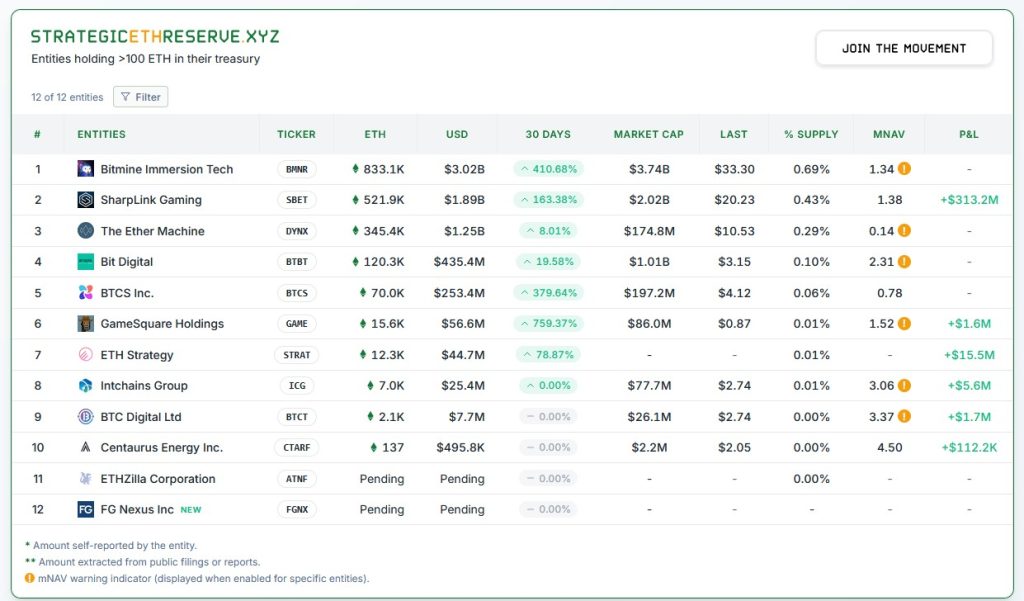

Since they emerged from stealth mode two months in the past, a dozen Ethereum treasury corporations have purchased 2 million ETH between them, with Customary Chartered analysts estimating they’ll add one other 10 million to that pile over time.

There’s rising pleasure that billions value of that ETH might stream into DeFi protocols as companies compete to chase yields better than the three%-5% on supply from staking and re-staking.

Etherealize’s Vivek Raman tells Journal “wholesome competitors” between treasury corporations for yield might mild a fireplace underneath the DeFi sector earlier than the tip of the 12 months.

“I’m truly fairly excited to see it. This could possibly be the stimulus wanted for DeFi Summer season 2.0 — however on the institutional scale and greater and higher.”

GameSquare Holdings, BTCS, BitDigital, The Ether Machine and ETHZilla have all introduced plans to juice ETH yields through DeFi, whereas Tom Lee’s BitMine Digital and Joe Lubin’s SharpLink Gaming are staking and restaking their ETH for now, whereas they refine their DeFi plans.

John Chard, vp of operations for SharpLink, tells Journal that he sees “selective DeFi participation as a pure subsequent step past staking, leveraging Ethereum-native infrastructure not solely to protect worth but additionally to develop it.”

“We additionally really feel that, as extra corporations undertake ETH as a steadiness sheet asset, they are going to notice, prior to later, DeFi isn’t only a curiosity — it’s a aggressive edge,” he says.

GameSquare targets as much as 14% return from ETH in DeFi

GameSquare Holdings is a profitable digital media, leisure and know-how enterprise that’s at the moment sixth on the ETH treasury leaderboard. It’s partnered with Ryan Zurrer’s Swiss crypto funding agency, Dialetic, to assist develop its ETH treasury 5x its present dimension to $250 million.

Rhydon Lee, from GameSquare’s advisory board, tells Journal that the three% return from staking ETH will be thought of the risk-free price of return — akin to purchasing treasuries in conventional finance. However GameSquare is setting its sights a lot increased.

“We’re focusing on 8%-14% yield era on simply our Ether alone — whether or not it’s different theses inside Ethereum, equivalent to digital NFTs, Web3 gaming, prediction markets, digital identification, stablecoins.”

Not like parking cash in an ETH ETF, investing in a number of the extra aggressive Ether treasury companies is extra like hiring a DeFi portfolio supervisor to attempt to develop your holdings. The extra profitable they’re at doing so, the extra engaging their inventory turns into to buyers.

Dialectic makes use of an algorithmic buying and selling system referred to as Medici that screens the exercise of profitable yield farmers to search out the very best danger adjusted returns throughout completely different liquidity swimming pools and protocols. It might probably routinely enter and exit tons of of positions at a time.

“There’s an entire crew of devs that operates that for Dialectic that’s programmatically allocating to particular swimming pools primarily based on particular parameters or primarily based on even issues like watching good cash wallets and the place they’re going into it.”

GameSquare even swapped fairness for a CryptoPunk, which Lee believes can multiply returns, given blue chip NFT costs are inclined to go up in ETH, whilst ETH goes up in USD phrases.

“If we have now 10 Ether, I hope we will have 11 Ether subsequent 12 months,” Lee says. “And primarily based on the returns that Dialectics has had over the past 4 years, I feel that’s achievable.”

ETH treasury corporations are greater than they appear

ETHZilla, which emerged on Ethereum’s tenth birthday with a $425-million increase, is pursuing an identical technique. It partnered with DeFi asset supervisor Electrical Capital on a “differentiated, onchain yield era program” to generate between 3% and 10% yearly.

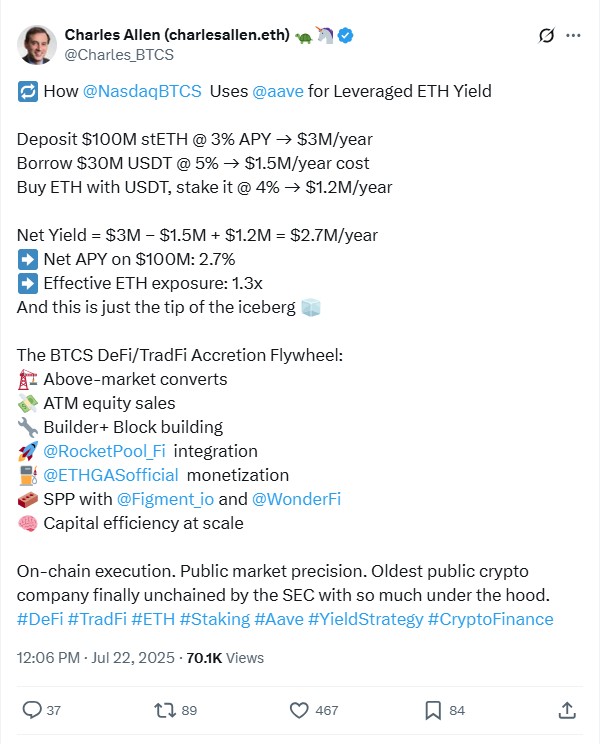

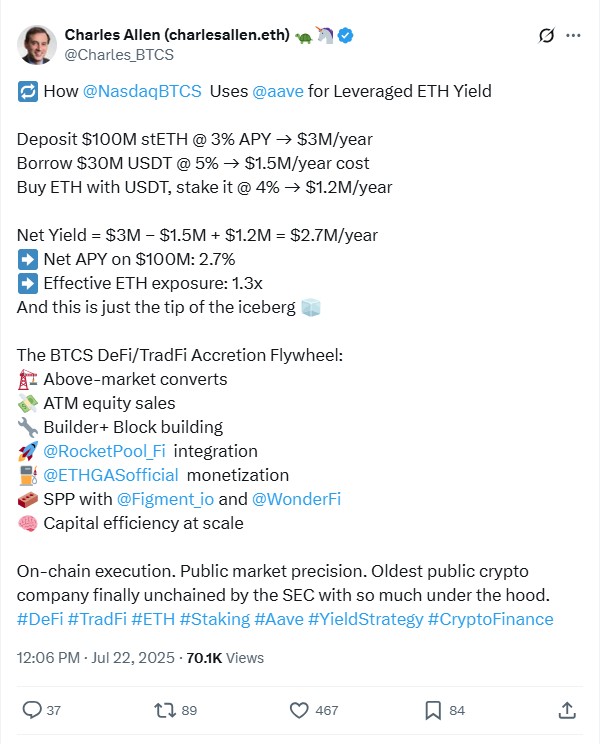

BTCS, in the meantime, is the oldest listed crypto firm within the US, having gone public in 2014. It shifted from Bitcoin mining to Ethereum infrastructure in 2017-2018 and now runs validators, analytics and block constructing.

BTCS CEO Charlie Allen instructed “The Milk Highway Present” podcast that working its personal solo ETH validator nodes or through Rocket Pool supplies “a few 40% enhance on the earnings” it might make utilizing third-party staking. It’s additionally using some arcane methods in DeFi which will appear dangerous to some.

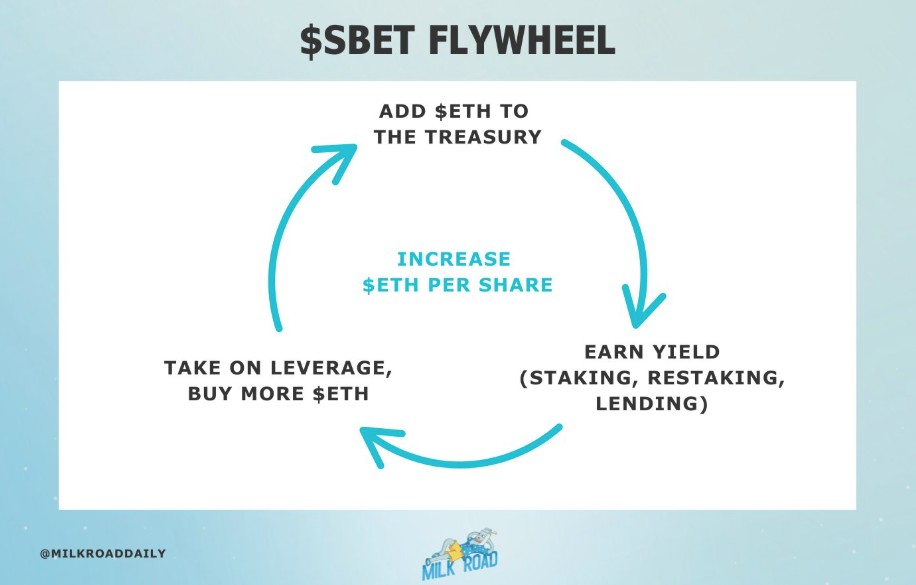

Allen revealed the corporate lately deposited $100 million in ETH to Aave for its flywheel technique. It borrows USDT in opposition to the ETH collateral and makes use of it to purchase extra ETH, which is then staked through “solo or Rocket Pool nodes to type of maximize yield.”

Bit Digital’s “alphamaneuvers”

One other former Bitcoin miner, Bit Digital operates a cloud infrastructure enterprise for generative AI with $100 million in contracted income, in addition to blockchain validator infrastructure and custody providers.

CEO Sam Tabar stated on “Bankless” that Bit Digital is already “extra alpha maneuvers” and intends to be “somewhat bit extra aggressive on the danger curve to guarantee that our yields are above common.”

He additionally dedicated to publishing Bit Digital’s month-to-month returns on its web site.

“I wish to name out the opposite corporations and see if they may present their yields… and see who’s producing extra yield for his or her ETH.”

Tabar believes that solely a handful of prime ETH treasury corporations will survive over the long run, with valuations primarily based on their potential to amass extra ETH.

Ethereum treasury of The Ether Machine

The Ether Machine takes its very title from its mission “to supply further Ether,” says founder Andrew Keys, previously of Consensys.

Its head of DeFi is Dairus Pryzdzial, a core contributor to the OG DeFi protocol Synthetix.

At this stage, it’s not YOLOing into bizarre methods in DeFi, preferring as a substitute to stake and restake most of its ETH. Keys characterizes the agency’s “eventual” DeFi technique as being “measured” and centered on “battle-tested blue chip DeFi protocols.”

Dangers and alternatives with staking and DeFi

Nevertheless, brokerage agency Bernstein cautions that even simply staking ETH to safe the community is tougher to handle and riskier for treasury corporations than merely holding Bitcoin.

It might probably trigger liquidity points because of the unsure size of the staking exit queue, and the additional corporations get into DeFi, the riskier issues develop into.

“Extra complicated yield optimization equivalent to restaking (equivalent to Eigenlayer restaking mannequin) and DeFi-based yield era would contain managing good contract safety danger,” Bernstein’s analysts famous.

Learn additionally

Options

MakerDAO’s plan to convey again ‘DeFi summer season’ — Rune Christensen

Options

The best way to resurrect the ‘Metaverse dream’ in 2023

On account of the extra dangers, Raman expects the vast majority of Ether raised will merely be staked.

“3% on $1 billion of treasury is $30 million a 12 months,” he says. “So, I really feel like they don’t need to take as a lot danger.”

However he believes that as much as 30% might transfer into DeFi as companies compete to develop their Ether holdings per share.

The danger of ETH treasury corporations blowing up chasing yield in Defi

Chasing increased yields in DeFi means taking up increased dangers, says Lee.

“Larger charges of return possibly require extra automation, extra esoteric markets and a type of higher understanding. The extra environment friendly a market is, possibly the much less return that’s attainable there,” he says.

However he says a well-run firm with good DeFi danger administration methods wouldn’t allocate greater than 0-30 bps of its belongings to a single pool, mitigating the danger to the treasury firm from a mortgage getting liquidated or a protocol getting hacked. In that case, he says:

“I might suppose that the chance of a blow up would, you already know, hopefully be low.”

BTCS’s Allen anticipates there’ll “undoubtedly be corporations to exit of enterprise” however plans to reduce the dangers to his personal agency by retaining the loan-to-value ratio under 40% and sticking to battle-tested platforms like Aave.

“I don’t suppose we’re overleveraged, however we’re undoubtedly leveraged,” he stated.

Lee argues the larger menace to listed treasury corporations is elevating important quantities of cash on the inventory market as USD debt however having the agency’s crypto belongings crashing in value under the worth of the greenback denominated debt.

“So, you probably have a mismatch, you already know, dollar-crypto liability-asset, I imply, to me, that’s the larger state of affairs of a blow up then hopefully single-digit bps in liquidity swimming pools.”

Will DeFi tokens pump on account of ETH treasury corporations?

To what extent all this new exercise will assist pump the costs of DeFi tokens is debatable.

DeFi lending and borrowing big Aave already has greater than $50 billion in complete worth locked, which is bigger than Customary Chartered’s prediction for the whole quantity of ETH that treasury corporations will finally amass.

If merely sticking additional billions into Aave pumped costs, Aave’s token wouldn’t be languishing at quantity 30.

However over and above the uncooked numbers, treasury corporations may even play an vital function in introducing Wall Avenue to the potential of DeFi.

SharpLink’s Chard says the ETH treasury corporations will show in actual time “that onchain finance can outperform legacy rails.”

“We’re speaking about sustained, long-term liquidity from institutionally pushed actors. If the primary cycles of decentralized finance had been pushed by innovation and grassroots experimentation, this subsequent evolution might be formed by regulatory readability, safety frameworks and the combination of conventional monetary infrastructure onchain,” he says.

Learn additionally

Options

Crypto is altering how humanitarian companies ship support and providers

Options

How Chinese language merchants and miners get round China’s crypto ban

“We consider treasury participation can anchor the subsequent evolution of onchain development, bringing legitimacy, quantity and new types of capital coordination.”

And as Keys factors out, each quarterly report and earnings name for The Ether Machine will promote DeFi to TradFi analysts.

“When we have now quarterly steerage calls with the general public markets, we’re going to be educating: ‘What’s DeFi?’ And we’re going to elucidate ‘What’s Aave?’ and ‘What’s staking?’ and ‘What’s restaking?’” he stated. “Half of that is the flexibility to elucidate what Ethereum is, institutionally.”

Etherealize’s Raman says the institutional legitimacy bestowed on Ethereum might be priceless.

“I feel it’s legitimacy and by funneling extra belongings and simply showcasing these use instances, it’s proven that these protocols are fairly battle-tested and resilient. They’ll have actual quantity and scale,” he says. “That’s going to be actually highly effective.”

“I’m positive all of the DeFi tokens will begin doing nicely as nicely.”

Goff Capital’s Lee additionally believes it might present a pleasant value bump for DeFi protocols.

“I might suppose it will be constructive for costs. However I feel it must be enduring exercise.”

Subscribe

Probably the most participating reads in blockchain. Delivered as soon as a

week.

Andrew Fenton

Andrew Fenton is a journalist and editor with greater than 25 years expertise, who has been protecting cryptocurrency since 2018. He spent a decade working for Information Corp Australia, first as a movie journalist with The Advertiser in Adelaide, then as Deputy Editor and leisure author in Melbourne for the nationally syndicated leisure lift-outs Hit and Switched on, revealed within the Herald-Solar, Each day Telegraph and Courier Mail.

His work noticed him cowl the Oscars and Golden Globes and interview a number of the world’s greatest stars together with Leonardo DiCaprio, Cameron Diaz, Jackie Chan, Robin Williams, Gerard Butler, Metallica and Pearl Jam.

Previous to that he labored as a journalist with Melbourne Weekly Journal and The Melbourne Instances the place he received FCN Finest Function Story twice. His freelance work has been revealed by CNN Worldwide, Unbiased Reserve, Escape and Journey.com.

He holds a level in Journalism from RMIT and a Bachelor of Letters from the College of Melbourne. His portfolio consists of ETH, BTC, VET, SNX, LINK, AAVE, UNI, AUCTION, SKY, TRAC, RUNE, ATOM, OP, NEAR, FET and he has an Infinex Patron and COIN shares.