A loss of life cross appeared on HBAR’s every day chart on April 14, signaling potential draw back. Nonetheless, the token has defied bearish expectations, rallying 20% over the previous two weeks amid a broader market rebound.

Whereas bullish momentum has cooled barely in latest days, the bulls stay in management. If demand grows additional, the HBAR token may very well be poised for extra upside.

HBAR Bulls Keep in Management After Dying Cross

A loss of life cross happens when an asset’s short-term transferring common—usually the 50-day—crosses under its long-term transferring common, normally the 200-day.

This crossover means the asset’s latest worth momentum is weakening, and a longer-term downtrend might take form. The sample typically indicators elevated promoting strain as merchants normally interpret it as a marker of a detrimental shift in market sentiment.

Nonetheless, this isn’t all the time the case, particularly in risky or recovering markets the place worth motion can defy conventional technical indicators. As an example, HBAR’s worth rocketed 20% up to now two weeks.

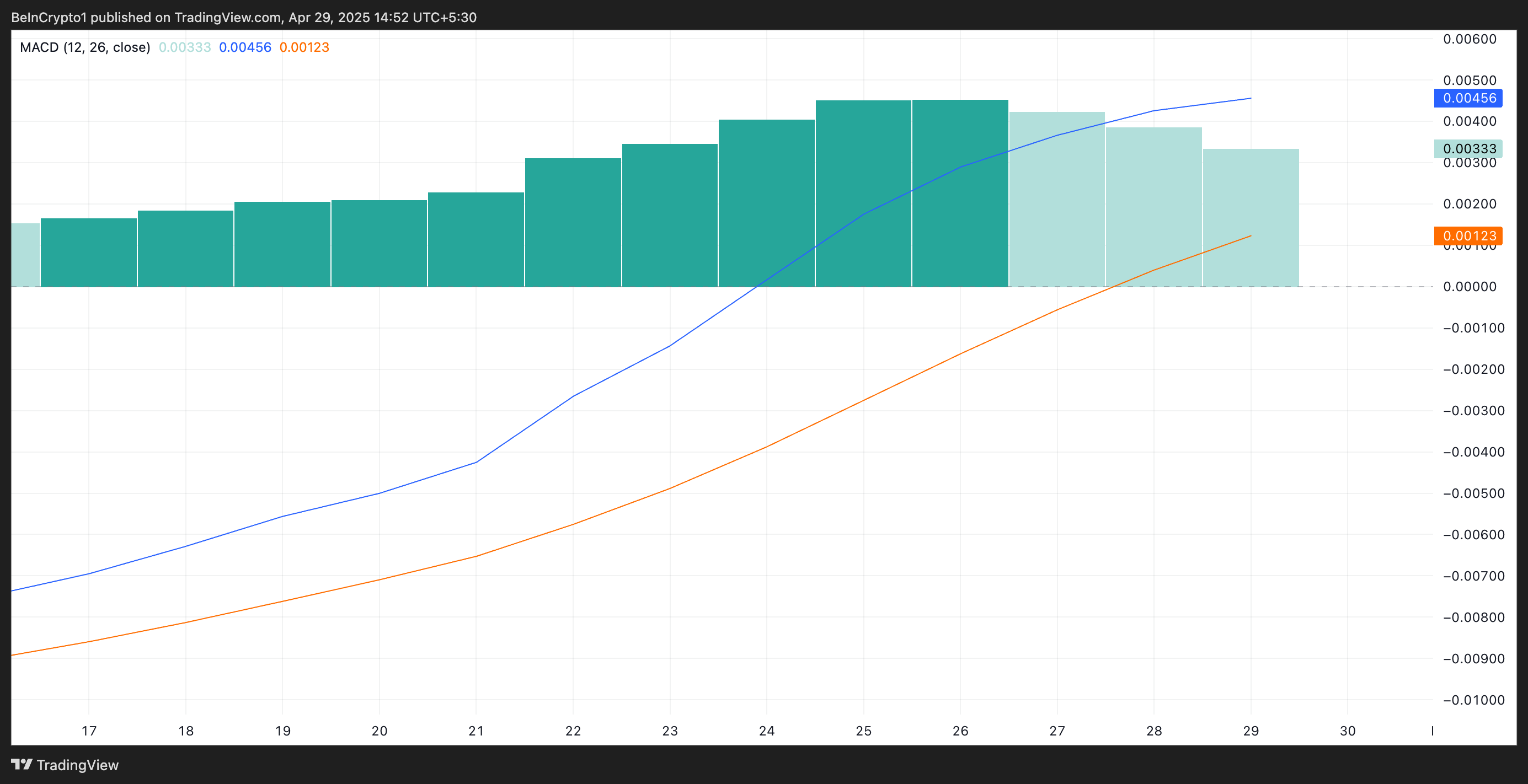

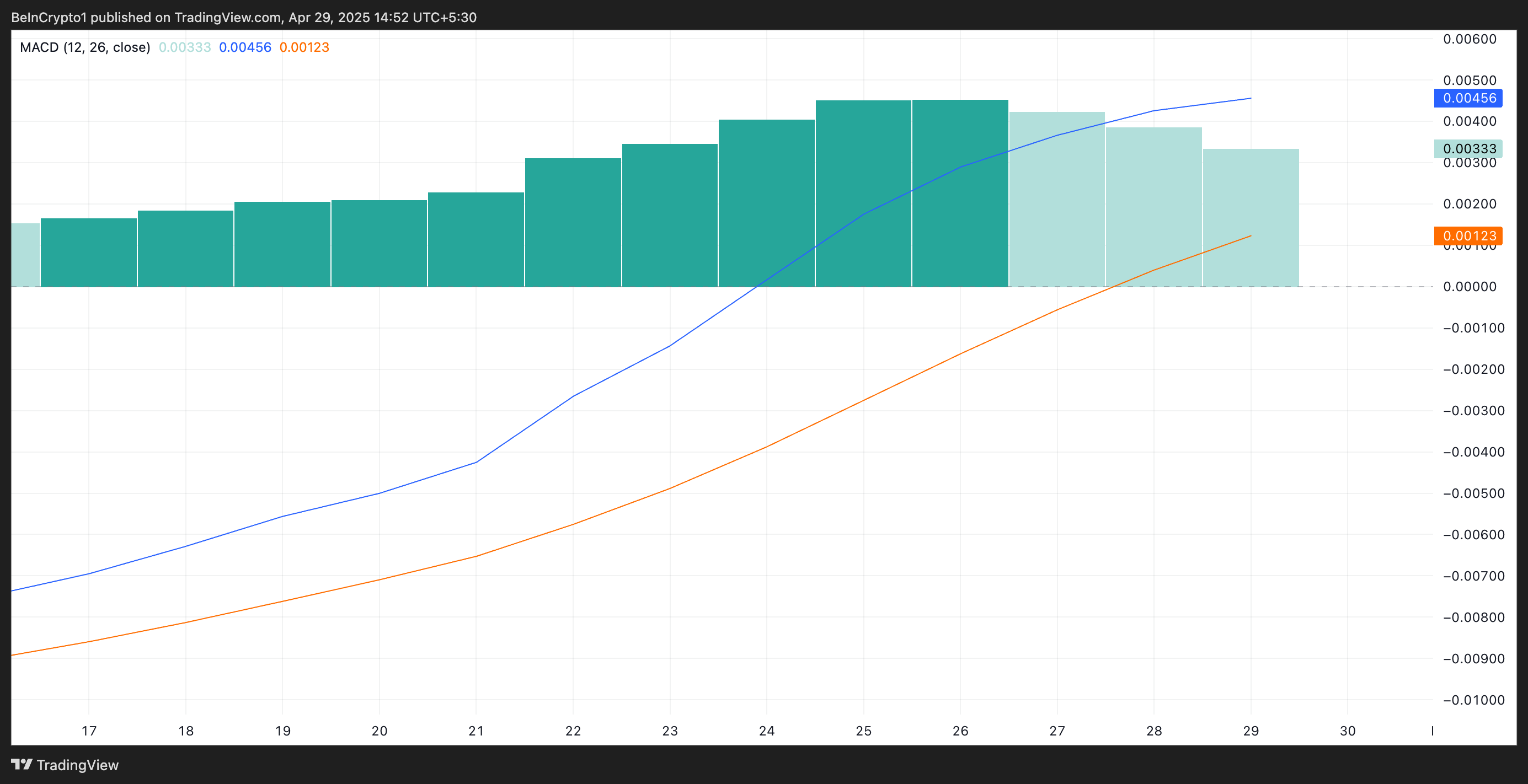

Though the bullish momentum has eased barely during the last three buying and selling classes, the bulls stay firmly in management. Readings from HBAR’s Shifting Common Convergence Divergence (MACD) indicator verify this.

Whereas the bars that make up this indicator have diminished over the previous three days—reflecting a slowdown in bullish momentum amid broader market consolidation—the MACD line stays above the sign line, indicating that purchasing strain nonetheless prevails amongst merchants.

This setup hints on the chance of additional worth features regardless of the loss of life cross.

HBAR Climbs Steadily—Will It Maintain the Line or Slip Again to $0.15?

Since April 16, HBAR has traded alongside an ascending pattern line, a bullish sample shaped when an asset constantly posts larger lows over time. This means rising investor confidence and sustained upward momentum, even amid short-term pullbacks.

For HBAR, this pattern suggests consumers proceed stepping in at more and more larger worth factors, reinforcing assist ranges. If the pattern holds, it might pave the best way for additional features, particularly if market sentiment stays optimistic.

HBAR’s worth might break above the $0.19 resistance on this state of affairs and rally towards $0.23.

Conversely, if selloffs resume, the worth of the HBAR token might fall to $0.15.

Disclaimer

In keeping with the Belief Challenge tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.