Trusted Editorial content material, reviewed by main business specialists and seasoned editors. Advert Disclosure

In response to market watcher Sir Chartist, Technique’s inventory (MSTR) could also be headed for a pointy drop earlier than it bounces again. He thinks shares might slide as little as $350. Then, as soon as promoting dries up, a recent push would possibly carry the value again to $700. It’s a two-step transfer he believes will play out quickly.

Prime Setup Indicators Breakdown

Sir Chartist factors out that MSTR has slipped under its 9-day exponential shifting common and its 20-day easy shifting common. These traces at the moment are converging in a bear-leaning sample. When that occurs, short-term momentum usually fades quick. He notes that April’s development—the place inexperienced candles stored driving the inventory increased—has given approach to heavier promoting.

Let’s break down this chart on $MSTR.

On the finish of this thread I’ll give my opinion on it as of TODAY!

As merchants and chartist, realizing and STUDYING charts is KEY to success.

Lets take a look 👇

THREAD 🧵 pic.twitter.com/gqxG9yRx2d

— SIR CHARTIST (@ChartBreakouts) Could 24, 2025

Quantity Tendencies May Mark A Backside

He’s looking ahead to a panic-driven drop towards $350. Quantity spikes on purple days imply sellers are in management. However a pointy fall adopted by decrease promoting quantity and greater inexperienced bars might sign the top of the decline. Primarily based on reviews, he’ll solely flip bullish as soon as shopping for quantity clearly outpaces the promoting.

Supply: NASDAQ

Fairness Increase And Bitcoin Shopping for Plans

Technique (previously MicroStrategy) plans to boost $2.1 billion by way of a inventory sale. That cash will go straight into extra Bitcoin. On one hand, extra BTC might elevate the share worth afterward. On the opposite, recent shares hitting the market would possibly weigh on MSTR whereas the deal is underway. Sir Chartist says this dilution impact is a part of why he expects the preliminary slide.

Previous Patterns Trace At Rally

He reminds traders of the breakout from an earlier sideways channel. That transfer delivered a little bit over 100% achieve with barely any pullback. Primarily based on that sample, he argues a repeat rally is probably going as soon as the inventory levels its subsequent low. His view: historical past doesn’t repeat precisely, but it surely usually rhymes.

Cautionary Views Add Weight

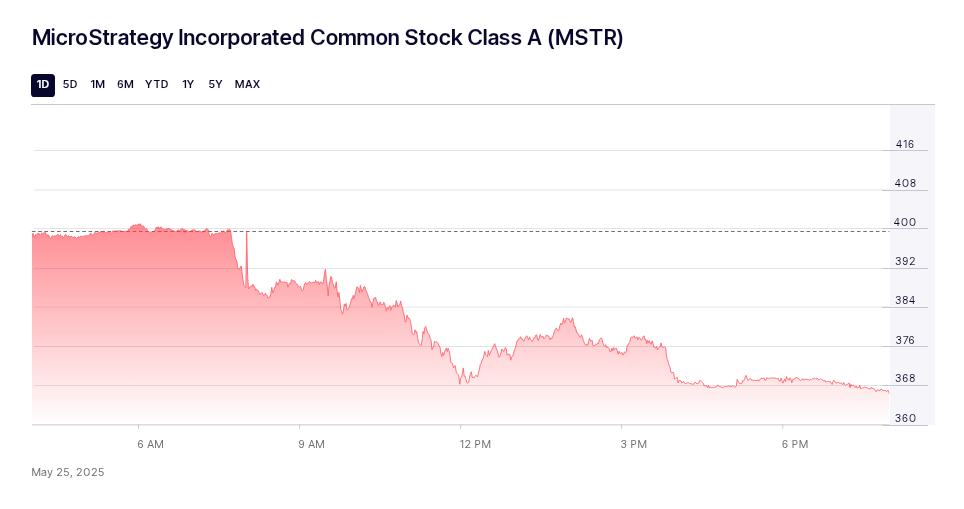

Crypto analyst Ali Martinez has additionally chimed in. He noticed a TD Sequential promote sign on MSTR’s weekly chart, which frequently flags a pending drop. And Technique’s latest Bitcoin purchase—7,390 BTC for roughly $765 million—lifted the inventory above $400 earlier this week. But even that huge buy wasn’t sufficient to cease the bearish alerts on the charts.

In brief, Sir Chartist is asking for a fast shakeout towards $350 earlier than an even bigger rally. He’s leaning on shifting averages, quantity shifts, previous breakouts and Bitcoin’s pull.

Featured picture from Livewire Markets, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.