- Whales dumped $93M in ETH to exchanges—undoubtedly not bullish.

- Technical indicators like MACD and spot promoting recommend bearish momentum is constructing.

- However most ETH holders are nonetheless worthwhile… for now.

Ethereum’s been wanting shaky these days, and now there’s contemporary whale drama stirring the pot. In simply two days, ETH whales unloaded a whopping 26,182 ETH, price almost $93.7 million, straight onto high exchanges like Binance, Kraken, OKX, and Bybit. Yeah, not precisely a quiet exit.

The transfers got here in chunks—1,000 to 2,000 ETH per transfer—clogging centralized platforms with sell-side stress. It’s bought merchants questioning: are whales spooked, or simply cashing out whereas the value holds up?

Spot Sellers Rule as Futures Get… Too Sizzling?

Let’s not sugarcoat it—bearish vitality is spreading. The Spot Taker CVD is now exhibiting a heavy tilt towards sellers, which strains up with the inflow of ETH hitting exchanges. Mainly, persons are promoting greater than they’re shopping for. Not an ideal signal.

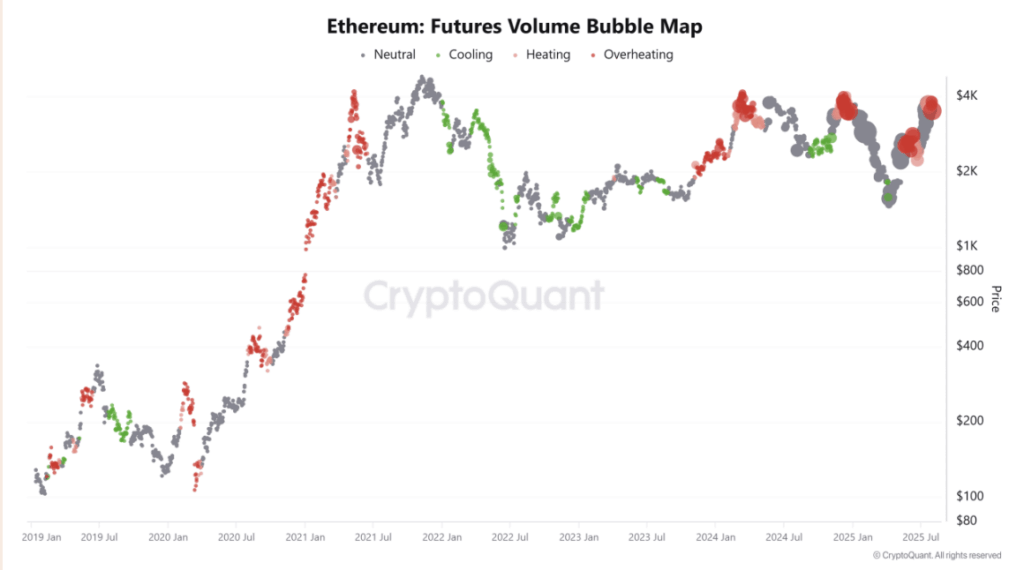

In the meantime, over in derivatives land, CryptoQuant’s bubble map is flashing warnings. Futures volumes round ETH’s $3,400–$3,500 vary are overheating. A variety of leverage increase right here, and when issues get that frothy, even small value dips may cause main wipeouts. If funding flips or merchants begin panicking, we might see a liquidation cascade. Once more.

Nonetheless within the Inexperienced… For Now

Curiously, not every little thing is doom and gloom. In accordance with IntoTheBlock, a strong 92.26% of ETH addresses are nonetheless sitting on income. Solely 4.77% are underwater, and one other 2.97% are break-even.

That provides Ethereum a little bit of a cushion—folks aren’t determined to promote simply but. However right here’s the catch: that $3,458 assist zone? It’s kinda essential. If ETH drops beneath that, these break-even holders would possibly begin sweating and dump their baggage, which might snowball rapidly.

Assist’s Holding—However Simply Barely

ETH has dipped into that $3,458–$3,490 vary, which beforehand sparked a reversal. It’s an excellent assist zone… nevertheless it’s additionally exhibiting cracks. The MACD simply flipped bearish on the day by day chart. That’s not an ideal look. The sign line crossed above the MACD line, a basic signal that bullish momentum’s fading quick.

If patrons don’t step up quickly, the ground would possibly fall out. And if that occurs? ETH might slide all the best way to $2,906—a drop that would sting actual unhealthy.

Whale Strikes: Wild, Unpredictable, and Nerve-Racking

To make issues messier, whale flows are everywhere. A 7-day spike of 8,294% in netflows simply reversed a -2,854% decline over 90 days. That type of swing doesn’t scream confidence. Whales appear nervous or uncertain, possibly adjusting to macro stuff or simply profit-taking.

This randomness isn’t serving to market construction in any respect. It’s including noise, making value motion more durable to belief. If whales maintain pulling out whereas the chart retains bleeding, ETH may very well be in for extra tough waters forward.