- Ethereum is flashing a hidden bullish divergence that analysts say may goal $8K.

- Tokenization and stablecoin development are strengthening ETH’s long-term narrative.

- Analysts argue Ethereum’s worth is tied extra to future adoption than present worth motion.

Ethereum is more and more discovering itself on the heart of the crypto market’s subsequent massive narrative. Past worth motion, ETH is turning into a core pillar within the rising dialogue round tokenization, stablecoins, and real-world belongings transferring on-chain. On the similar time, technical alerts are beginning to line up, with some analysts pointing to a contemporary bullish divergence that might set the stage for a a lot bigger transfer, doubtlessly towards the $8,000 vary.

A Hidden Bullish Divergence Takes Form

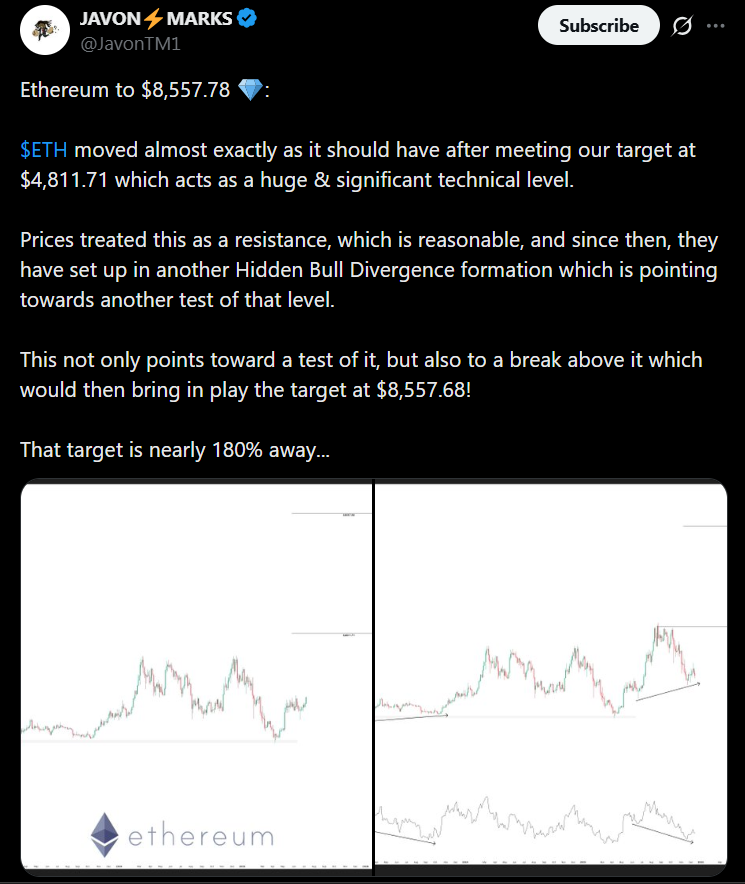

Based on monetary analyst Javon Marks, Ethereum’s latest worth conduct is flashing a hidden bullish divergence, a setup that always seems earlier than sturdy continuation strikes. Marks famous that ETH reacted nearly completely after reaching a key technical stage close to $4,811, treating it as resistance earlier than pulling again in a managed method. Since then, worth motion has quietly shaped one other bullish divergence, suggesting a renewed push greater may very well be constructing.

If Ethereum manages to clear near-term resistance zones, Marks believes the trail opens towards a a lot bigger goal round $8,557. That transfer would characterize practically 180% upside from present ranges, a projection that’s catching consideration as sentiment slowly improves relatively than peaks.

Tokenization Places Ethereum within the Highlight

Past charts, Ethereum’s broader attraction continues to develop because of its position within the tokenization narrative. As Wall Road explores tokenized funds, bonds, and different real-world belongings, Ethereum stays the almost certainly settlement layer for a lot of of those merchandise. Stablecoins, institutional-grade infrastructure, and developer tooling are already deeply embedded within the Ethereum ecosystem, reinforcing its place because the default alternative for large-scale on-chain finance.

This structural benefit is a part of why long-term traders stay centered on Ethereum’s future relatively than short-term volatility. The thought isn’t nearly what ETH is doing at this time, however what it may characterize as soon as tokenization adoption accelerates.

Lengthy-Time period Optimism Nonetheless Runs Deep

A number of the most aggressive long-term forecasts proceed to border Ethereum as a multi-cycle asset. Tom Lee has repeatedly argued that many traders underestimate Ethereum by focusing too narrowly on present situations. In his view, Ethereum’s worth is tied to a coming supercycle pushed by tokenization and monetary infrastructure, not simply speculative buying and selling. Whereas a $100,000 ETH stays a distant and controversial prediction, it underscores how bullish some outlooks stay.

What Comes Subsequent for ETH

Ethereum’s highway to $8,000 received’t be clean, and short-term pullbacks are nonetheless doable, particularly in a unstable macro setting. Nonetheless, the mixture of bettering technical alerts and robust structural narratives offers ETH a compelling setup. If momentum continues to construct and resistance ranges break, Ethereum may reassert itself as one of many market’s strongest long-term performs.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.