Bitcoin (BTC) is now one yr previous its most up-to-date halving, and this cycle is shaping as much as be in contrast to any earlier than it. In contrast to earlier cycles the place explosive rallies adopted the halving, BTC has seen a much more muted achieve, up simply 31%, in comparison with 436% over the identical timeframe within the final cycle.

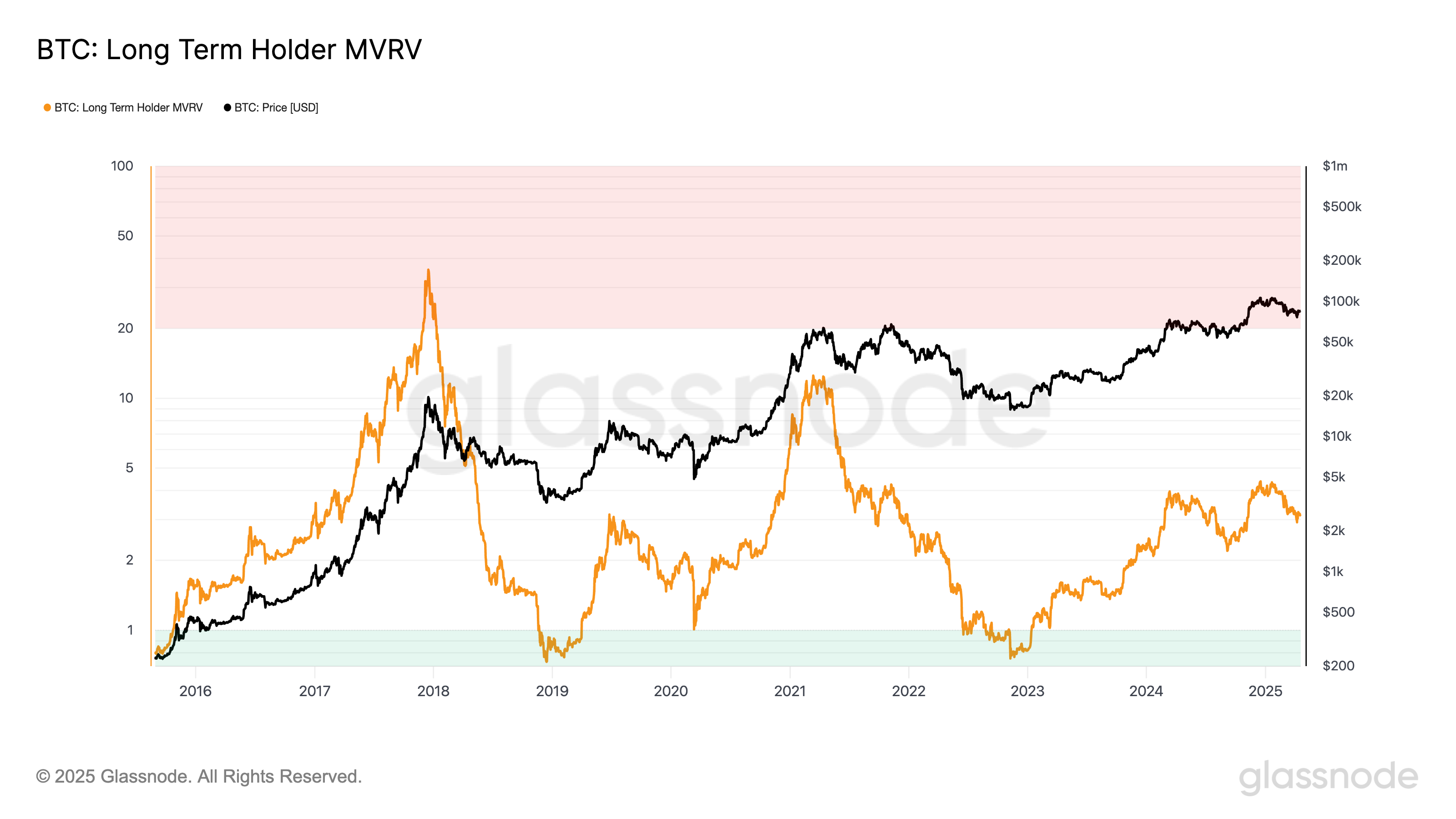

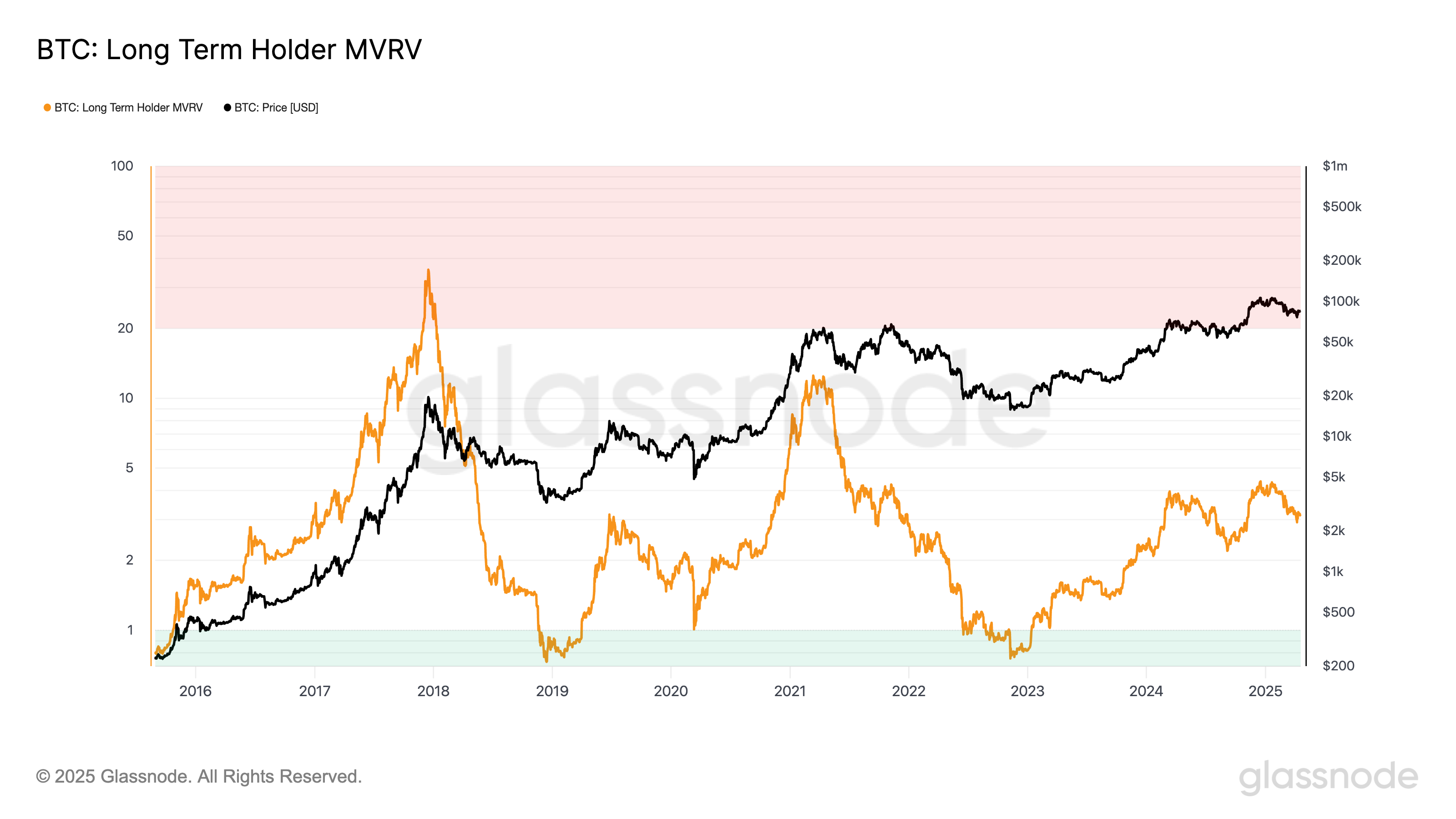

On the similar time, long-term holder metrics just like the MVRV ratio are signaling a pointy decline in unrealized income, pointing to a maturing market with compressing upside. Collectively, these shifts recommend Bitcoin could also be getting into a brand new period, outlined much less by parabolic peaks and extra by gradual, institution-driven progress.

A Yr After the Bitcoin Halving: A Cycle In contrast to Any Different

This Bitcoin cycle is unfolding noticeably in another way than earlier ones, signaling a possible shift in how the market responds to halving occasions.

In earlier cycles—most notably from 2012 to 2016 and once more from 2016 to 2020—Bitcoin tended to rally aggressively round this stage. The post-halving interval was typically marked by robust upward momentum and parabolic value motion, largely fueled by retail enthusiasm and speculative demand.

The present cycle, nonetheless, has taken a special route. As a substitute of accelerating after the halving, the value surge started earlier, in October and December 2024, adopted by consolidation in January 2025 and a correction in late February.

This front-loaded habits diverges sharply from historic patterns the place halvings usually acted because the catalyst for main rallies.

A number of components are contributing to this shift. Bitcoin is not only a retail-driven speculative asset—it’s more and more seen as a maturing monetary instrument. The rising involvement of institutional traders, coupled with macroeconomic pressures and structural modifications out there, has led to a extra measured and sophisticated response.

One other clear signal of this evolution is the weakening energy of every successive cycle. The explosive beneficial properties of the early years have grow to be more durable to copy as Bitcoin’s market cap has grown. For example, within the 2020–2024 cycle, Bitcoin had climbed 436% one yr after the halving.

In distinction, this cycle has seen a way more modest 31% enhance over the identical timeframe.

This shift may imply Bitcoin is getting into a brand new chapter. One with much less wild volatility and extra regular, long-term progress. The halving could not be the primary driver. Different forces are taking on—charges, liquidity, and institutional cash.

The sport is altering. And so is the best way Bitcoin strikes.

Nonetheless, it’s essential to notice that earlier cycles additionally featured intervals of consolidation and correction earlier than resuming their uptrend. Whereas this part could really feel slower or much less thrilling, it may nonetheless signify a wholesome reset earlier than the following transfer increased.

That stated, the chance stays that this cycle will proceed to diverge from historic patterns. As a substitute of a dramatic blow-off high, the result could also be a extra extended and structurally supported uptrend—much less pushed by hype, extra by fundamentals.

What Lengthy-Time period Holder MVRV Reveals About Bitcoin’s Maturing Market

The Lengthy-Time period Holder (LTH) MVRV ratio has at all times been a stable measure of unrealized income. It exhibits how a lot long-term traders are sitting on earlier than they begin promoting. However over time, this quantity is falling.

Within the 2016–2020 cycle, LTH MVRV peaked at 35.8. That signaled huge paper income and a transparent high forming. By the 2020–2024 cycle, the height dropped sharply to 12.2. This occurred at the same time as Bitcoin value hit recent all-time highs.

Within the present cycle, the best LTH MVRV thus far is simply 4.35. That’s an enormous drop. It exhibits long-term holders aren’t seeing the identical form of beneficial properties. The pattern is evident: every cycle delivers smaller multiples.

Bitcoin’s explosive upside is compressing. The market is maturing.

Now, within the present cycle, the best LTH MVRV studying thus far has been 4.35. This stark drop suggests long-term holders are experiencing a lot decrease multiples on their holdings in comparison with earlier cycles, even with substantial value appreciation. The sample factors to 1 conclusion: Bitcoin’s upside is compressing.

This isn’t only a fluke. Because the market matures, explosive beneficial properties are naturally more durable to return by. The times of maximum, cycle-driven revenue multiples could also be fading, changed by extra reasonable—however doubtlessly extra steady—progress.

A rising market cap means it takes exponentially extra capital to maneuver the value considerably.

Nonetheless, it’s not definitive proof that this cycle has already topped out. Earlier cycles typically included prolonged intervals of sideways motion or modest pullbacks earlier than new highs had been reached.

With establishments taking part in a bigger position, accumulation phases may stretch longer. Subsequently, peak profit-taking could also be much less abrupt than in earlier cycles.

Nonetheless, if the pattern of declining MVRV peaks continues, it may reinforce the concept that Bitcoin is transitioning away from wild, cyclical surges and towards a extra subdued however structured progress sample.

The sharpest beneficial properties could already be behind, particularly for these getting into late within the cycle.

Disclaimer

Consistent with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.