Hedera (HBAR) is beneath heavy strain, falling 5% prior to now 24 hours and down greater than 25% during the last 30 days. The sharp decline has pushed a number of technical indicators into bearish territory, elevating considerations a couple of potential breakdown.

Momentum has weakened considerably, with BBTrend and RSI signaling deteriorating energy and rising promoting strain. All eyes at the moment are on the vital $0.153 assist degree, which may decide whether or not HBAR rebounds—or slides additional towards new lows.

HBAR Struggles to Regain Momentum

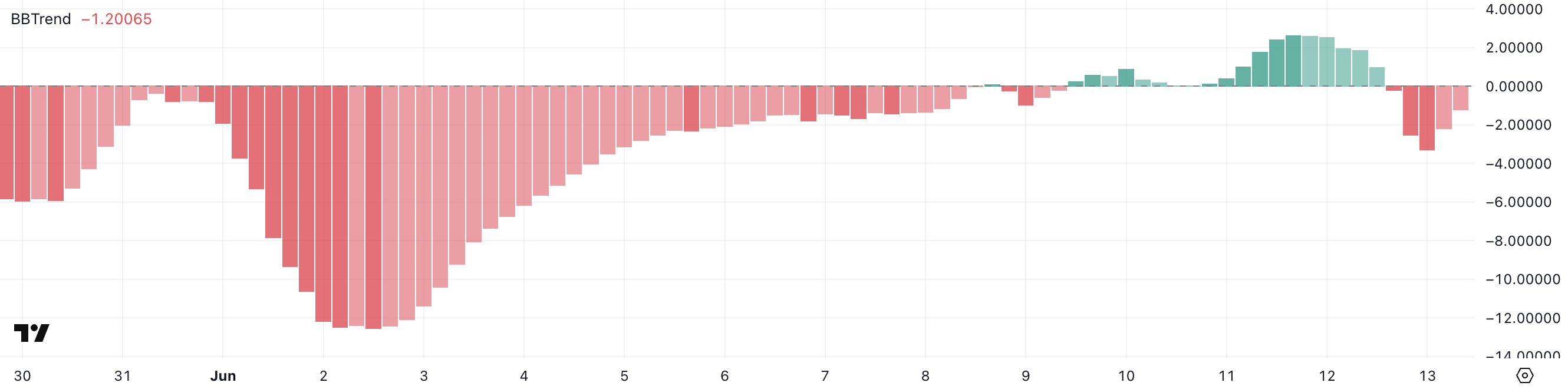

Hedera’s BBTrend is now at -1.2, recovering from -3.27 earlier right this moment however nonetheless under the two.63 seen two days in the past.

The drop alerts fading bullish momentum after a short-lived rally. HBAR could also be shifting from a breakout try to a consolidation section.

The fast bounce from deeper damaging ranges suggests some purchaser assist, however the total pattern stays weak.

BBTrend, or Bollinger Band Development, measures the directional energy and volatility of worth actions relative to the Bollinger Bands.

Values above +1 sometimes point out robust upward momentum, whereas readings under -1 counsel bearish strain. With HBAR’s BBTrend hovering at -1.2, the sign leans bearish, however not deeply so—hinting that whereas promoting strain nonetheless dominates, it might be shedding depth.

If the BBTrend strikes again towards impartial or flips constructive, it may sign a shift towards restoration or renewed shopping for curiosity.

HBAR RSI Plunges Under 30: Oversold Sign Factors to Attainable Rebound

Hedera’s RSI has dropped sharply to 22.29, down from 61.99 simply two days in the past. This factors to shortly growing promoting strain.

The decline pushes HBAR deep into oversold territory, signaling an aggressive correction. Whereas it might replicate panic promoting, it may additionally open the door for a rebound if consumers step in.

RSI is a momentum indicator that tracks the velocity and measurement of worth adjustments on a scale from 0 to 100. Readings above 70 usually imply an asset is overbought, whereas values under 30 counsel it’s oversold.

HBAR’s present RSI of twenty-two.29 places it nicely into oversold territory. If key assist holds, this might restrict additional draw back and sign a possible rebound.

Hedera Faces Breakdown Threat at $0.153

Hedera worth is at the moment hovering simply above a key assist degree at $0.153, a zone that has held in earlier pullbacks.

Nonetheless, if this assist is examined and fails, Hedera may decline towards the subsequent main assist round $0.124.

Including to the bearish outlook, HBAR’s EMA strains lately shaped a loss of life cross—a technical sign that sometimes signifies downward momentum and potential for additional losses.

That mentioned, a reversal in momentum may shortly change the outlook. If bulls regain management and push HBAR above the instant resistance at $0.168, the token may then take a look at larger ranges at $0.175 and even $0.183 if the uptrend accelerates.

These resistance zones have traditionally acted as inflection factors and would want robust quantity to be damaged decisively.

Whether or not HBAR breaks down or rebounds will seemingly rely on the way it behaves across the $0.153 degree within the coming periods.

Disclaimer

In step with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.