- Matrixport sees ETH momentum fading, with a possible retest under $4,355.

- Practically $1B in ETH left Binance in two days, suggesting holders are shifting to chilly storage.

- Dan Tapiero highlights 9 progress sectors that would set off the following altcoin cycle.

Ethereum’s sizzling streak in August appears prefer it’s cooling off, with Matrixport warning that ETH may dip below $4,355 within the quick time period. On the identical time, contemporary knowledge reveals almost $1 billion price of ETH was pulled from Binance, elevating new questions on the place the market heads subsequent.

Momentum Dropping Steam

Matrixport’s notice identified that Ethereum had been using its 21-day shifting common via most of August, bouncing off it each time the market dipped. That playbook labored properly early within the month, however by the final week, features have been slowing down.

The agency now sees ETH locked in a spread between $4,355 and $4,958, with a retest of the decrease stage wanting extra doubtless if consumers don’t step in quickly. Plenty of this, they argued, is determined by whether or not treasury-style corporations holding ETH can maintain elevating capital and pushing the narrative.

Charts alongside the report confirmed ETH holding above its averages for weeks, however the regular upward stress is fading. Matrixport went so far as to name it “the largest story in crypto proper now,” warning that ignoring these indicators may imply lacking the following main shift in ETH’s development.

Binance Exercise Heats Up

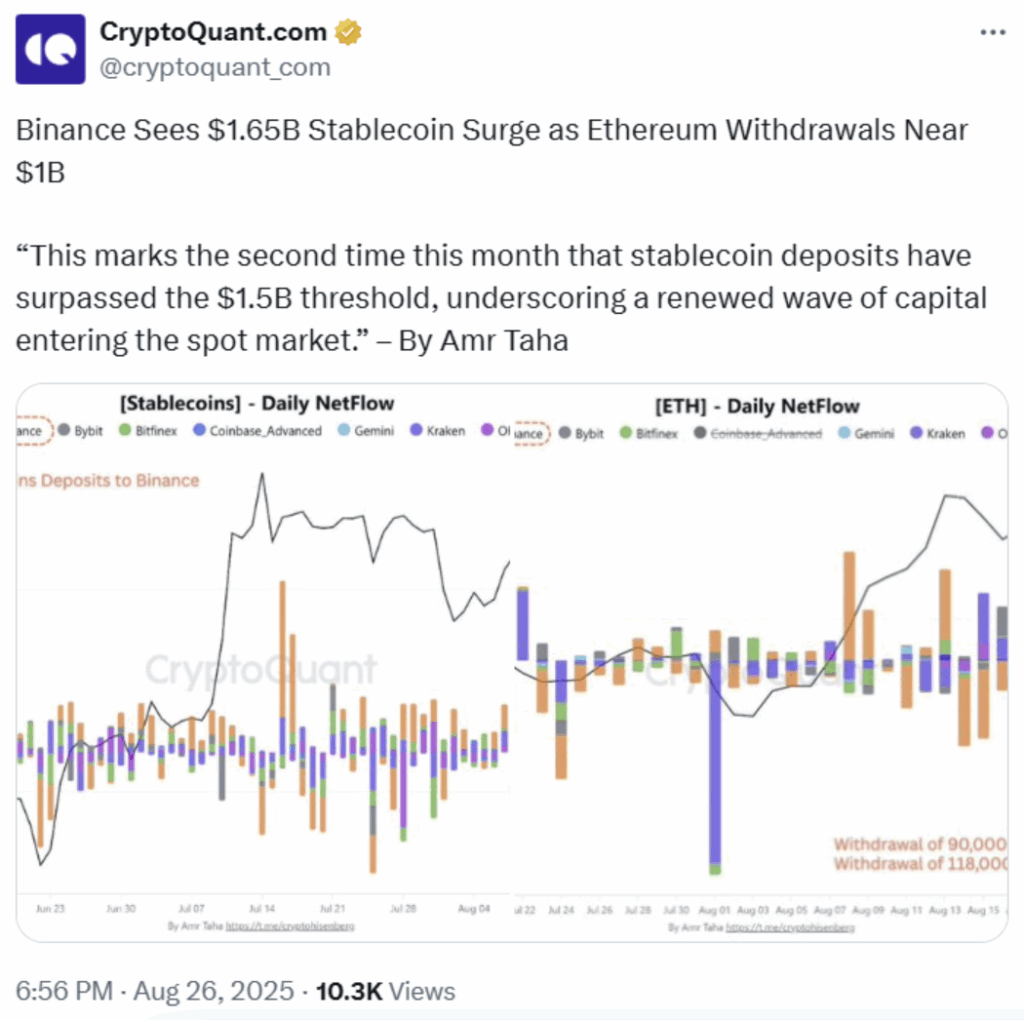

On-chain trackers additionally flagged some eye-catching strikes out of Binance. Stablecoin deposits surged previous $1.65 billion in August, crossing the $1.5B mark twice—normally an indication merchants are gearing as much as deploy contemporary capital.

However the greater story was ETH withdrawals. On August 24, round 90,000 ETH was taken off Binance. A day later, one other 118,000 ETH adopted. At present costs, that’s simply shy of a $1 billion exit in 48 hours.

Giant outflows like which can be normally interpreted as buyers shifting to chilly storage, an indication they’re not seeking to dump within the close to time period. It additionally means there’s merely much less ETH left on exchanges, which may dampen instant promoting stress. Binance nonetheless dominates for each deposits and withdrawals, because of its liquidity, low charges, and international attain.

Dan Tapiero’s 9 Catalysts for Altcoins

Including a wider lens, Dan Tapiero of DTAP Capital laid out 9 areas he thinks may gas the following part of altcoin progress. He famous that the altcoin market cap (excluding BTC and ETH) is mainly flat in comparison with the 2021 peak—and barely above 2018 ranges—despite the fact that the ecosystem has developed massively since then.

Tapiero pointed to 9 drivers: stablecoins, DeFi, yield merchandise, Solana, NFTs, decentralized exchanges, real-world property, AI integrations, and prediction markets. Every sector, he argued, is just partially valued proper now and will convey severe upside if adoption deepens.

His case is that buyers are nonetheless anchored to Bitcoin and Ethereum, however ultimately capital will circulation to the broader crypto stack. And when that occurs, he believes a contemporary alt season is on the horizon.

The submit Ethereum Momentum Slows as $1B Withdrawn From Binance first appeared on BlockNews.

Supply hyperlink