Hedera’s HBAR token is up almost 2% at present, however the broader pattern nonetheless appears to be like shaky. Over the previous week, HBAR has dropped near 10%, and its general construction continues to boost questions.

Regardless of the Layer 1 community, designed for enterprise-grade purposes, displaying clear bullish patterns and heavy whale accumulation, the worth hasn’t managed a convincing transfer upward.

Whale Wallets Maintain Rising, However HBAR Value Stalls

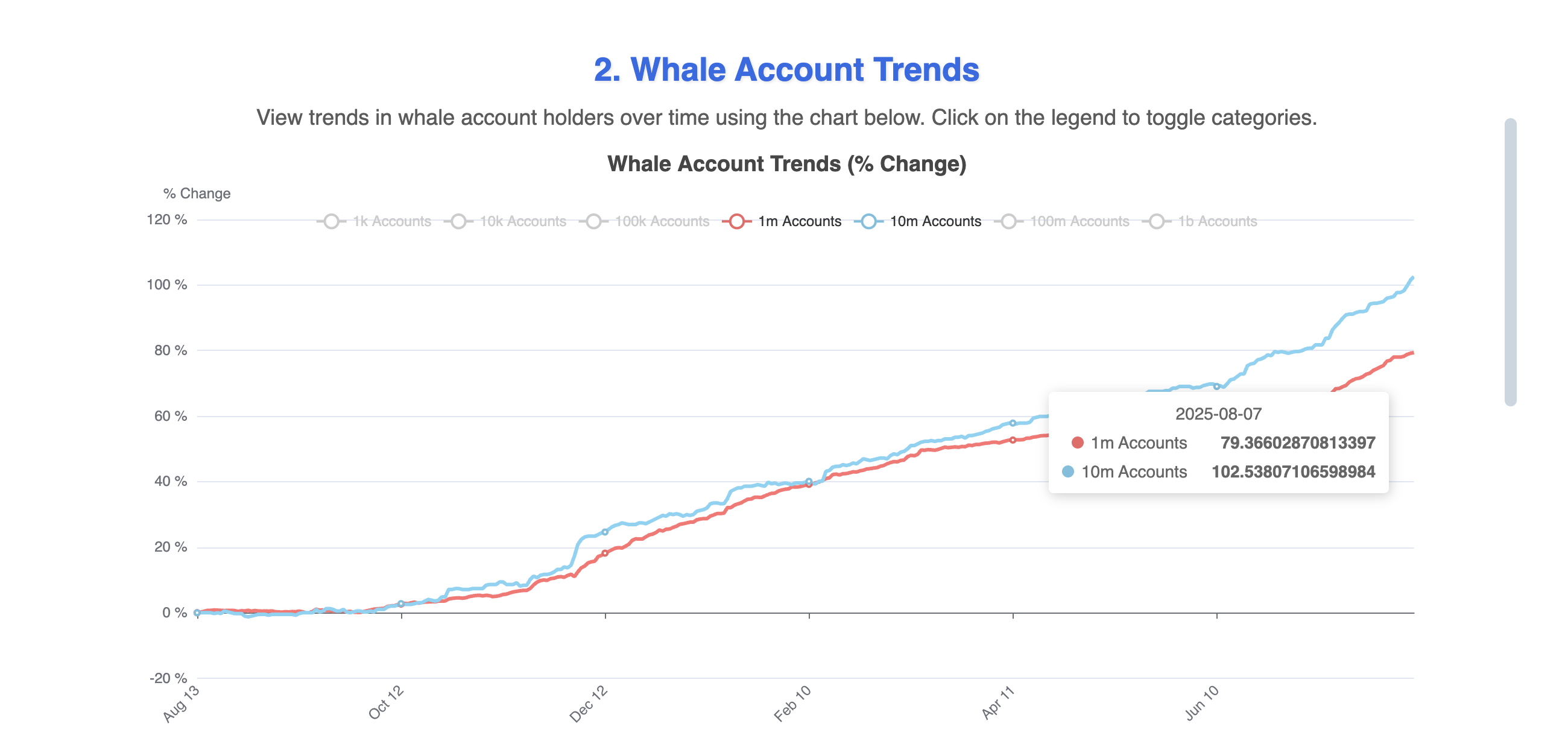

During the last three weeks, whale wallets holding between 1 million and 10 million HBAR have steadily elevated. From early August, these pockets cohorts jumped from 77 and 96 to 79 and 102, respectively. That alone represents a minimal of 62 million tokens soaked up from the circulating provide, assuming the bottom holding threshold per pockets.

On the similar time, web alternate flows have stayed unfavorable all through August and even half of July. That sometimes signifies a provide crunch as tokens transfer off exchanges into self-custody wallets. Nevertheless, the worth hasn’t responded to this bullish conduct.

One potential cause? These outflows could also be fully whale-driven. In different phrases, whales could also be rotating HBAR from exchanges into chilly storage; accumulation, sure, however with out contemporary demand coming into the market. No retail participation, no value raise.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

Retail and Sensible Cash Nonetheless Not Satisfied

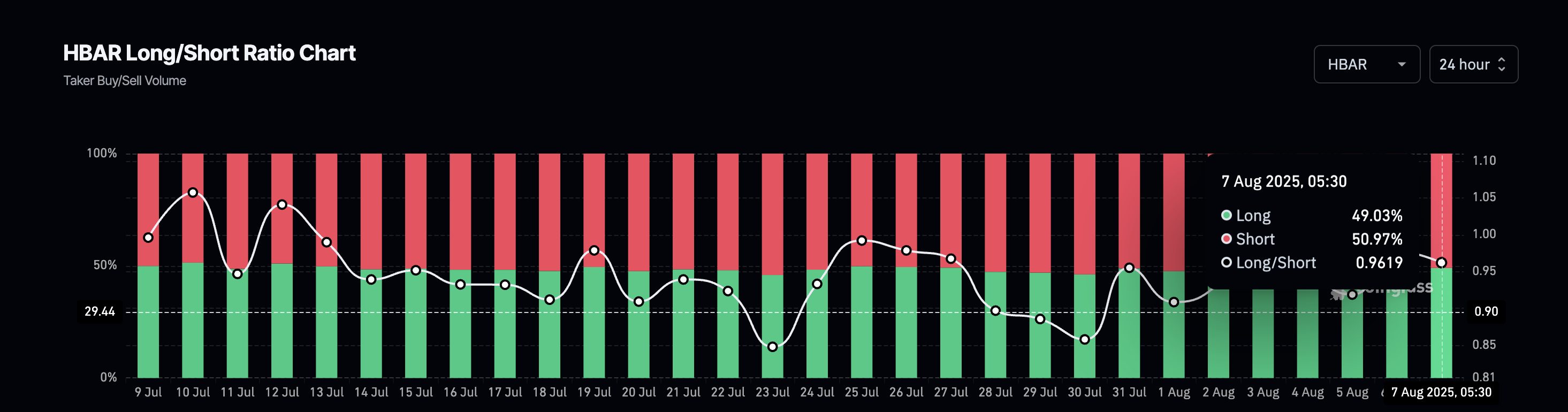

That concept checks out when wanting on the broader sentiment. The lengthy/quick ratio exhibits that fifty.97% of positions are nonetheless shorting HBAR. This quick bias is minimal, but it surely nonetheless means the market is betting towards the worth transferring up.

With no clear rotation of merchants flipping lengthy or new consumers stepping in, HBAR continues to wrestle for momentum. Even with bullish provide indicators, the sentiment stays bearish. Till the short-side conviction breaks, retail might sit on the sidelines.

CMF Divergence Provides Strain to the Ascending Triangle And The HBAR Value

Technically, the HBAR value remains to be holding above the ascending trendline seen on the 2-day chart. However there are cracks forming. The Chaikin Cash Stream (CMF) indicator, which measures fund influx momentum, has been printing decrease highs whilst value has tried larger highs.

This divergence suggests fading shopping for energy, a pink flag. And this aligns with the shortage of retail and good cash participation.

If value fails to interrupt above the $0.26 resistance zone, the sample might lose steam. A transfer beneath $0.23 would invalidate the present construction, confirming that good cash isn’t pushing HBAR ahead regardless of the whale-led accumulation.

Nevertheless, if the higher trendline of the triangle is breached, adopted by the HBAR value reclaiming $0.30, we might anticipate all of the bearish sentiments to fade in skinny air. That will additionally ignite the opportunity of a contemporary HBAR value rally.

The put up HBAR Whales Accumulate Over 60 Million Tokens: Why the Value Nonetheless Isn’t Responding appeared first on BeInCrypto.

Supply hyperlink