Ripple and the U.S. Securities and Trade Fee collectively petitioned Decide Analisa Torres on June twelfth to elevate the injunction on XRP gross sales and scale back excellent fines, a transfer designed to carry their years-long authorized battle to an expedited shut.

This step issues as a result of it not solely clears the best way for XRP’s broader market participation but additionally units a precedent for the way digital property are regulated in the US.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t liable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page.

As regulatory readability edges nearer, traders are weighing how these shifts may reshape portfolio methods and gas renewed confidence in token choices. In a nutshell, with key court docket approval looming, it’s the very best crypto to purchase now.

Ripple-SEC Settlement Nears Verdict, Awaits Court docket Nod to Finish XRP Injunction

Ripple and the SEC collectively requested Decide Torres on June twelfth to elevate an XRP gross sales ban and scale back fines. This transfer goals to settle their lengthy authorized battle, marking a key step ahead.

The court docket granted a requested 60-day pause in appeals till August fifteenth. Lawyer Invoice Morgan expects Decide Torres to rule a lot sooner, avoiding additional delays complicating settlement talks.

Morgan clarified that Ripple precipitated delays by insisting the injunction be dissolved. The SEC really cooperated to facilitate this transformation, exhibiting flexibility to achieve settlement.

SEC v Ripple: How the settlement course of goes

1. Settlement settlement signed by Ripple events on April 23, 2025 and by the SEC on Might 8, 2025 ✅.

2. Events filed a movement to carry the attraction and cross attraction in abeyance and obtained 60 days abeyance from April 16, 2025 to…

— invoice morgan (@Belisarius2020) June 18, 2025

Beforehand, a settlement movement was rejected for procedural errors. The events refiled appropriately on June twelfth, prompting the SEC to hunt the appeals pause.

Each side stress an pressing ruling is required to finalize their settlement. With out it, expensive appeals on key authorized points will proceed as deliberate.

The settlement final result critically impacts potential US XRP-spot ETFs. An SEC attraction win may jeopardize them by doubtlessly reclassifying XRP gross sales.

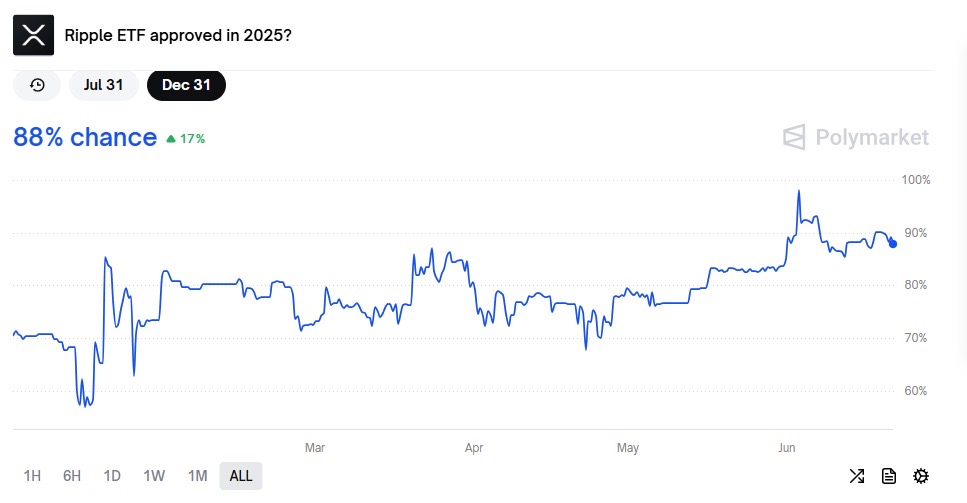

Regardless of authorized uncertainty, Polymarket odds favor a 2025 XRP-spot ETF approval at 88%. This displays optimism the settlement will in the end succeed.

Finest Crypto to Purchase Now

With the Ripple-SEC case nearing its end line, authorized readability may ignite contemporary market momentum. Traders are eyeing tokens that may capitalize on renewed confidence and regulatory certainty, however just one choose stands out in at present’s panorama. It’s time to zero in on the very best crypto to purchase now.

SUBBD

With the Ripple vs. SEC case coming to an finish ahead of anticipated, authorized readability is fueling optimism for utility tokens throughout the market, together with SUBBD, which is quickly gaining traction as an AI-powered platform for creators and followers.

Most content material platforms at present are constructed to extract worth from followers and funnel it upward. Whereas efficient, this mannequin is turning into outdated within the period of Web3.

The way forward for platforms ought to deal with creators as extra than simply content material producers and followers as greater than paying prospects. Each ought to have possession, affect, and added worth past content material alone.

Present platforms are sometimes inflexible, with little enter from creators or followers. What if these customers may assist form the platform’s route? That stage of management shouldn’t be attainable at present.

SUBBD goes past being simply one other platform; it’s a brand new form of creator-fan ecosystem. Entry is earned, engagement is participatory, and choices are made collaboratively.

Followers can be a part of token-gated communities, take part in unique livestreams, and revel in immersive digital experiences, all powered by AI instruments that carry creators and followers nearer collectively.

On SUBBD, fan engagement isn’t restricted to likes or follows. Followers unlock premium content material, entry unique livestreams, and earn rewards just by holding $SUBBD tokens or staking them for credit.

By holding $SUBBD, customers acquire entry to AI-powered instruments for creating lifelike photos, movies, and fan-driven media. This transforms content material creation right into a two-way expertise for everybody concerned.

Solaxy

As authorized certainty boosts market sentiment, tasks delivering actual utility, resembling Solaxy, are more and more seen as the subsequent wave of breakout alternatives within the evolving crypto panorama.

Solaxy’s presale has raised a formidable $56 million, simply days earlier than its change itemizing. The venture goals to unravel Solana’s congestion points, permitting for smoother transactions throughout peak durations.

This innovation may change how customers work together with Solana. As an alternative of utilizing Solana’s Layer 1 instantly, builders and merchants may use Solaxy, which is able to then settle transactions on the Solana predominant community.

With Solana valued at over $77 billion and $56 million raised for Solaxy, the venture’s potential for development is evident. Solaxy’s success may play a significant position in increasing Solana’s ecosystem.

Wanting forward, the Solaxy neighborhood is happy for the launch of its predominant community, native DEX, and meme coin launchpad, all scheduled for July. These milestones are extremely anticipated by traders and customers alike.

Solaxy made waves final week by burning 35 billion tokens, value $62 million, in a strategic transfer to extend shortage. This motion goals to make sure the venture’s long-term success and sustainability.

The burn occasion generated robust constructive reactions from the neighborhood. Media shops highlighted the transfer, analysts praised it, and new traders flooded into the presale. In response, Solaxy burned one other 20 billion $SOLX on Tuesday.

In whole, 55 billion $SOLX tokens have now been burned, representing 40% of the whole provide. With fewer tokens in circulation, elevated demand may result in a sharper rise within the $SOLX value.

Bitcoin Hyper

Bitcoin Hyper marries Bitcoin’s rock‑stable basis with hyper‑scalable sidechains. In an period craving each stability and pace, this hybrid play may simply be the breakout star as soon as regulatory mud settles.

In a world the place most crypto tasks take cautious routes, Bitcoin Hyper is rising as a prime contender for 2025. It stands out by providing one thing distinct in a crowded market.

Bitcoin Hyper operates on the Solana Digital Machine, a framework recognized for efficiency and transparency. This highly effective mixture may assist it thrive if regulatory pressures develop.

With Bitcoin Hyper, customers can ship, obtain, and work together with Bitcoin in close to real-time. They will additionally faucet into the rising Bitcoin-based DeFi ecosystem, unlocking new monetary alternatives.

One in all Bitcoin Hyper’s standout options is the Canonical Bridge, which facilitates all withdrawals from and to Layer 2. This bridge performs a key position within the ecosystem’s performance.

Bitcoin Hyper is constructing a complete ecosystem, together with a bridge, pockets, staking, and meme options. These parts may make it one of the crucial utility-rich Bitcoin tasks in the marketplace.

Whereas Bitcoin is the unique cryptocurrency, its growing older infrastructure is beginning to present limitations. Bitcoin Hyper gives an answer, enhancing Bitcoin’s capabilities with fashionable expertise.

Based on a well known crypto YouTuber, 99Bitcoins, Bitcoin Hyper is anticipated to ship 100x returns.

XRP

The courtroom drama that formed crypto legislation is lastly winding down, and XRP stands on the middle. As a ruling nears, this veteran token may shake off its authorized constraints and reclaim its place among the many heavyweights.

XRP is the native token of the XRP Ledger, an open-source blockchain designed to enhance international monetary transfers and foreign money exchanges. It’s additionally used for storing worth and capitalizing on value adjustments.

Ripple, a blockchain providers firm, makes use of XRP and the XRP Ledger to facilitate transactions between monetary establishments, companies, and organizations. This enhances cross-border funds and liquidity.

The XRP Ledger was developed in 2011 by Jed McCaleb, David Schwartz, and Arthur Britto to handle Bitcoin’s limitations. It was launched in 2012, with XRP created to help its performance.

The chart exhibits XRP consolidating in a sideways vary after a decline from early June highs close to $2.35. Worth has discovered a ground round $2.10 on a number of events, indicating a transparent demand zone, whereas the realm round $2.25 has capped upside makes an attempt. Quantity has tapered off barely throughout the latest pullback to help, suggesting the transfer decrease was extra a scarcity of latest consumers than aggressive promoting.

A decisive break above $2.25 on elevated quantity would sign renewed bullish curiosity and will goal the June 9 peak close to $2.35. Conversely, a break beneath $2.10 on heavy quantity would doubtless open the door to the subsequent help close to $2.05. Merchants might look to purchase close to the decrease boundary with a cease just below $2.09 and goal the top quality, or look forward to a confirmed breakout earlier than committing.

Conclusion

The joint movement by Ripple and the SEC is an indication {that a} landmark resolution relating to XRP is coming, and ahead of most anticipated. Except for the short-term impact on XRP’s value, this case is a mirrored image of the crypto trade’s course of in direction of regulatory maturity and institutional acceptance.

For traders, it means a extra outlined roadmap for portfolio administration and threat allocation. By concentrating on utility tokens with sensible makes use of and established groups, one can get forward of the curve. In spite of everything, with authorized ambiguity within the rearview mirror, now’s the very best crypto to purchase now.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t liable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, instantly or not directly, for any harm or loss precipitated or alleged to be attributable to or in reference to use of or reliance on any content material, items or providers talked about.