PI is down 17% within the final 24 hours, falling beneath the $1 mark regardless of the Pi Basis’s announcement of a $100 million startup fund. The newly launched Pi Community Ventures goals to spice up real-world adoption by investing in corporations integrating PI into AI and fintech sectors.

Whereas the initiative has sparked ecosystem pleasure, technical indicators are flashing warning indicators. Momentum is weakening throughout a number of indicators, suggesting that profit-taking and broader corrections could already be underway.

Pi Community Launches $100 Million Fund as Momentum Exhibits Indicators of Slowing

After constructing some hype, the Pi Basis has launched Pi Community Ventures, a $100 million startup fund to speed up real-world adoption of the PI token.

Funded by 10% of the PI provide, the initiative will spend money on early to Collection B corporations that combine PI into sectors like AI, fintech, ecommerce, and shopper apps.

Most investments shall be made in PI tokens reasonably than fiat, aligning with the undertaking’s long-term ecosystem targets. After months of decline, PI has just lately rebounded, gaining 85% up to now two weeks amid renewed investor curiosity and Binance itemizing rumors.

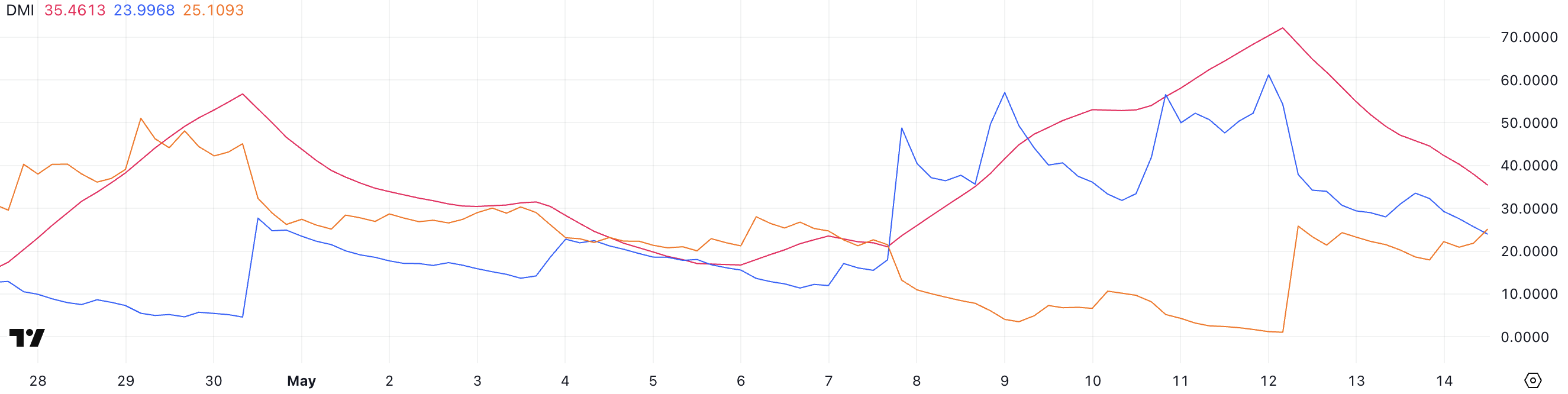

Regardless of the worth surge, Pi’s technical indicators counsel the rally could also be dropping energy. The DMI chart reveals its ADX has dropped from 72 to 35.46 in two days, signaling a pointy weakening in pattern energy.

ADX values above 25 point out a powerful pattern, whereas drops beneath 20 typically level to pattern exhaustion. In the meantime, the +DI (bullish stress) has plunged from 61 to 23.99, and the -DI (bearish stress) has climbed from 1.2 to 25.

This crossover means that bearish momentum is overtaking bullish energy, and until shopping for stress returns, PI might enter a consolidation or correction section.

Chaikin Cash Circulate Drop Flags Potential Revenue-Taking in PI

Pi Community Chaikin Cash Circulate (CMF) has dropped considerably, falling from 0.24 to -0.05 in simply two days. This shift suggests that purchasing stress has rapidly pale, and distribution could also be beginning to take over.

The CMF is a volume-weighted indicator that measures the movement of cash into and out of an asset. Optimistic values sign accumulation (shopping for stress), whereas adverse values counsel distribution (promoting stress).

A studying of -0.05 isn’t deeply bearish. Nonetheless, the drop from robust constructive territory might point out weakening investor confidence, particularly following the hype earlier than the announcement of the $100 million Pi Community Ventures fund.

If CMF continues to fall, it might trace at a short-term value correction as merchants take income after the current rally.

PI Falls Beneath $1 as EMA Alerts Flip Bearish

PI value has dropped 17% within the final 24 hours, falling again beneath the $1 mark and erasing a lot of its current good points.

The present value motion is aligned with weakening technicals, because the EMA traces are tightening and hinting at doable dying crosses—indicators typically related to additional draw back.

If the correction continues, PI might check help at $0.90, and a break beneath that degree may open the trail to $0.78 and even $0.636.

Nonetheless, a reversal isn’t off the desk. If bulls regain management, PI might bounce again to check resistance at $1.23. A clear transfer above that would pave the best way for additional upside towards $1.67 and $1.798.

Disclaimer

In keeping with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.