- Ethereum’s network activity is booming, with a record 17.4 million weekly active addresses and Layer 2 usage multiplying, suggesting a surge in demand and possible breakout momentum.

- DeFi capital is flowing back into Ethereum, pushing TVL to $86.63B, while exchange outflows hint at a supply squeeze — bullish signals stacking up across the board.

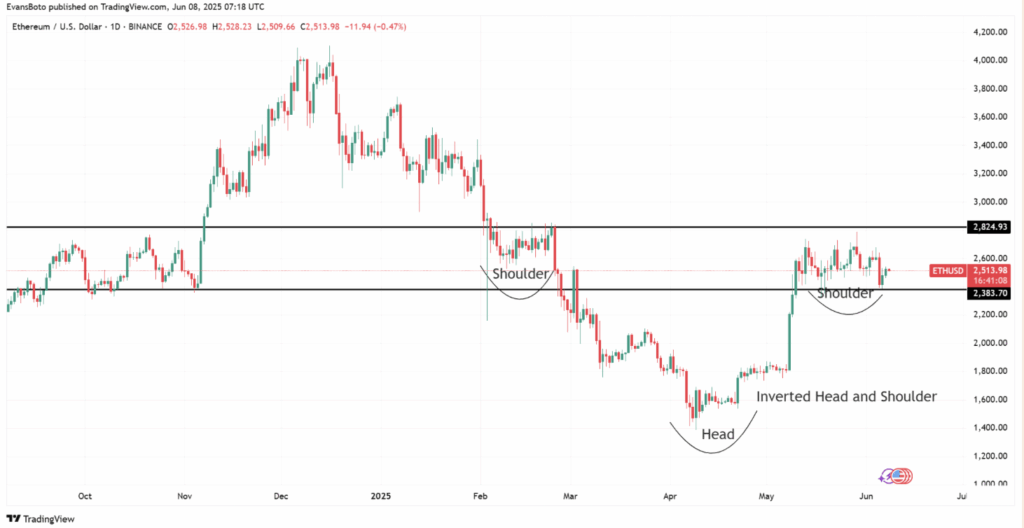

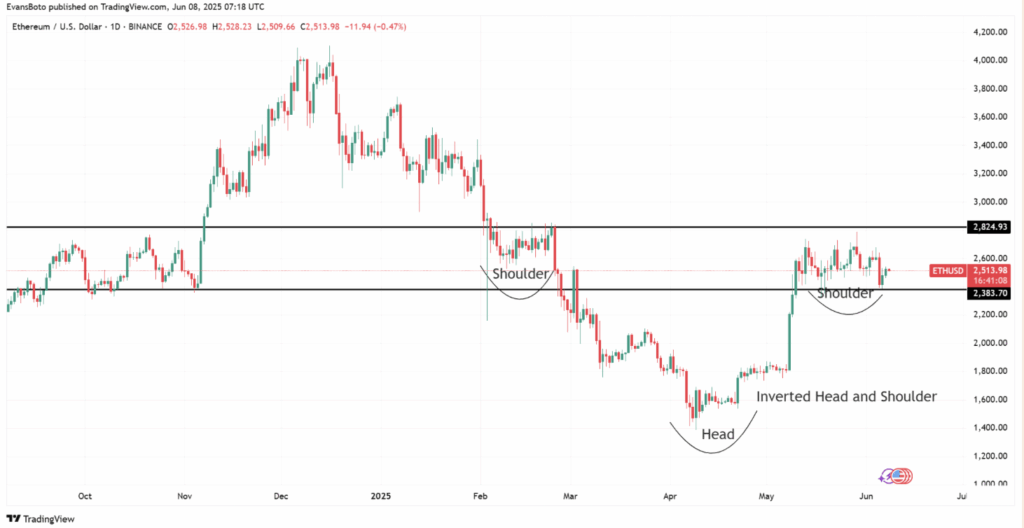

- ETH is forming an inverted head-and-shoulders pattern, with $2,824 acting as the breakout line; a clean move above could send prices toward $3K, but failure might trap price in consolidation.

Ethereum’s ecosystem just lit up this June. Weekly active addresses shot past 17.4 million — yeah, that’s a brand new all-time high. What’s even more interesting is the wild 18.43% surge in Layer 2 interactions. Multiply that by 7.55x and you get a clear signal: people are piling into these scaling solutions fast.

Cross-chain stuff might’ve dipped a little, sure, but core Ethereum usage is roaring. That kind of attention — from everyday users and big players alike — might be the spark ETH needs for a breakout. Or maybe just a tease. Time will tell.

DeFi Confidence Creeping Back In

Let’s talk DeFi — because it’s not dead. Not even close. Ethereum’s Total Value Locked (TVL) just nudged up to $86.63 billion, with a 1.28% jump in a single day. Not a moonshot, but steady is good, right?

Clearly, capital is trickling back into Ethereum’s lending, staking, and liquidity protocols. Some might say it’s slow… others would call it conviction. Either way, it’s helping ETH’s fundamentals look a little sturdier. And when DeFi thrives, ETH usually does too.

Exchanges Losing ETH — Is a Supply Squeeze Brewing?

Here’s a juicy one: exchange balances are dropping. Netflows turned negative by 1.59%, which means folks are yanking ETH off exchanges and stashing it elsewhere — maybe in cold wallets, maybe in staking. Either way, it’s not sitting around waiting to be dumped.

Fewer coins on exchanges usually means less sell pressure. If this keeps up and demand sneaks in, we could see prices shoot up fast — classic supply crunch move.

Traders All-In on Longs… But Is That a Red Flag?

Now here’s the tricky part — trader behavior. Volatility fell off a cliff, from over 80% to around 47% in two days. Meanwhile, Binance’s ETH long/short ratio is sitting at 1.84, with nearly 65% of folks betting long.

That’s confidence — maybe a little too much. Overcrowded trades like this? They don’t always end well. If sentiment flips, longs could get smoked. But right now? The bulls still have the ball.

All Eyes on $2,824

Ethereum’s trading between $2,383 and $2,824 right now, carving out an inverted head-and-shoulders pattern — a classic bullish setup. The recent bounce to $2,515.80 is promising, but it’s that $2,824 neckline that really matters.

Break it, and ETH might just sprint toward $3K. Miss it, and we’re probably looking at more sideways chop. Everything — from on-chain strength to market vibes — is leaning bullish. But until ETH clears that resistance, it’s still stuck in wait-and-see mode.