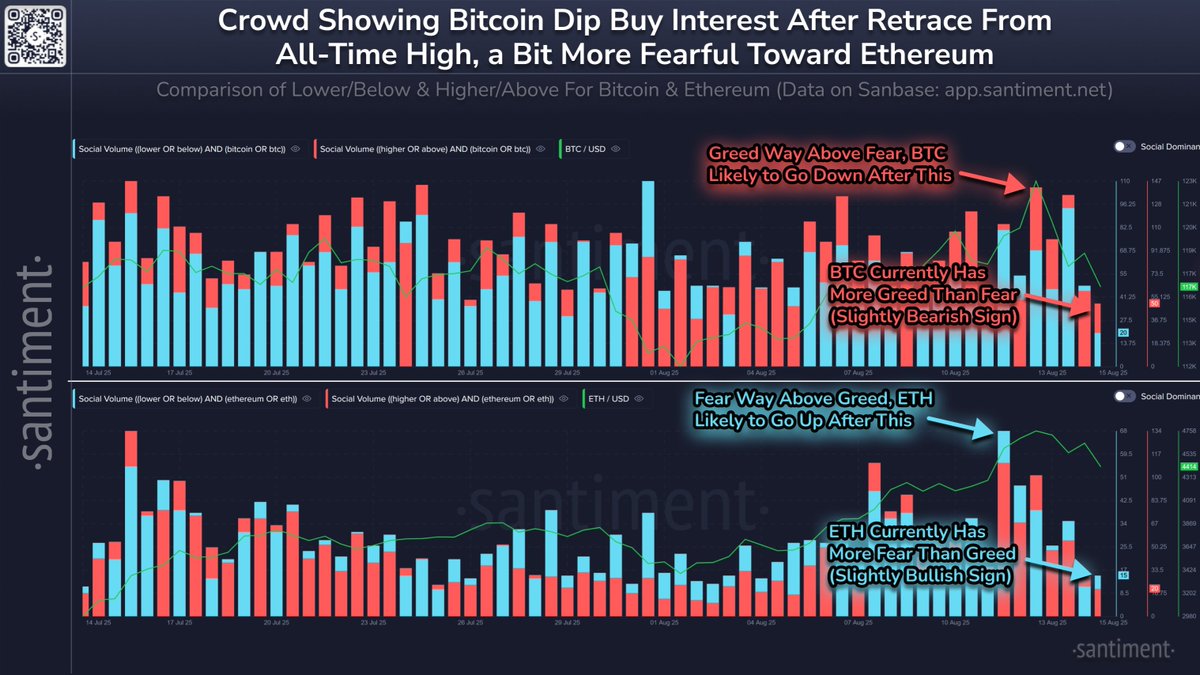

Fresh data from market intelligence platform Santiment reveals a striking divergence in sentiment between Bitcoin (BTC) and Ethereum (ETH) that could set the stage for Ethereum to outperform in the near term.

Santiment’s analysis compared social media mentions of “lower” or “below” versus “higher” or “above” in relation to each asset’s price levels. For Bitcoin, the greed spike coincided almost perfectly with its all-time high and subsequent local top – a historically bearish sign. The report notes that excessive optimism often precedes a price pullback, suggesting BTC’s rally may be cooling.

In contrast, Ethereum has quietly outperformed Bitcoin over the past three months yet has generated far less bullish chatter. In fact, the ETH crowd is showing more fear than greed – an unusual dynamic that Santiment views as a slightly bullish signal.

Historically, prices tend to move opposite to retail sentiment. When traders show strong greed, assets often dip, while fear-dominated markets can fuel upside as sellers get exhausted.

This suggests Ethereum’s relative lack of hype, despite its strong performance, may leave more room for gains compared to Bitcoin, where sentiment appears overheated.

If this divergence continues, Ethereum could see renewed buying interest from contrarian traders betting on a sentiment-driven rotation away from Bitcoin.

Source link