Hedera (HBAR) is up over 6% within the final 24 hours because it tries to reclaim the $8 billion market cap. Its buying and selling quantity has jumped 19% to just about $176 million, displaying renewed curiosity.

Key indicators are blended. The BBTrend stays bearish, however RSI and EMA traces counsel rising bullish momentum. A golden cross might quickly type, and HBAR is nearing key resistance ranges. Its subsequent transfer may affirm whether or not a breakout or a pullback is coming.

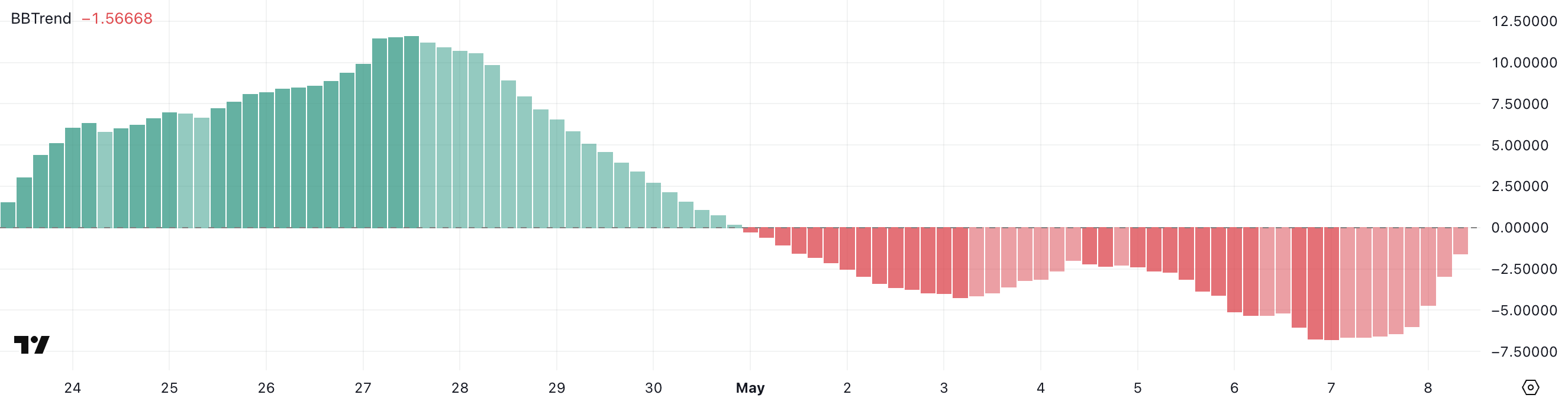

Hedera BBTrend Stays Damaging—Is the Worst Over?

Hedera’s BBTrend indicator is presently at -1.56 and has remained in unfavorable territory since Could 1. It hit a low of -6.76 yesterday, marking essentially the most bearish studying in over a month earlier than bouncing barely right this moment.

This ongoing unfavorable pattern means that downward momentum has dominated the market, whilst short-term promoting stress exhibits indicators of easing.

The BBTrend, or Bollinger Band Pattern indicator, measures worth positioning relative to Bollinger Bands to find out a pattern’s energy and course.

Values above +1 counsel robust bullish momentum, whereas readings under -1 point out robust bearish situations. A impartial vary between -1 and +1 usually displays consolidation or weak pattern conviction.

With HBAR’s BBTrend at -1.56, it stays bearish territory, although the uptick from yesterday’s excessive means that the selloff could also be shedding steam.

If the BBTrend continues to rise and crosses above -1, it may sign a shift towards worth restoration or at the very least a pause within the downtrend.

Hedera Approaches Overbought Zone After Sturdy Rebound

Hedera Relative Energy Index (RSI) has surged to 66.2, up sharply from 31.41 simply two days in the past.

This fast rise displays a powerful shift in momentum, taking HBAR from oversold situations right into a zone that alerts rising bullish stress.

Such a transfer usually signifies patrons are stepping in aggressively, reversing latest weak spot and probably setting the stage for a short-term breakout if the pattern continues.

The RSI is a standard momentum indicator that ranges from 0 to 100. Readings under 30 counsel oversold situations and a possible rebound. Values above 70 point out the asset could also be overbought and due for a pullback.

Readings between 50 and 70 present rising energy in an uptrend. HBAR’s RSI is now at 66.2—near overbought, however not there but. This alerts extra upside potential if momentum continues.

Nevertheless, merchants ought to look ahead to any indicators of exhaustion if RSI crosses 70 within the coming periods.

HBAR Subsequent Transfer: 38% Rally or 33% Correction Forward?

Hedera EMA traces are tightening, and a golden cross may very well be on the horizon as short-term transferring averages strategy a crossover above long-term ones.

This setup is often seen as bullish, suggesting upward momentum might quickly strengthen. If the golden cross confirms and Hedera worth breaks above the $0.191 and $0.199 resistance ranges, the subsequent targets may very well be $0.215 and $0.258.

A rally to these ranges would symbolize a possible 38% upside from present costs.

Nevertheless, if HBAR fails to interrupt via the $0.19 resistance zone, it may face a pullback.

A drop to help at $0.175 can be the primary check, with deeper declines potential towards $0.160 and $0.153 if promoting stress intensifies.

HBAR may fall as little as $0.124 in a powerful downtrend, marking a potential 33% correction.

Disclaimer

In keeping with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.