Be a part of Our Telegram channel to remain updated on breaking information protection

Metaplanet plans to boost $135 million to increase its Bitcoin holdings, doubling down on the asset even after it plunged 33% from an all-time excessive on Oct. 6.

The Japan-based Bitcoin treasury agency mentioned in a Nov. 20 announcement that it plans to problem 23.6 million Class B shares priced at 900 yen ($5.71) every, bringing the overall increase to 21.249 billion yen.

The providing will likely be executed by way of a third-party allotment to abroad buyers relying on whether or not the plan receives approval from a shareholder assembly on Dec. 22.

The announcement got here as Bitcoin headed for its worst month-to-month efficiency since June 2022, following the collapse of Do Kwon’s TerraUSD stablecoin. BTC has plummeted greater than 10% previously 24 hours to commerce at $81,956.25 as of 6:07 a.m. EST, CoinMarketCap reveals.

Metaplanet Providing Comes With 4.9% Dividend

The brand new providing, which the corporate is looking “MERCURY,” will supply holders a 4.9% mounted annual dividend and provides them the appropriate to transform their most popular shares into widespread inventory at a conversion value of $6.34.

In the present day we introduced MERCURY, our new Class B perpetual most popular fairness. 4.9% mounted dividend. ¥1,000 conversion value. A brand new step in scaling Metaplanet’s Bitcoin treasury technique. pic.twitter.com/UtnHA2lPRE

— Simon Gerovich (@gerovich) November 20, 2025

The corporate will retain a market-price name possibility that may be exercised if Metaplanet’s inventory trades greater than 130% above the liquidation desire for 20 consecutive buying and selling days. The shares may even include no voting energy, however will carry redemption rights underneath particular occasions.

Metaplanet Inventory Slides

Metaplanet shares have plunged greater than 61% previously six months and tumbled 7% throughout the previous 24 hours.

Its mNAV (a number of Web Asset Worth), which is its market cap divided by the worth of the Bitcoin it holds, has dropped beneath 1 to face at 0.98 as of 5:37 a.m. EST.

Metaplanet share value (Supply: Google Finance)

Metaplanet is the fourth-largest company Bitcoin holder globally with 30,823 BTC on its stability sheet. At present costs, the greenback worth of those holdings equates to $2.55 billion, based on knowledge from Bitcoin Treasuries.

The agency bought its Bitcoin holdings at a median value of $108,036, leading to an unrealized loss for the corporate of greater than 23%.

MSCI May Quickly Axe Metaplanet

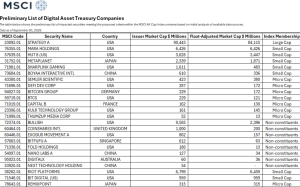

Metaplanet might quickly face further issues after information that MSCI is consulting with the funding group on whether or not to exclude from its indexes corporations with greater than 50% of crypto property.

A preliminary checklist launched by MSCI reveals 38 crypto firms could also be excluded.

Preliminary checklist of firms that is perhaps excluded (MSCI)

MSCI mentioned that some digital asset treasury firms could also be extra just like funding funds that aren’t eligible for inclusion in its indexes.

The Odds that MSCI excludes such corporations are ”solidly in favor of it,” Charlie Sherry, head of finance at BTC Markets, advised CoinTelegraph. It ”solely places adjustments like this into session once they’re already leaning that means,”

JPMorgan estimates that if the MSCI excluded Michael Saylor’s Technique, and different index suppliers did the identical, it might face a $12 billion hit as passive buyers that observe the indexes rebalance their portfolios.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection