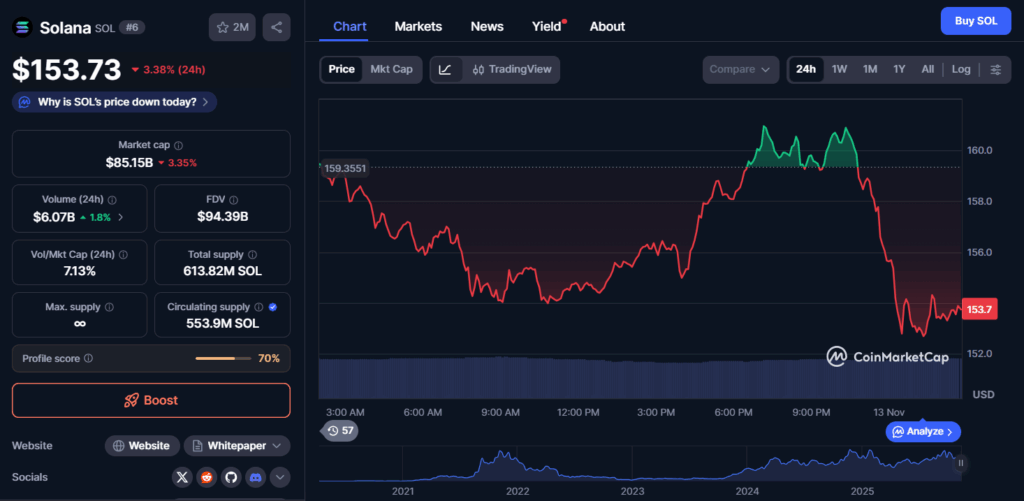

- Solana slipped practically 5% to $153.49, breaking key assist regardless of $336 million in weekly ETF inflows.

- Alameda Analysis unlocked one other 193,000 SOL price $30 million, including promoting stress as a part of ongoing chapter distributions.

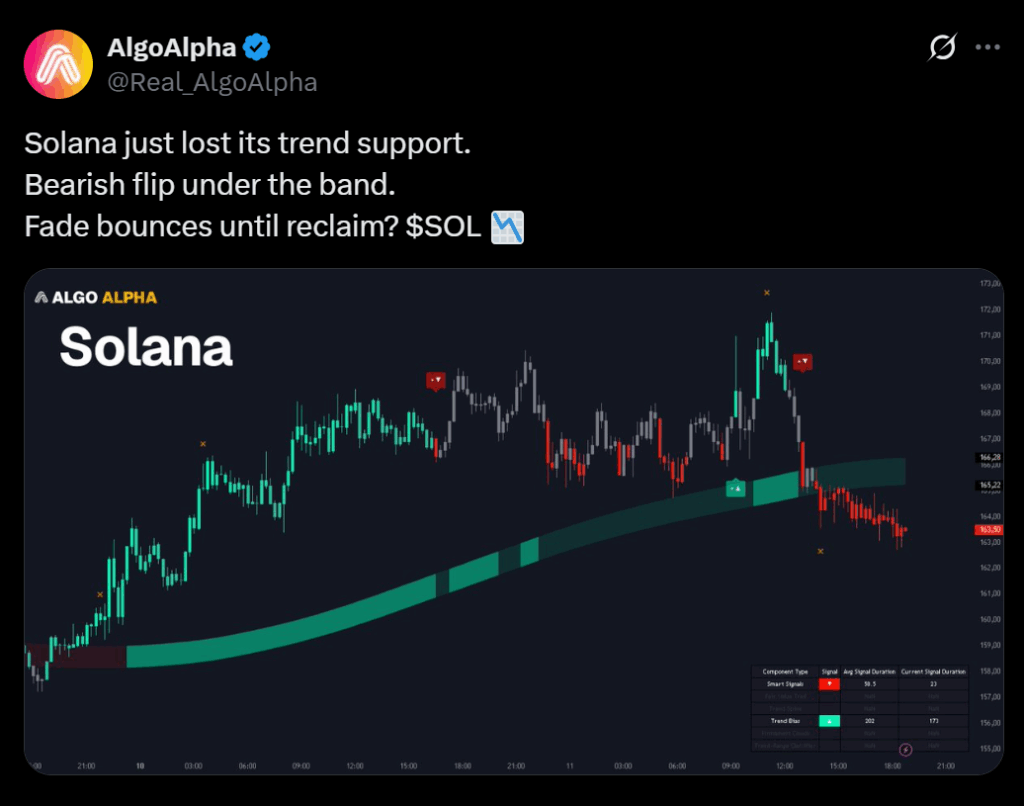

- Technical breakdowns under $156 triggered heavy quantity and confirmed bearish momentum, although ETF inflows recommend longer-term accumulation.

Solana’s newest pullback comes amid renewed provide stress from Alameda Analysis’s chapter property, which launched one other 193,000 SOL tokens valued at about $30 million on November 11. The vesting program has been progressively distributing over 8 million tokens since late 2023, and these structured unlocks typically hit exchanges to repay collectors.

Regardless of this, institutional curiosity stays sturdy. Solana-based ETFs recorded $336 million in inflows this week — their tenth straight day of internet features. Main establishments together with Rothschild Funding and PNC Monetary Companies added publicity, whereas Grayscale launched choices buying and selling for its Solana Belief ETF to increase hedging instruments for skilled merchants.

Even with sturdy inflows, the recent token provide seems to have outweighed demand within the brief time period, creating headwinds for SOL’s value motion.

Technical Breakdown and Market Response

The sell-off accelerated after SOL misplaced its footing under the $156 assist zone. Inside one hour, costs slid from $155.40 to $152.86 on quantity 123% increased than common. That flush confirmed a breakdown and established a descending channel, concentrating on the $152.50–$152.80 demand zone as the following space of assist.

Analysts say institutional merchants are nonetheless lively, utilizing the dip to reposition reasonably than totally exit. The 24-hour buying and selling quantity surged over 17% above the seven-day common, hinting at aggressive rotation as a substitute of panic promoting.

Outlook: Vary-Sure for Now

Technically, Solana faces resistance close to $156 and $160 — ranges it should reclaim to interrupt the bearish construction. Help sits at $152.80 and $150, with deeper draw back danger towards $145 if promoting continues. Nonetheless, ETF accumulation and staking yield demand close to 7% yearly may present a cushion as soon as promoting from Alameda slows.

For now, merchants count on consolidation between $150 and $160 till clearer catalysts emerge, however the bias stays cautious as provide overhang and market volatility persist.

The publish Solana Drops 4.9% Breaking Under Key Help as Alameda Unlocks Proceed — Here’s what’s driving the sell-off first appeared on BlockNews.

Supply hyperlink