Pi Coin (Pi) has gone down by 43% in the past month and currently stands at 43% as selling pressure keeps mounting.

Pi’s supply has been expanding ever since the token the mainnet was launched as users are now able to migrate their tokens and sell them via centralized exchanges (CEXs).

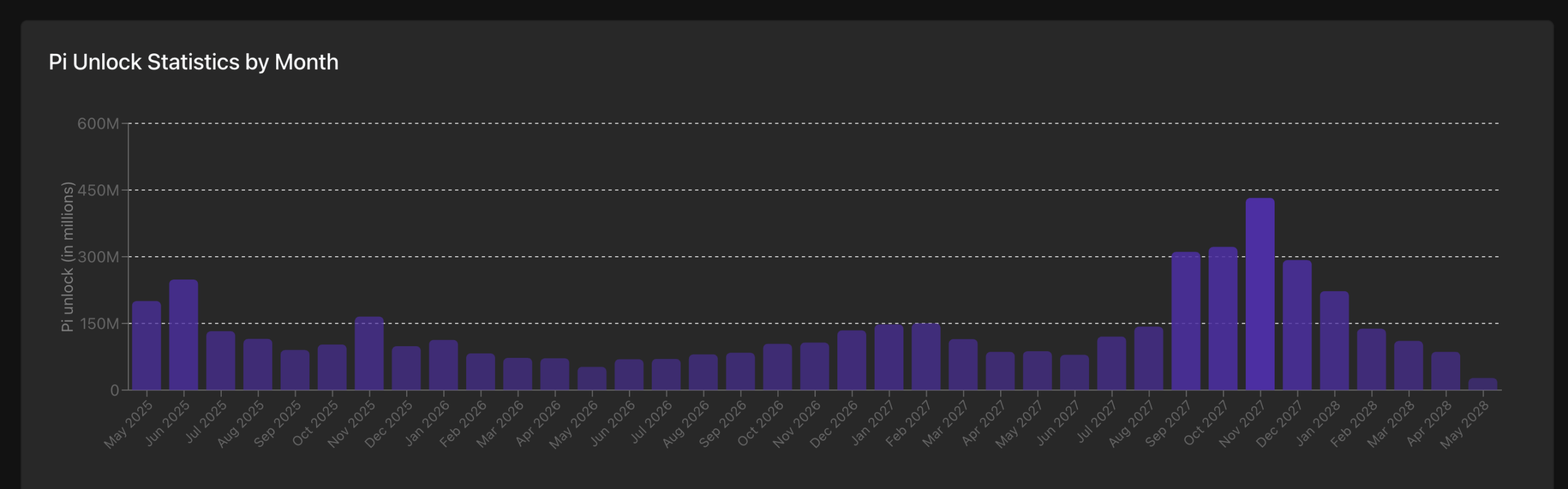

This month alone, 200 million Pi tokens will be unlocked according to PiScan. This accounts for around 2.7% of the token’s circulating supply.

The community has been complaining about the Pi Core Team’s inability to respond to token holders’ concerns.

Dr. Altcoin, a prominent supporter of the project on the social media platform X, emphasized that the team should deliver “something significant” by the next Pi Day – an event that is scheduled to take place in late June.

Failing to do so could result in further downside for the token as it would confirm that the project’s ecosystem growth initiatives have been stalled.

In response to the team’s silence, the community came up with a wild proposal to assign a fixed value to each Pi token of $314,259 – around 100 times the value of the mathematical constant that gives the project its name.

R.I.P Pi GCV!

Let alone with the current 7.4 billion circulating supply of Pi—rest assured, GCV has no hope of becoming reality, even if the circulating supply were limited to the 340 million Pi currently available on CEXs.

Why?

Because 340 million Pi at GCV would result in a…

— Dr Altcoin (@Dr_Picoin) June 11, 2025

The Core Team has not publicly endorsed this proposal while Dr. Altcoin said that it is not feasible in practice to enforce this as it would mean that the value of all outstanding Pi will exceed that of the world’s gross domestic product (GDP).

Pi Price Prediction: Pi Could Recover After it Hits This Key Support

Looking at the 4-hour chart, Pi just retested its all-time low of $0.40 yesterday after news broke about an Israeli attack on Iran that resulted in the death of key military leaders.

However, the price bounced strongly off that mark and managed to close that huge red candle at $0.55. Meanwhile, the price action today attempted a move to the $0.60 level – a former key support that has now been turned into resistance.

Both short-term exponential moving averages (EMAs) are way below the 200-period EMA and the price is once again failing to close above those key indicators.

A retest of the $0.60 level would be plausible at this point and would confirm a bearish outlook for Pi that could push the token once again to the $0.40 level.

The Relative Strength Index (RSI) is stepping out of oversold territory at the moment. A move above its 14-period moving average could confirm this “bullish” Pi Price Prediction to $0.60 However, a bullish breakout above $0.60 seems unlikely at the time, especially in these chaotic market conditions.

Although Pi may have disappointed some of its supporters, the most promising crypto presales of this year like Solaxy (SOLX) could perform much better than expected.

Solaxy (SOLX) Alleviates Solana’s Congestion Issues by Launching a Powerful L2

Solaxy (SOLX) is a layer-2 scaling protocol for Solana that alleviates the mainnet’s burden by bundling transactions offline in a side chain.

The developing team has made significant progress already in testing the solution and has scheduled the official launch of the Solaxy L2 for this month.

As the protocol’s utility token, the demand for $SOLX will skyrocket once top wallets and exchanges adopt Solaxy.

In addition to the huge upside potential that this token offers, its staking rewards are quite attractive as well. Currently, the APY stands at 84%.

To buy $SOLX, head to the Solaxy website and connect your wallet (e.g. Best Wallet). You can either swap USDT or SOL for this token or use a bank card to invest.