A serious shift is underway in crypto markets as Ethereum begins to outpace Bitcoin in each value efficiency and buying and selling exercise.

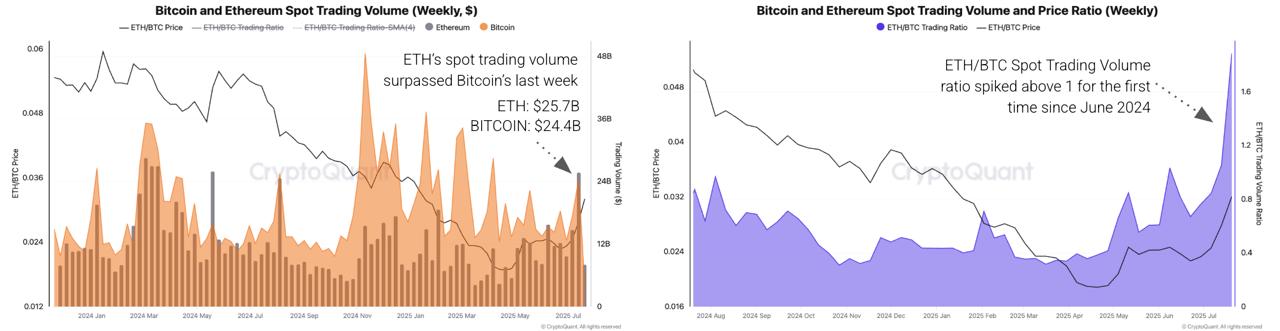

In line with new knowledge from CryptoQuant, ETH’s spot buying and selling quantity surpassed Bitcoin’s for the primary time since June 2024, signaling renewed investor urge for food for altcoins and accelerating indicators of a possible new “altcoin season.”

ETH Outperforms BTC as Quantity, Demand Spike

Ethereum’s weekly spot buying and selling quantity hit $25.7 billion, topping Bitcoin’s $24.4 billion. This marks the primary time in over a yr that ETH has persistently led in spot buying and selling exercise. The ETH/BTC buying and selling quantity ratio additionally rose above 1.0, a major technical milestone final seen in mid-2024.

Since bottoming out in April, ETH has outperformed Bitcoin by 72%, with the ETH/BTC value ratio rising from 0.018 to 0.031—the very best since January. Analysts hyperlink this momentum to Ethereum’s undervaluation section, now reversing as accumulation grows and promote strain fades.

Altcoin and ETF Information Verify Rotation Development

Altcoin curiosity isn’t restricted to Ethereum. Whole spot buying and selling quantity for altcoins surged to $67 billion on July 17, the very best since March. In the meantime, U.S.-based ETF knowledge exhibits Ethereum allocations gaining floor towards Bitcoin. The ETH/BTC ETF Holding Ratio climbed from 0.05 to 0.12, indicating institutional traders are shopping for ETH in bigger portions.

This momentum is additional supported by change influx knowledge. Considerably much less ETH is being deposited on exchanges in comparison with BTC, suggesting decrease promoting strain and potential for continued outperformance.

Outlook: ETH/BTC Features Might Lengthen

With rising institutional inflows, spiking spot volumes, and a good on-chain profile, Ethereum seems to be regaining market dominance. If this rotation pattern holds, ETH/BTC might proceed climbing—pushing extra capital towards Ethereum and broader altcoin markets within the coming weeks.

Supply hyperlink