- Canary Capital’s XRPC ETF launched strongly with over $277M in XRP holdings.

- If XRP adopted Bitcoin’s 103% ETF-driven yearly development, its value would hit $4.83.

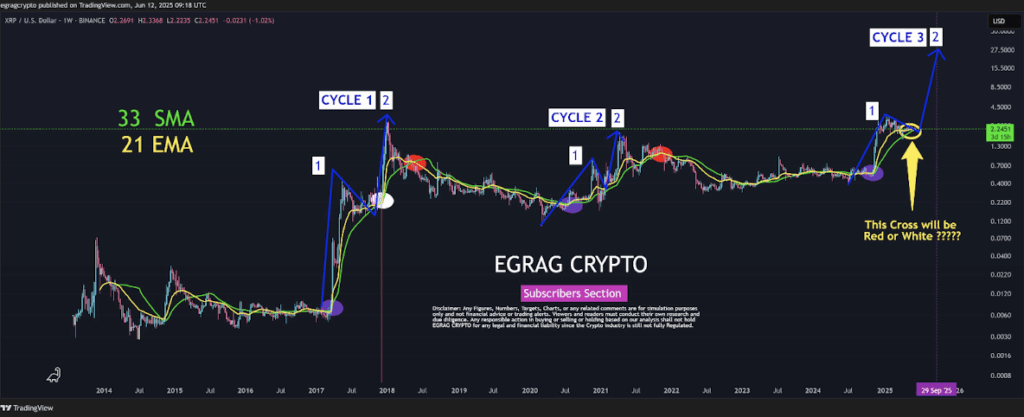

- Analysts like EGRAG nonetheless challenge a lot increased long-term targets between $6.5–$27, with a mean path round $11.

With the crypto market buzzing over the rise of spot Bitcoin ETFs, XRP holders have began questioning… might XRP expertise one thing comparable? The dialog heated up quick after the launch of the Canary Capital XRP ETF (XRPC) — the first-ever spot XRP ETF. Its debut was surprisingly sturdy, pulling in roughly $245 million in inflows after which including extra over the following two days, bringing its holdings to $277.82 million value of XRP.

Some customers identified that XRPC’s first-day efficiency truly beat BlackRock’s IBIT debut — which pulled in about $111.6 million — although it didn’t keep the identical explosive follow-through IBIT noticed afterward. Nonetheless, the early outcomes opened the door for one massive query: What occurs to XRP if ETF inflows ramp up the way in which Bitcoin’s did?

Might XRP ETFs do for XRP what Bitcoin ETFs did for BTC?

Bitcoin’s ETFs modified every little thing. A 12 months after launching on Jan. 11, 2024, Bitcoin ETFs had collected over $36.2 billion in internet inflows. XRP supporters don’t count on XRP ETFs to draw that degree of institutional cash — XRP is smaller, much less dominant, and has a really completely different market construction.

However right here’s the twist:

As a result of XRP’s market cap is way smaller than Bitcoin’s, it wouldn’t want billions and billions to maneuver the value dramatically. Even average inflows might create outsized results, particularly if the ETF narrative catches fireplace.

What XRP’s value could possibly be if it adopted Bitcoin’s ETF trajectory

We checked out Bitcoin’s efficiency one 12 months after ETF buying and selling started. When IBIT and the opposite BTC ETFs launched, Bitcoin was buying and selling round $46,678. By Jan. 11, 2025 — precisely one 12 months later — BTC had climbed to $94,975. That’s a 103% enhance.

Now apply that very same trajectory to XRP:

- When XRPC launched on Nov. 13, 2025, XRP was priced at $2.386.

- If XRP mirrored Bitcoin’s +103% ETF-driven run…

- XRP would attain roughly $4.83 by November 2026.

Not a moonshot, however a brand new all-time excessive nonetheless.

Analysts say the actual goal could possibly be a lot increased

Whereas $4.83 suits the BTC-style development mannequin, many XRP analysts argue {that a} correct bull run — mixed with ETF momentum, lowered provide, and macro catalysts — might ship XRP far past modest projections.

Again in June, market analyst EGRAG outlined targets between $6.5 and $27, relying on which technical mannequin performed out.

Extra lately, he launched 4 XRPBTC simulation paths, every pointing to completely different long-term outcomes. When averaged collectively, these simulations place XRP round $11 — a degree EGRAG recommended in July was believable, whereas noting that $27 “isn’t off the desk.”

So whereas a $4–$5 XRP would match Bitcoin’s ETF-era development, many within the XRP neighborhood consider the following cycle might gas one thing far greater.

The underside line

If spot XRP ETFs handle even a fraction of the traction Bitcoin’s did, XRP might simply set a brand new ATH round $4.8… however the extra aggressive fashions nonetheless level sharply increased. Whether or not these higher targets ever hit is determined by liquidity, macro developments, ETF flows, and naturally, investor conviction — all issues XRP holders will likely be watching intently over the following 12 months.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.