Though specialists and establishments proceed to present optimistic forecasts for Bitcoin’s value within the quick and long run, some level to divergence alerts which will point out an upcoming reversal.

A divergence sign happens when the worth creates the next excessive, however the indicators or correlated knowledge weaken. This displays declining momentum. Presently, Bitcoin is dealing with a number of of those divergence alerts.

Divergence Alerts Warn of a Potential Bitcoin Correction

The primary warning comes from a technical sign within the month-to-month timeframe.

Traders typically overlook bigger timeframes just like the month-to-month chart in favor of every day value actions. Consequently, this sign may catch many traders abruptly.

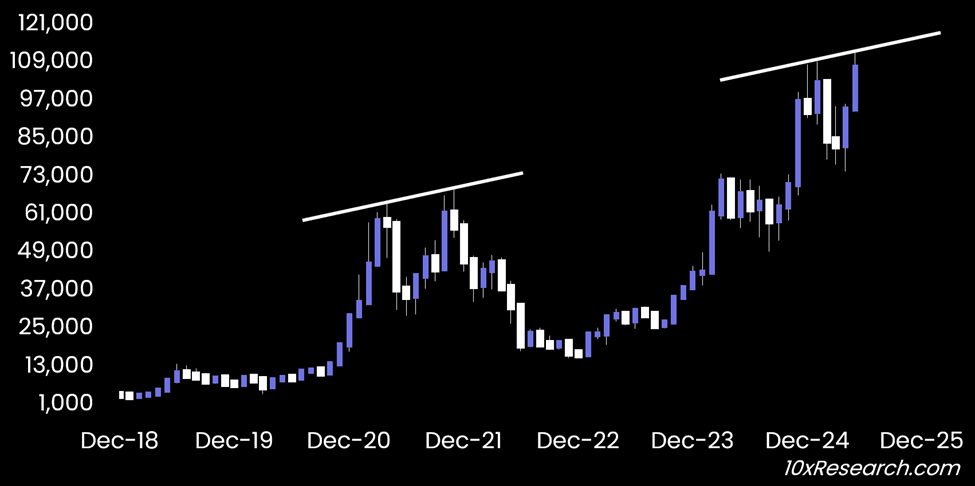

A latest report from 10xResearch warns that Bitcoin has reached resistance and is forming a sample much like 2021. The chart exhibits that in 2021, Bitcoin fashioned two peaks, with the second being greater than the primary. The identical value sample now appears to be repeating in 2025.

As well as, analyst Matthew Hyland has identified a bearish divergence within the RSI on the weekly timeframe. Analyst Mitch Ray additionally famous that Bitcoin has confirmed a bearish divergence with the MACD-H indicator on the every day chart.

These a number of divergence alerts counsel that Bitcoin could also be shedding upward momentum. This lack of momentum might result in a major correction within the coming month.

In addition to technical alerts, analyst James Van Straten highlighted one other divergence—this time between the inventory value of MicroStrategy (MSTR) and Bitcoin.

The chart exhibits that in November 2021, MSTR dropped about 50% from its earlier excessive, whereas Bitcoin reached a brand new all-time excessive of $69,000. An identical situation is unfolding now. MSTR has accomplished a 50% drop from its late-2024 peak, but Bitcoin continues to hit new highs above $111,000.

Though James didn’t provide a definitive conclusion, this sign once more suggests a possible Bitcoin correction—or perhaps a reversal, as seen within the 2021–2022 cycle.

“Bitcoin simply posted one other robust month, however beneath the floor, cracks are forming. A rising divergence between value motion, volatility, and retail conduct suggests the cycle could also be shifting. Main gamers, resembling MicroStrategy, are slowing their purchases, and key altcoins are slipping beneath crucial assist ranges. Volumes are fading, momentum is fracturing, and the technical indicators are eerily much like what we noticed in 2021, simply earlier than issues turned,” 10xResearch reported.

Regardless of these warning alerts, BeInCrypto has reported a wave of Bitcoin accumulation by firms exterior the crypto sector, from gaming to healthcare and retail. Bitwise additionally tasks that institutional capital inflows might attain $426.9 billion by 2026, locking up 20% of Bitcoin’s complete provide.

These new forces could symbolize a key distinction between the 2025 market and that of 2021. They may make direct comparisons between the 2 intervals deceptive.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.