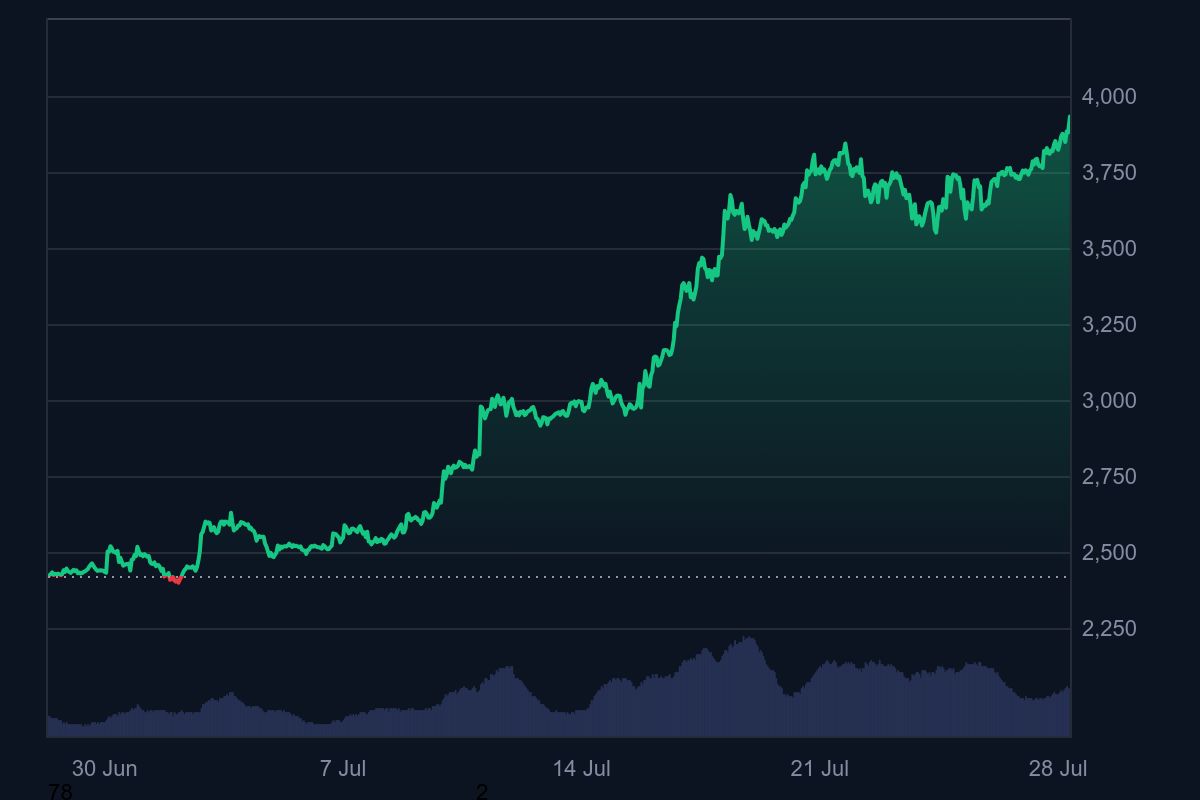

Ethereum simply crossed the $3,900 mark, rising over 62% prior to now month, based on CoinMarketCap information.

The transfer is backed by large institutional accumulation, rising buying and selling quantity, and renewed pleasure for altcoins. Merchants like MMCrypto now say this breakout confirms the beginning of Altcoin Season.

Over the weekend, SharpLink Gaming added one other 77,210 ETH value $295 million, bringing their whole to 438,017 ETH. The corporate additionally introduced plans to stake a lot of its holdings—tightening provide and signaling long-term confidence. Different companies like Bitmine Immersion have adopted swimsuit, including Ethereum to their steadiness sheets as a core treasury asset.

This momentum is drawing comparisons to Ethereum’s 2017 bull run, however this time with greater gamers concerned. Dealer Merlijn highlighted how Ethereum has reclaimed its 50-week shifting common and damaged out of an extended consolidation zone. In his phrases: “Identical setup. Extra capital. A lot greater stakes.”

Institutional flows and ETF momentum gasoline rally

On the ETF aspect, Ethereum inflows have massively outpaced Bitcoin. Based on SoSoValue, ETH spot ETFs added $1.85 billion final week, in comparison with simply $72 million for BTC. That is the second-highest weekly web influx for ETH ETFs since launch. BlackRock’s ETHA alone now manages over $9.17 billion in property, showcasing rising Wall Avenue curiosity.

Market sentiment displays this shift. The worldwide Worry & Greed Index now sits at 67—firmly in “Greed” territory—mirroring Ethereum’s 61% 30-day rally. Analysts count on this altcoin window to be short-lived however extremely worthwhile for individuals who rotate neatly out of Bitcoin and into ETH and associated tokens.

Even Michaël van de Poppe has turned bullish on altcoins like SUI, noting its rising ecosystem, TVL enlargement, and BTC bridge growth. He believes a consolidation interval is subsequent—adopted by a brand new all-time excessive.

Brief window for earnings as ETH closes in on ATH

Ethereum is now approaching main psychological resistance close to $4,000. If it breaks this stage cleanly, merchants anticipate a quick transfer towards worth discovery. MMCrypto pressured that whereas Bitcoin stays king, Ethereum’s breakout offers one of many clearest indicators in years for altcoin upside. “As soon as we affirm the breakout, it’s GO TIME,” he wrote.

As institutional cash rotates into utility-focused cash, Ethereum stays the anchor of this new wave. Whether or not the window lasts days or perhaps weeks, ETH’s surge marks a transparent regime shift—and the beginning of a high-stakes altcoin season.