- Ethereum surged 20% to $2,331 as $265 million in shorts have been liquidated, marking its greatest one-day acquire of the yr.

- Analysts warn of a possible pullback with $2,232 as key assist, whereas $2,550 stays the following main resistance.

- Regardless of the rally, ETH/BTC’s MVRV ratio suggests Ethereum is undervalued, however flat community exercise and ETF outflows elevate considerations.

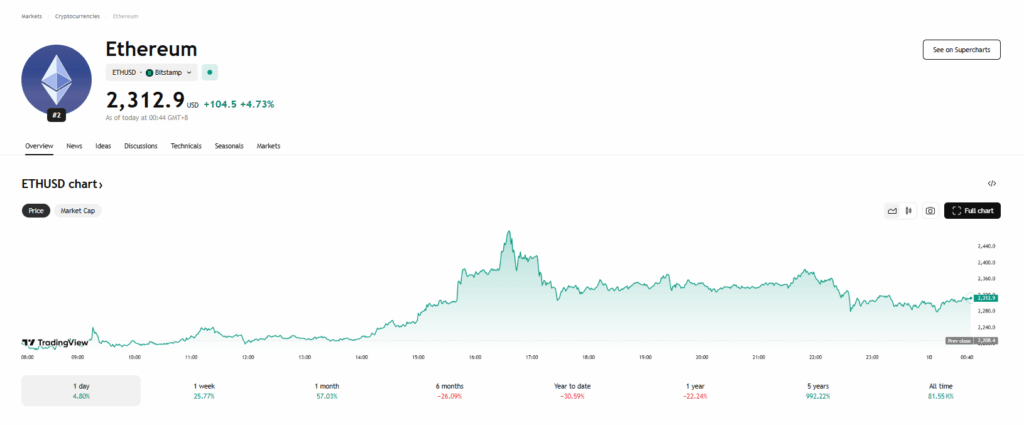

Ethereum simply pulled off its largest single-day acquire of the yr, skyrocketing 20% to $2,331. The surge comes as brief merchants get crushed — over $265 million in ETH shorts have been liquidated, fueling a worth spike that coincided with a 184% soar in futures quantity and a 20% rise in open curiosity, per Coinglass.

Apparently, the simultaneous rise in worth and open curiosity suggests new lengthy positions are piling in, not simply brief overlaying. Might be the beginning of an even bigger development, however for now, ETH stays down 26% year-to-date, regardless of climbing 54% within the final month as altcoins regain some shine.

Technical Outlook — Breaking Key Ranges

Ethereum’s breakout above the $1,950 assist stage despatched it ripping via a rising channel that had held it down since mid-April. Now at $2,331, the following resistance ranges to observe are $2,386 and $2,550.

However momentum’s wanting a bit overheated. MACD’s flashing overbought alerts, suggesting a pullback might be on deck. If ETH slips, $2,232 is the important thing stage to carry — the higher boundary of the breakout channel. Drop beneath that, and $2,101 may come into play as the following assist.

Commerce Setup:

- Purchase Above: $2,232

- Take Revenue: $2,550

- Cease Loss: $2,101

Is Ethereum Undervalued vs. Bitcoin?

Some analysts at the moment are pushing the narrative that ETH is undervalued relative to Bitcoin. CryptoQuant flagged Ethereum’s ETH/BTC MVRV ratio between 0.4 and 0.8 — its lowest since 2019. Traditionally, this stage has preceded large ETH rallies, like in 2017, 2019, and 2021.

However there’s a catch. Community exercise is flat, ETH burns are slowing, and DeFi is plateauing. In the meantime, Grayscale’s ETHE is bleeding capital, with billions in redemptions as institutional curiosity cools. If ETH goes to interrupt out for actual, it’d want a contemporary catalyst — perhaps a DeFi surge or a staking enhance.