- Ethereum wiped $10B in leverage in three days as open curiosity tumbled.

- MVRV ratio at 2.10 alerts overheating, echoing previous native tops.

- Regardless of sell-offs, ETH exhibits resilience, with FOMO prone to drive the following breakout.

Ethereum is sitting in a tense zone round $4,500, caught between merchants’ FOMO and the burden of profit-taking. The previous few days have been messy—open curiosity fell nearly 7% in a single session, and in simply three days practically $10 billion in leverage vanished from the market. It appears to be like like a textbook deleveraging occasion after ETH ran a bit too scorching.

MVRV Screams Overheated

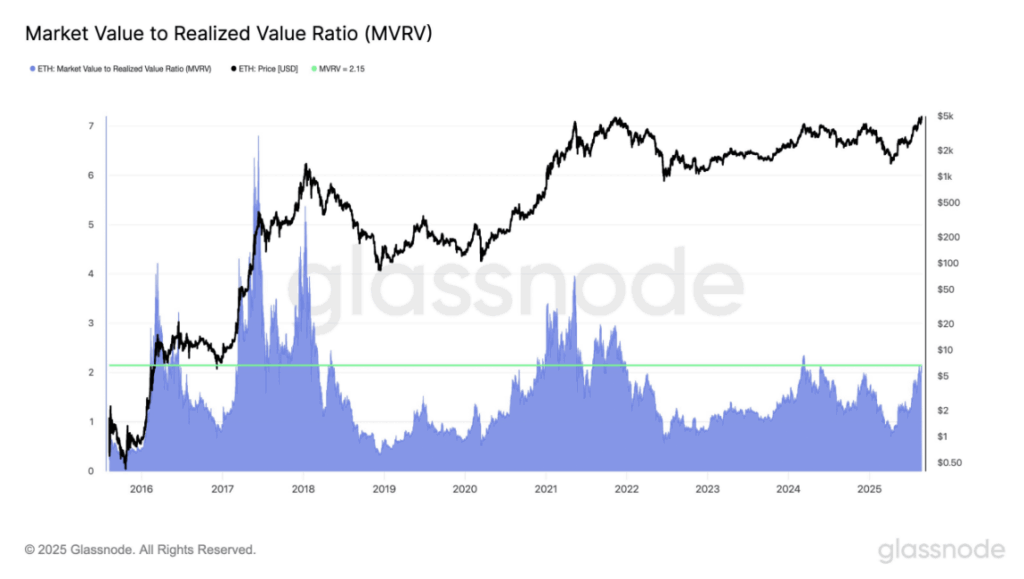

Including to the jitters, Ethereum’s Market Worth to Realized Worth (MVRV) ratio touched 2.10 proper because the coin brushed towards its $4.9k all-time excessive. Each time this ratio has spiked prior to now, ETH has stumbled. Again in March 2024, for instance, MVRV hit 2.35 and the worth promptly fell off a cliff—dropping greater than 50% in simply seven weeks earlier than good cash scooped up the dip.

That very same sample is likely to be beginning once more. The ten% slide on August 25, from a $4,800 open, wasn’t simply random noise. It was ETH’s overheated metrics catching up, signaling a short-term high earlier than a possible reset.

FOMO Retains ETH within the Recreation

Nonetheless, Ethereum refuses to interrupt. This August, MVRV jumped above 2.10 not as soon as however twice. After the primary spike close to $4,790, ETH bought off exhausting, dipping near $4,000. However inside days, the asset flipped again with a brand new excessive, touching $4.9k. That form of resilience exhibits that even after heavy liquidations, the construction is unbroken, and consumers are nonetheless stepping in.

Now, with one other MVRV spike above 2.10 on August 22 and the $10 billion wipeout behind us, the market might need the setup for a better leg. Brief-term worry and profit-taking might proceed, however FOMO is clearly fueling momentum, and ETH appears to be like primed to check new ranges as soon as the mud settles.

Supply hyperlink