On this piece we stroll via the present technical panorama, join it with the broader crypto backdrop, and description the important thing ranges that would determine the following substantial transfer.

Abstract

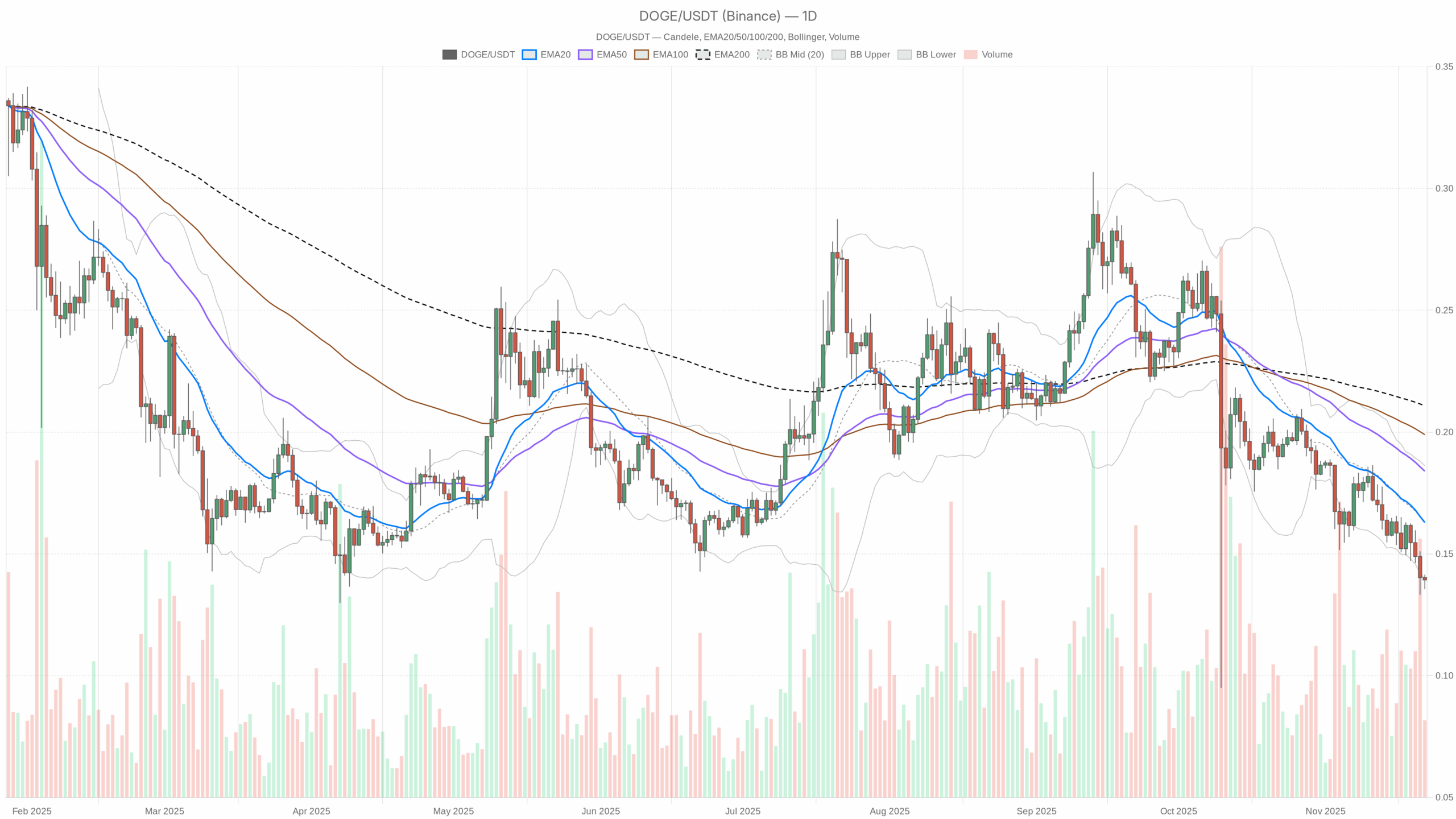

The day by day development is clearly tilted to the draw back, with worth parked round 0.14, under all fundamental shifting averages. Momentum on the upper timeframe is weak, as seen in a sub-50 RSI and a flattening MACD, pointing to bearish market strain greater than aggressive capitulation. Nevertheless, intraday indicators have cooled, displaying a impartial stance with the worth hugging short-term averages. Volatility is compressed, because the slender Bollinger Bands and really low ATR recommend a section of volatility contraction. In the meantime, the broader market is barely within the purple over 24 hours, and sentiment is dominated by Excessive Concern. This combine of things hints at a market the place sellers nonetheless have the higher hand, however the place sharp, directional strikes could solely reappear on a transparent catalyst.

Market Context and Route

The broader crypto atmosphere offers an essential backdrop for this pair. Whole market capitalization stands slightly below 3 trillion {dollars}, and it has slipped by about 0.14% over the previous day. Furthermore, Bitcoin instructions roughly 56.8% market dominance, underscoring a regime the place capital is gravitating towards the benchmark asset relatively than towards speculative altcoins.

That stated, sentiment is arguably probably the most placing information level: the Concern & Greed Index sits at 11, firmly within the Excessive Concern zone. In such an atmosphere, members typically prioritize capital preservation as an alternative of chasing short-lived bounces in riskier names. Because of this, draw back setups in alt pairs can see cleaner follow-through, whereas restoration rallies are usually shallow except macro situations immediately enhance.

Technical Outlook: studying the general setup

On the day by day chart, the pair trades at 0.14, noticeably under the 20-day exponential shifting common at 0.16, the 50-day at 0.18, and the 200-day at 0.21. This clear alignment of the EMAs above present worth confirms a well-established bearish development construction, with sellers constantly capping makes an attempt to push greater. Till worth can reclaim at the very least the shortest of those averages, the trail of least resistance stays to the draw back or, at finest, sideways.

The RSI on the day by day timeframe sits close to 31.8. This stage is near, however not but deep inside, the basic oversold territory. It means that draw back momentum is current however not exhausted. Bears nonetheless management the tape, but situations are approaching a zone the place additional promoting could begin to lose incremental energy, opening the door to reduction bounces as an alternative of a relentless slide.

Turning to the MACD, each the road and sign are round -0.01 with a flat histogram close to zero. The indicator subsequently factors to momentum stagnation inside a bearish backdrop. The downtrend is undamaged, however the absence of a widening unfavourable histogram hints that probably the most aggressive section of promoting has already cooled for now.

Bollinger Bands add one other essential layer: the mid-band coincides with 0.16, whereas the decrease band is clustered round 0.14, primarily the place worth is at the moment sitting. The higher band is close to 0.19. This reveals that worth is urgent the decrease boundary, highlighting underlying draw back bias, but the bands usually are not dramatically extensive.

Mixed with an ATR of simply 0.01, the image is one in all compressed volatility inside a downtrend. Strikes are small in absolute phrases, so merchants mustn’t anticipate giant swings except a breakout from this volatility pocket happens.

The day by day pivot framework is tightly centered round 0.14 for the primary level, with close by help and resistance additionally clustering on the identical worth. This uncommon overlap displays how the market has coiled round a slender vary, reinforcing the concept of an rising steadiness space after prior weak spot. A decisive push away from this zone would probably be handled as a recent directional sign.

Intraday Perspective and DOGE crypto Momentum

Zooming into the hourly chart, the image appears to be like much less heavy. Worth once more sits at 0.14, however now the 20- and 50-period EMAs are nearly on prime of worth, whereas the 200-period EMA lags barely greater at 0.15. In the meantime, the RSI on this timeframe is near 49, reflecting a impartial, range-bound intraday regime relatively than a development day.

MACD intraday is basically flat, and Bollinger Bands have collapsed across the present worth, with ATR near zero. Because of this, short-term merchants are dealing with an atmosphere of minimal realized volatility, the place breakout methods usually tend to produce false begins except quantity and momentum return. The 15-minute chart echoes this message: EMAs are tightly clustered round 0.14, RSI is modestly above 50, and MACD is once more flat, underscoring how short-term flows are neither strongly bullish nor bearish.

This intraday neutrality contrasts with the day by day downtrend. It means that fast promoting strain has eased, however patrons haven’t but stepped in with conviction. For energetic merchants, this typically means ready for a transparent shift—both a decisive push above intraday shifting averages with strengthening momentum, or a renewed breakdown via the decrease band of latest ranges.

Key Ranges and Market Reactions for DOGE

With worth pinned at 0.14, this space acts as each a de facto help and a short-term pivot. A sustained maintain above this zone would preserve the present consolidation intact. Nevertheless, if the pair loses this stage on increasing volatility, it might sign that the bearish continuation state of affairs is reasserting itself, probably opening room for one more leg decrease.

On the upside, the area across the 20-day EMA close to 0.16 is the primary significant resistance to observe. A day by day shut above that shifting common, particularly if accompanied by a rising RSI again towards the mid-40s or greater, could be the primary signal that draw back momentum is cooling in a sturdy approach. Additional resistance would probably emerge close to the mid-Bollinger Band space and across the 50-day EMA, the place medium-term members may look to cut back publicity after any rebound.

Future Situations and Funding Outlook for DOGE

Total, the primary state of affairs for DOGE stays bearish on the day by day timeframe, framed by a worth under all main EMAs, a low however not but exhausted RSI, and a compressed volatility construction. Within the quick time period, the impartial intraday posture hints that the following huge transfer has but to be determined.

Conservative merchants could want to attend for both a transparent break under 0.14 with rising ATR, confirming recent draw back, or a restoration above 0.16–0.18, suggesting a extra significant corrective section.

Extra energetic members may discover tactical trades inside the present vary, however they need to acknowledge that the broader development nonetheless favors sellers. In a local weather of maximum concern and powerful Bitcoin dominance, danger administration and place sizing stay essential. Any technique must be constructed round the concept this asset remains to be working via a late-stage downtrend that has not absolutely reversed, even when short-term charts seem deceptively calm.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making funding choices.