Regardless of Bitcoin hovering previous $120,000 and testing new all-time highs, a number of high-frequency market indicators counsel that the present bull run should still be gathering momentum.

In accordance with Swissblock’s newest multi-chart evaluation, the market construction stays wholesome, with no indicators of overheating habits sometimes seen at main cycle tops.

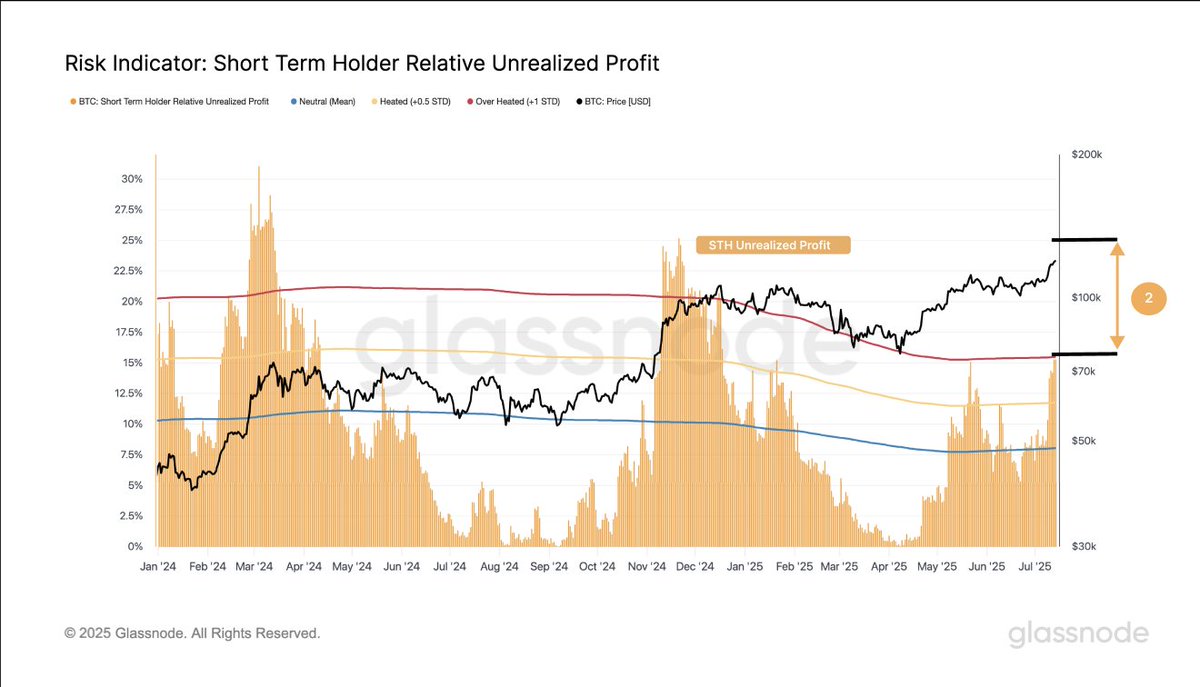

Revenue-taking habits stays in verify

Glassnode’s Quick-Time period Holder Relative Unrealized Revenue metric—used to evaluate the profitability of current consumers—stays far under prior cycle peak thresholds from January and April 2024. Traditionally, this metric spikes when markets change into euphoric, as buyers rush to lock in features. The present subdued studying signifies that merchants should not but in a frenzy of profit-taking, which frequently precedes a high.

Swissblock interprets this as an indication of ongoing market self-discipline, implying there’s nonetheless room for BTC to climb with out triggering mass exits.

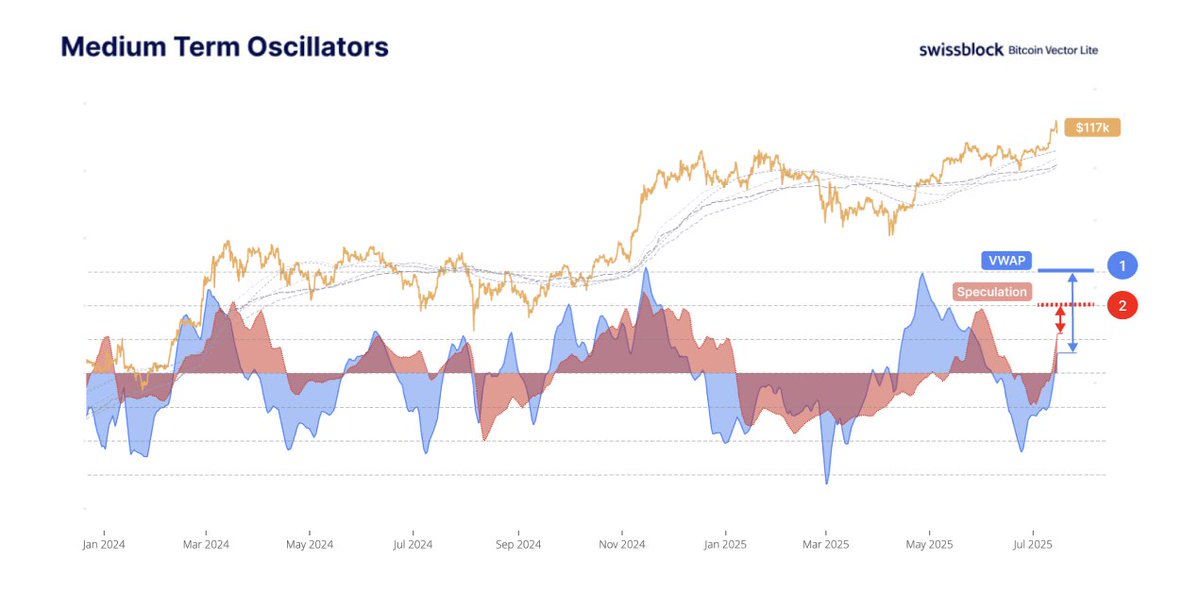

Hypothesis index and liquidity flows stay balanced

Woonomic’s Hypothesis Index and VWAP Liquidity, two key sentiment and liquidity oscillators, additionally stay inside impartial zones. These instruments, which measure threat urge for food and liquidity stress, present no indicators of extra—in contrast to prior cycle peaks the place these indicators reached excessive ranges.

This steadiness signifies that the rally will not be being pushed by reckless leverage or overconcentration of capital, however moderately by regular demand and orderly accumulation. Actually, BTC’s worth is climbing alongside wholesome liquidity dispersion—a trademark of sustainable development moderately than speculative blow-off.

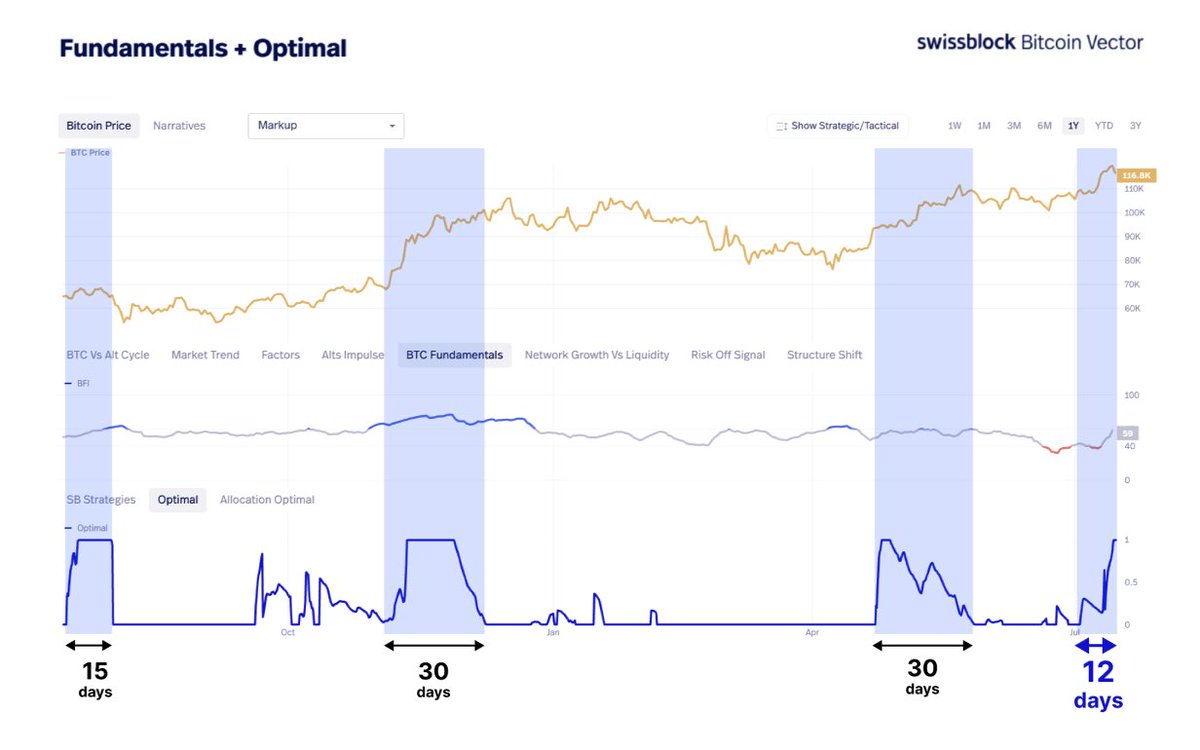

The cycle clock says there’s nonetheless time

Swissblock’s Optimum Sign, constructed by BitcoinVector, tracks the period of Bitcoin’s previous main rallies. Traditionally, sturdy upward strikes final between 15 and 30 days. The present uptrend is just 12 days in, suggesting this cycle is way from over. Earlier expansions in comparable setups typically skilled peak momentum within the second half of the rally window.

Including additional weight to this thesis is capital rotation into Ethereum, which usually follows Bitcoin’s lead mid-cycle as buyers search increased beta publicity.

Backside line: No high—but

Whereas merchants naturally marvel, “Has $BTC topped?”, Swissblock’s information suggests in any other case. Key revenue, liquidity, and timing indicators present restraint and steadiness—not the reckless abandon that has marked earlier cycle climaxes.