Bitcoin (BTC) is exhibiting indicators of a possible bullish development in Might, pushed by key indicators. Consultants have highlighted components corresponding to miner economics, community hashrate, long-term holder accumulation, and rising world fiat liquidity, suggesting {that a} worth improve might be on the horizon.

This comes as the most important cryptocurrency continues its restoration rally from early April lows, up 14.6% over the previous month.

Is a Bitcoin Bull Run Returning?

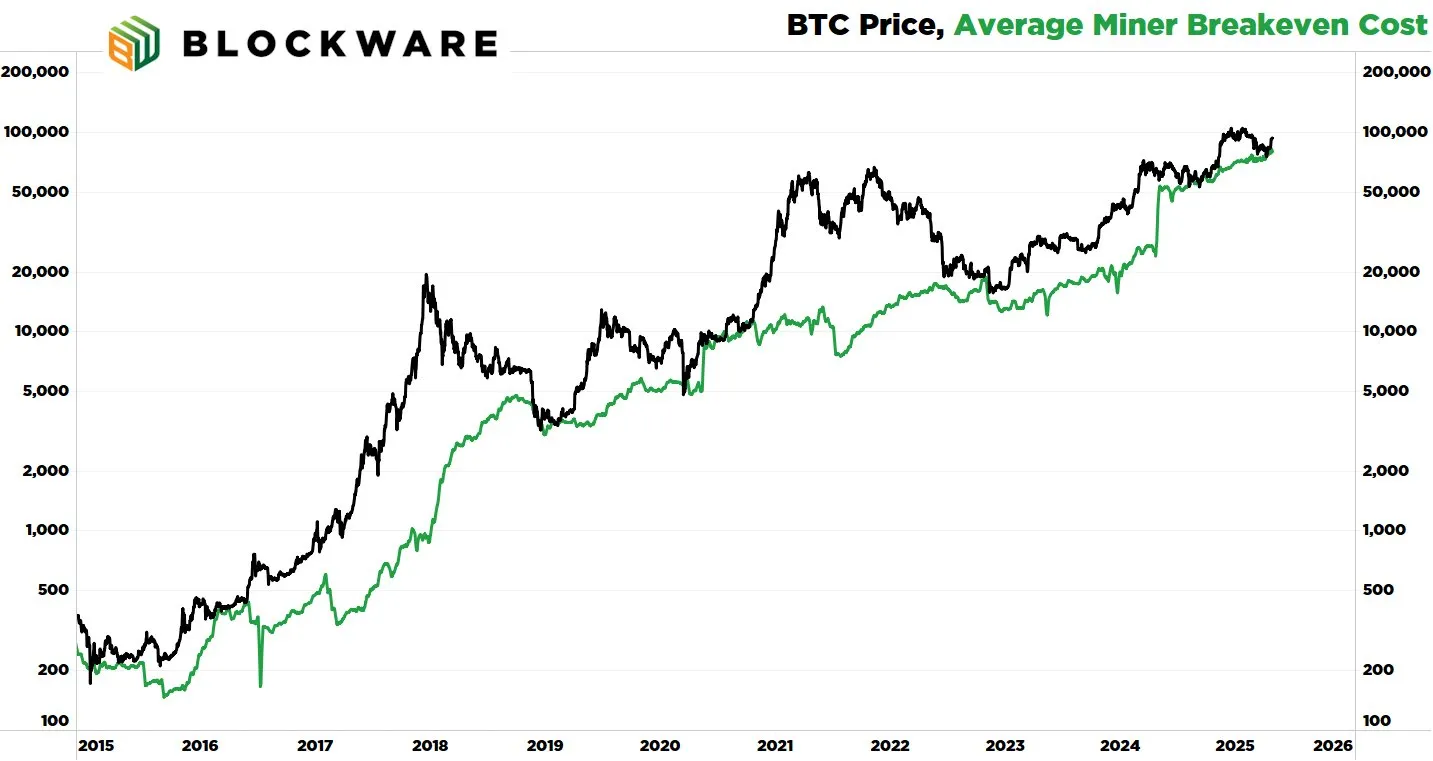

Within the newest X (previously Twitter) publish, analyst and WiM Media founder Robert Breedlove referenced Blockware Crew’s common miner breakeven price information to forecast that Bitcoin is perhaps on the cusp of a bull market.

He famous that the value typically doesn’t stay beneath this common for prolonged intervals, because it represents the brink at which miners could stop operations if unprofitable.

“In a rational economic system, belongings not often commerce beneath their price of manufacturing,” Breedlove remarked.

He highlighted that the index precisely recognized six bottoms between 2016 and 2024. Notably, it indicators one other backside, suggesting {that a} worth improve in Bitcoin might be imminent.

MacroMicro information additional helps this. On the time of writing, the 30-day shifting common (MA) of the mining cost-to-BTC worth ratio stood at 1.05.

This indicated that miners have been working at a loss on common over the previous month. Due to this fact, this might probably result in an upward worth motion as miners working at a loss cut back, tightening provide.

The Bitcoin hash price worth mannequin, which evaluates Bitcoin’s worth primarily based on the historic relationship between its worth and hash price, provides to the bullish outlook.

Analyst Giovanni commented on X that the mannequin is presently at a Bitcoin assist degree.

“The actual fact the hash price primarily based BTC valuation is on the assist degree signifies that most likely we reached some form of native backside,” the analyst mentioned.

Extra market indicators reinforce the case for a possible rally. Breedlove identified that long-term holders have collected roughly 150,000 BTC over the previous 30 days. This instructed decreased promoting strain within the $80,000 to $100,000 vary.

As fewer persons are keen to promote Bitcoin at these ranges, the value might face upward strain as demand stays robust, however the provide of accessible Bitcoin dwindles.

“At its core, the Bitcoin worth is just a operate of provide and demand. After a rise within the Bitcoin worth, you begin to see beforehand inactive cash transfer on-chain. Inversely, after extended intervals of sideways or unfavourable worth motion, long-term holders start accumulating extra cash, setting the stage for a supply-shock and upward worth strain,” he added.

Moreover, rising world fiat liquidity is increasing the pool of capital obtainable to put money into Bitcoin. That is additional bolstered by exchange-traded funds (ETFs), Bitcoin treasury corporations, and convertible bonds.

These monetary automobiles present simpler entry for brand new liquidity to enter the Bitcoin market, bridging the hole between conventional finance and cryptocurrency.

“And it’s not simply USD liquidity that’s growing – liquidity of all fiat currencies is on the rise, and Bitcoin is a world asset,” Breedlove said.

Not too long ago, BeInCrypto additionally highlighted a number of bullish components for BTC. The coin’s obvious demand turned constructive, implying a rise in curiosity or shopping for exercise for Bitcoin.

Moreover, the Market Worth to Realized Worth (MVRV) ratio rebounded from the traditionally important imply of 1.74. This motion has beforehand confirmed to be a dependable indicator of the early phases of a bull marketplace for Bitcoin.

Amidst these bullish indicators, BTC’s worth efficiency has been fairly notable. After briefly dropping beneath the 75,000 mark in early April, the value has continued to get better.

Over the previous week, BTC has seen a 4.3% uptick. At press time, Bitcoin’s buying and selling worth stood at $97,048, representing each day features of two.3%.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.