- EIP-7782 aims to cut Ethereum block time from 12s to 6s, doubling confirmation speed.

- Faster slots could mean smoother DeFi trades, lower gas volatility, and stronger ETH demand.

- It’s a behind-the-scenes change with big front-end impact—one that could shape DeFi’s future.

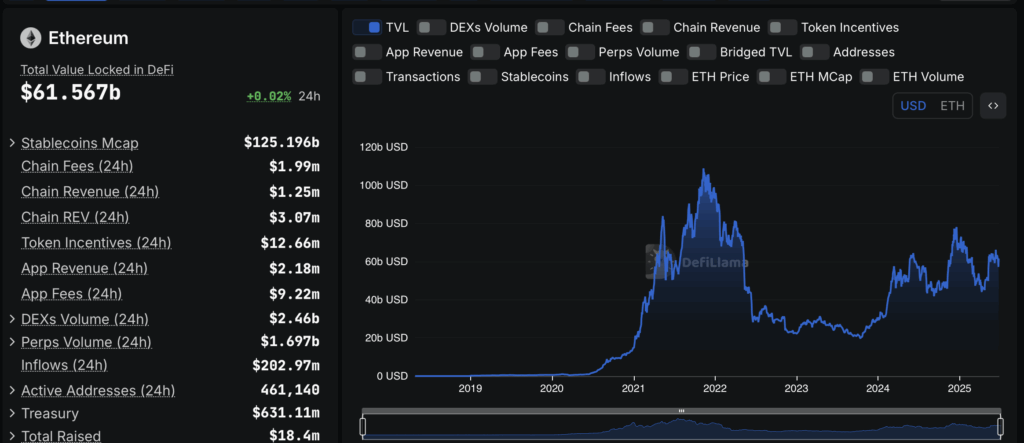

Ethereum isn’t just about price charts or headlines—it’s the backbone of decentralized finance. With over $60 billion locked in its DeFi ecosystem, the chain’s real strength lies in its utility. And now, devs are stepping things up. A new proposal, EIP-7782, aims to cut Ethereum’s slot time in half—from 12 seconds down to just 6. Sounds small, right? But the effects? Potentially huge.

With the recent Pectra upgrade already in the rearview and this next one on the table, 2025 might be the year Ethereum finally gets its long-overdue speed boost. But let’s be honest: Is this just a flashy tech upgrade, or could it actually change how people use the chain

Faster Blocks, Tighter Network—What’s Actually Changing?

Right now, Ethereum proposes a new block every 12 seconds. If the proposal passes, that shrinks to 6 seconds flat. Same gas limit, same transaction capacity—but twice as many blocks per hour. That means stuff just moves faster. No increase in throughput, but confirmation times? Way better.

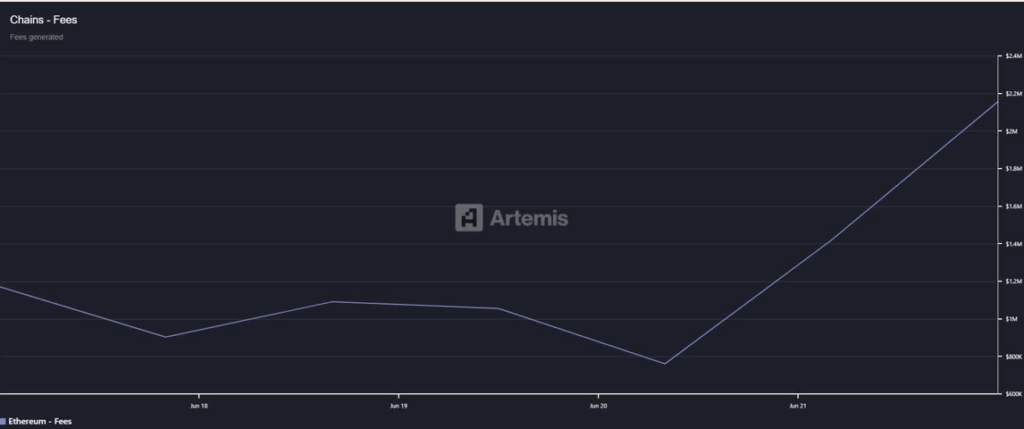

Why does that matter? Because fees could get more predictable. Right now, when things get busy, you might toss in extra gas just to get your transaction through. But if blocks come more often, you’re less likely to overpay. More blocks = smoother flow.

Some devs are calling this change Ethereum’s “biggest rollup yet”—not because it adds flashy features, but because it makes the whole engine run tighter. And honestly, that kind of quiet upgrade might be exactly what DeFi needs.

Real DeFi Gains: Not Just a Speed Bump Fix

Let’s talk real-world DeFi. You’re swapping tokens, staking ETH, or pulling yield from some liquidity pool—you want speed. Right now, every action on-chain has to wait about 12 seconds for confirmation. In calm markets, fine. But when volatility spikes? That delay can cost you.

Cutting it to 6 seconds means DeFi reacts faster. Swaps on Uniswap become smoother. Lending rates adjust quicker. The whole experience just feels less… sluggish. Plus, better execution draws in more volume, which feeds liquidity, which boosts returns. You see where this is going.

More activity means more stakers. More stakers = more demand for ETH. It’s like a feedback loop, but one that actually benefits users.

This Isn’t Just Tech—It’s a Power Move

It’s easy to dismiss this slot-time stuff as a backend detail. But zoom out. Ethereum is the bedrock of DeFi. Any change at the protocol level ripples across the entire stack. Faster blocks = lower fees, sharper price tracking, and more responsive dApps.

Ethereum isn’t chasing hype here. It’s digging into the infrastructure, making it leaner and more efficient. That’s not just about UX—it’s about giving users and devs a reason to stay.

2025 might just be Ethereum’s biggest growth year yet—not because of price pumps, but because the chain itself is finally growing into the backbone it was always meant to be.