Ethereum recovered over 50% in Might. On-chain knowledge is providing new insights into the altering sentiment of Ethereum buyers following the Pectra improve. Consequently, many analysts are actually anticipating increased worth ranges.

This on-chain knowledge consists of ETH withdrawals from exchanges, trade reserves, and ETH whale accumulation. Over the previous month, all these metrics have hit spectacular milestones.

Over 1 Million ETH Withdrawn from Exchanges within the Previous Month

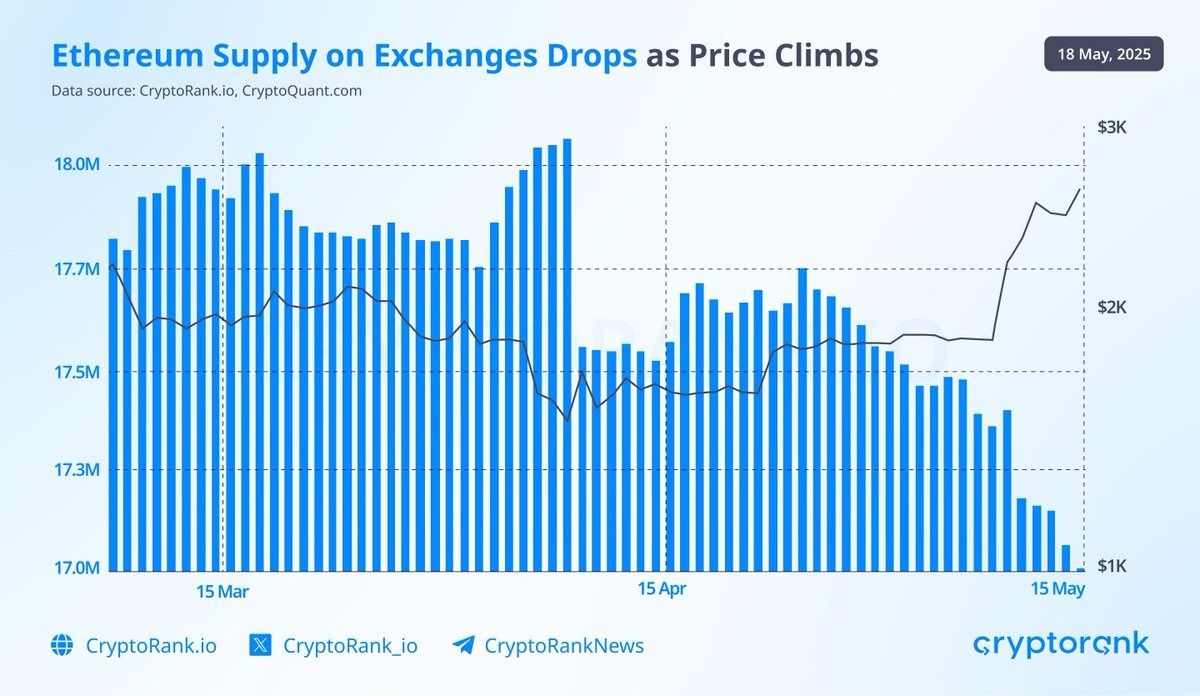

Based on Cryptorank, the quantity of ETH obtainable on centralized exchanges has dropped from over 18 million to almost 17 million inside one month.

“Over the previous month, greater than 1 million ETH have been withdrawn from centralized exchanges, which accounts for roughly 5.5% of the full ETH held on these platforms. This development means that customers are more and more selecting to build up Ethereum reasonably than commerce it. The latest Pectra improve, which went stay on Might 7, might additional assist this habits and, in flip, add upward strain to Ethereum’s worth,” Cryptorank stated.

CryptoQuant knowledge reveals that over 300,000 ETH have been withdrawn from Binance alone up to now month. For the reason that starting of the 12 months, greater than 800,000 ETH have been withdrawn from the platform.

This withdrawal exercise occurred not simply when ETH costs dropped sharply beneath $1,400 in early April, but in addition accelerated throughout ETH’s rebound above $2,400 in Might.

Moreover, the chart from CryptoRank illustrates that ETH costs surged whereas trade reserves fell, reinforcing the correlation between provide and worth.

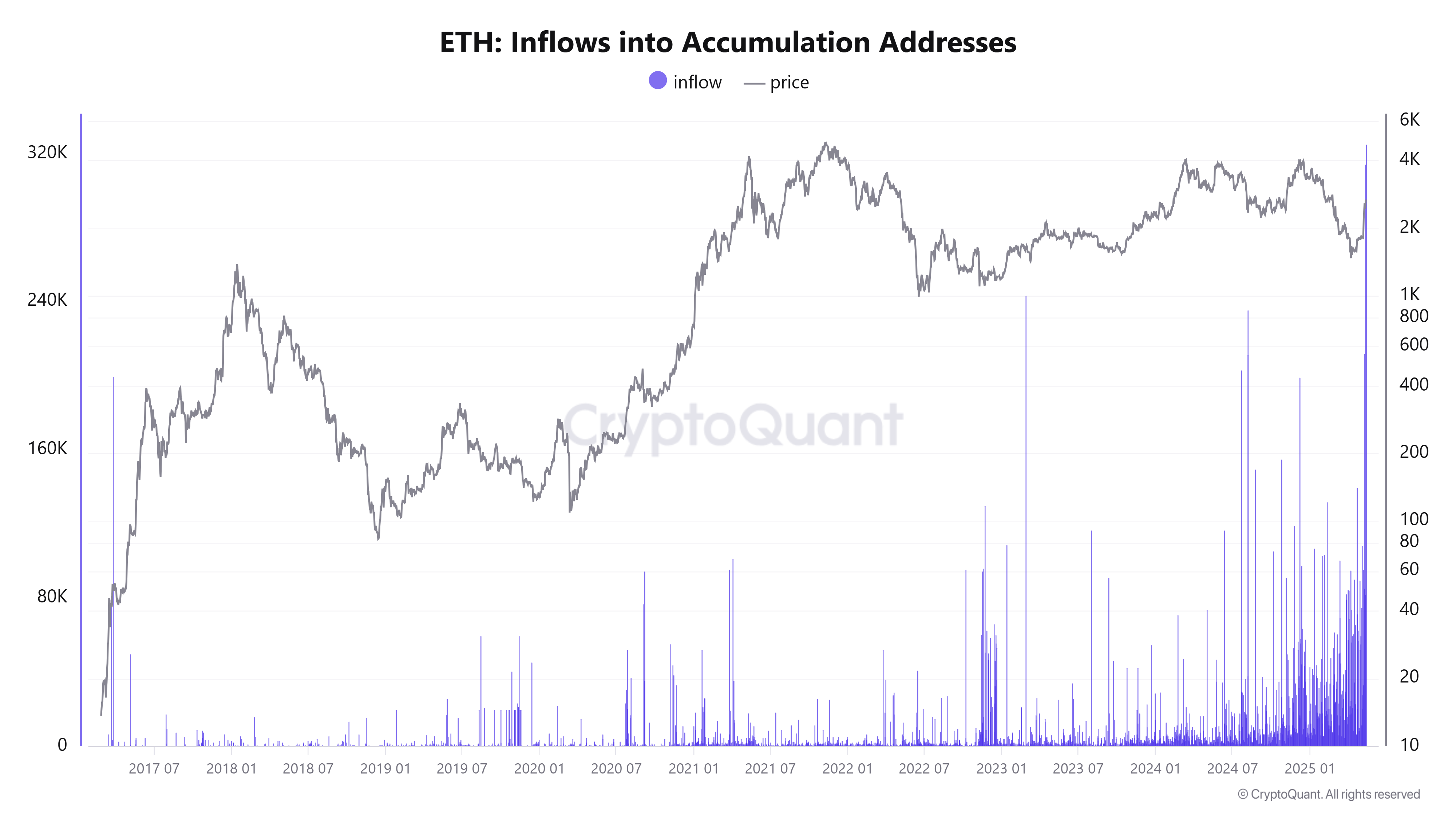

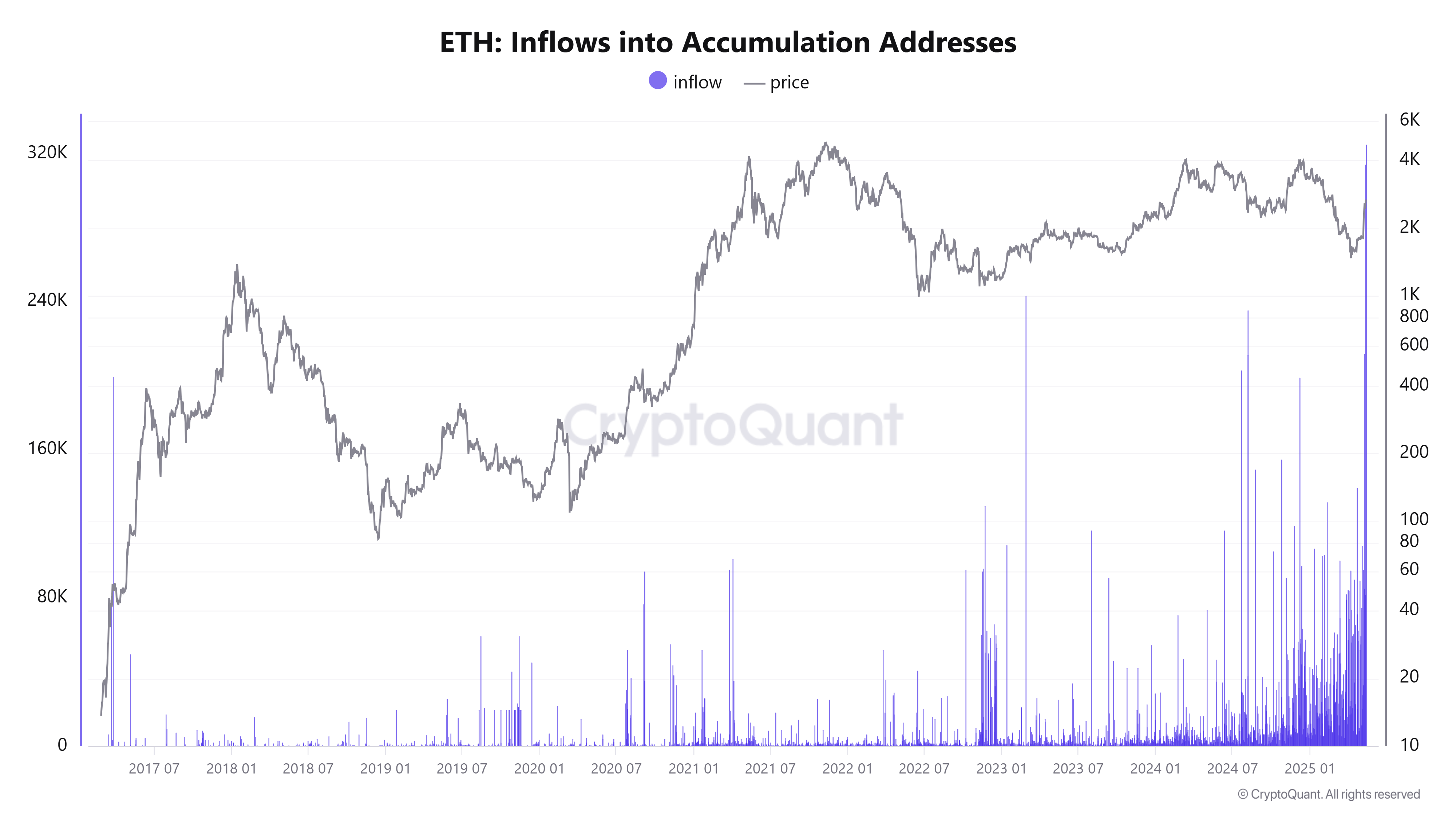

As well as, giant accumulation addresses recorded their highest influx in historical past. Particularly, CryptoQuant reported that on Might 12, whale wallets gathered over 325,000 ETH — the best single-day quantity ever recorded.

When whales accumulate, they usually withdraw ETH from exchanges to retailer in chilly wallets. This reduces the circulating provide and creates upward strain on the worth.

In the meantime, based mostly on a uncommon bullish technical sample that emerged in Might, analyst TedPillows predicted ETH may quickly return to $3,000, a key psychological degree.

“ETH Golden Cross confirmed. $3,000 Ethereum is coming subsequent,” Ted predicted.

Arthur Hayes Predicts Ethereum Will Outperform Solana

Regardless of these constructive on-chain indicators, ETH’s worth remains to be removed from its peak. It will must rise one other 70% to surpass its 2024 excessive, and it will must greater than double to achieve a brand new all-time excessive.

Bitcoin analyst PlanB not too long ago labeled Ethereum as “centralized” and “pre-mined,” whereas Zach Rynes argued that ETH lacks a coherent financial narrative.

Nonetheless, in a Might 18 interview, Arthur Hayes provided a distinct perspective. He admitted that whereas ETH is commonly disliked, it stays probably the most safe blockchain with the best Whole Worth Locked (TVL). He believes ETH may quickly outperform Solana.

“I believe Ethereum has a greater efficiency outlook principally as a result of it’s very hated. Everybody thinks Ethereum does nothing, that they haven’t achieved something appropriately. Nevertheless it nonetheless has probably the most TVL, probably the most builders, and remains to be probably the most safe proof-of-stake blockchain. Yeah, the worth hasn’t achieved that properly from 2020 to now. Solana clearly did very properly, going from $7 to $172. But when I’m going to deploy a recent unit of fiat capital into the system, I believe Ethereum may outperform Solana on this subsequent 18–24 month bull run,” Hayes defined.

Furthermore, many business consultants go even additional. They predict that ETH may ultimately outperform Bitcoin, particularly as Ethereum is more and more central in real-world belongings (RWA) and the broader DeFi ecosystem.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.